- United States

- /

- Life Sciences

- /

- NasdaqGM:TKNO

Take Care Before Jumping Onto Alpha Teknova, Inc. (NASDAQ:TKNO) Even Though It's 30% Cheaper

Unfortunately for some shareholders, the Alpha Teknova, Inc. (NASDAQ:TKNO) share price has dived 30% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 85% share price decline.

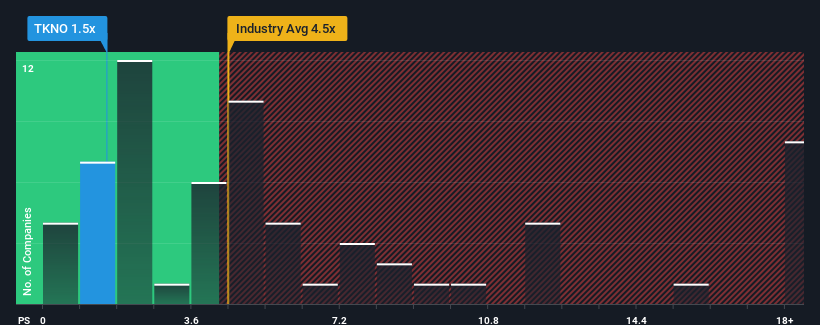

Following the heavy fall in price, Alpha Teknova may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 4.5x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Alpha Teknova

How Alpha Teknova Has Been Performing

Recent times have been advantageous for Alpha Teknova as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Alpha Teknova will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Alpha Teknova?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Alpha Teknova's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 99% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 22% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 6.9% each year, which is noticeably less attractive.

In light of this, it's peculiar that Alpha Teknova's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Shares in Alpha Teknova have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Alpha Teknova's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Alpha Teknova (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on Alpha Teknova, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TKNO

Alpha Teknova

Produces critical reagents for the discovery, development, and commercialization of novel therapies, vaccines, and molecular diagnostics in the United States and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives