- United States

- /

- Life Sciences

- /

- NasdaqGM:TKNO

Revenues Tell The Story For Alpha Teknova, Inc. (NASDAQ:TKNO) As Its Stock Soars 28%

Despite an already strong run, Alpha Teknova, Inc. (NASDAQ:TKNO) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 116% in the last year.

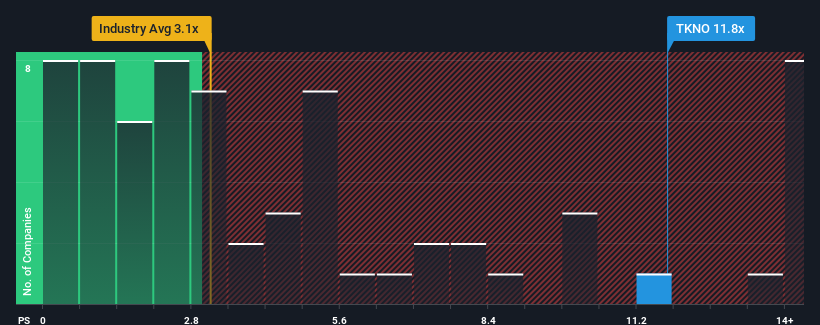

After such a large jump in price, when almost half of the companies in the United States' Life Sciences industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Alpha Teknova as a stock not worth researching with its 11.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Alpha Teknova

How Has Alpha Teknova Performed Recently?

While the industry has experienced revenue growth lately, Alpha Teknova's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alpha Teknova.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Alpha Teknova's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 1.6% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 5.0% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Alpha Teknova's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Alpha Teknova have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Alpha Teknova shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 3 warning signs for Alpha Teknova that you need to take into consideration.

If you're unsure about the strength of Alpha Teknova's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TKNO

Alpha Teknova

Produces critical reagents for the discovery, development, and commercialization of novel therapies, vaccines, and molecular diagnostics in the United States and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives