- United States

- /

- Life Sciences

- /

- NasdaqGM:TKNO

Not Many Are Piling Into Alpha Teknova, Inc. (NASDAQ:TKNO) Stock Yet As It Plummets 25%

To the annoyance of some shareholders, Alpha Teknova, Inc. (NASDAQ:TKNO) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The recent drop has obliterated the annual return, with the share price now down 9.1% over that longer period.

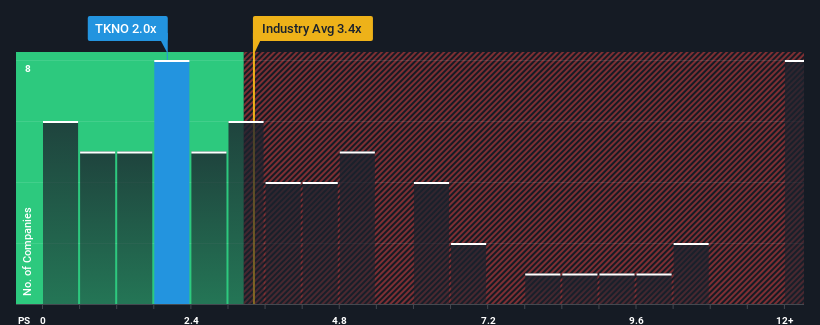

Following the heavy fall in price, Alpha Teknova's price-to-sales (or "P/S") ratio of 2x might make it look like a buy right now compared to the Life Sciences industry in the United States, where around half of the companies have P/S ratios above 3.4x and even P/S above 7x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Alpha Teknova

What Does Alpha Teknova's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Alpha Teknova has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Alpha Teknova will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Alpha Teknova's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 36% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 6.5% per annum, which is noticeably less attractive.

With this information, we find it odd that Alpha Teknova is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Alpha Teknova's P/S?

Alpha Teknova's recently weak share price has pulled its P/S back below other Life Sciences companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Alpha Teknova's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 4 warning signs for Alpha Teknova that you need to take into consideration.

If these risks are making you reconsider your opinion on Alpha Teknova, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Alpha Teknova, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TKNO

Alpha Teknova

Produces critical reagents for the discovery, development, and commercialization of novel therapies, vaccines, and molecular diagnostics in the United States and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives