- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

Optimistic Investors Push TG Therapeutics, Inc. (NASDAQ:TGTX) Shares Up 27% But Growth Is Lacking

TG Therapeutics, Inc. (NASDAQ:TGTX) shares have continued their recent momentum with a 27% gain in the last month alone. The last month tops off a massive increase of 152% in the last year.

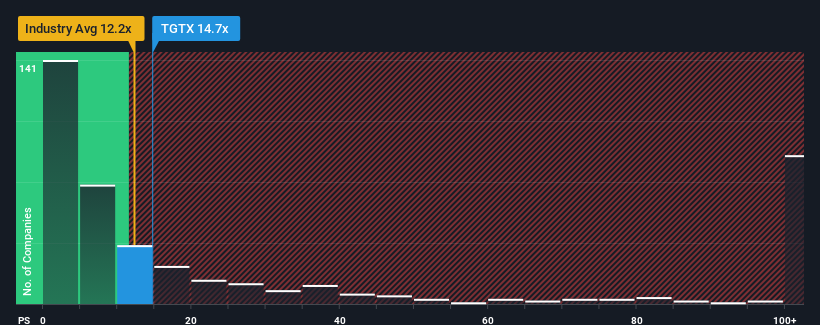

Since its price has surged higher, TG Therapeutics may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 14.7x, since almost half of all companies in the Biotechs in the United States have P/S ratios under 12.2x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for TG Therapeutics

What Does TG Therapeutics' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, TG Therapeutics has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think TG Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is TG Therapeutics' Revenue Growth Trending?

TG Therapeutics' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 56% each year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 129% each year, which is noticeably more attractive.

In light of this, it's alarming that TG Therapeutics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does TG Therapeutics' P/S Mean For Investors?

TG Therapeutics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for TG Therapeutics, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for TG Therapeutics with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Exceptional growth potential with excellent balance sheet.