- United States

- /

- Pharma

- /

- NasdaqGS:TERN

Terns Pharmaceuticals (TERN) Is Up 6.5% After Positive TERN-701 Data at Jefferies Conference – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Terns Pharmaceuticals recently presented at the Jefferies London Healthcare Conference 2025, sharing updates on its pipeline and clinical progress, including new data for TERN-701 in chronic myeloid leukemia.

- Interim results from the Phase 1 CARDINAL trial highlighted a strong molecular response rate for TERN-701 in patients with resistant or relapsed disease, spotlighting its potential impact in this difficult-to-treat population.

- We’ll explore how the promising TERN-701 data shapes Terns Pharmaceuticals’ investment narrative amid upcoming conference presentations and industry attention.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Terns Pharmaceuticals' Investment Narrative?

Anyone considering Terns Pharmaceuticals right now is really buying into the vision that one truly effective therapy, like TERN-701, could transform the company’s financial outlook and standing in cancer drug development. The latest news from the Jefferies London Healthcare Conference, reinforced by the strong molecular response rates in the CARDINAL trial, meaningfully changes the tone around near-term catalysts. With big Phase 1 results and analyst upgrades fresh in the market, the key short-term drivers have shifted toward upcoming data at the American Society of Hematology meeting and the company’s ability to secure partnerships or licensing. The biggest sticking point remains that Terns is unprofitable, posting a net loss of over US$24 million last quarter and no revenue forecast in the next year, but the buzz around TERN-701 does put more focus, and possibly more risk, on clinical progress and future funding needs.

On the other hand, the risk of dilution or delays in late-stage trials could catch some investors off guard.

Exploring Other Perspectives

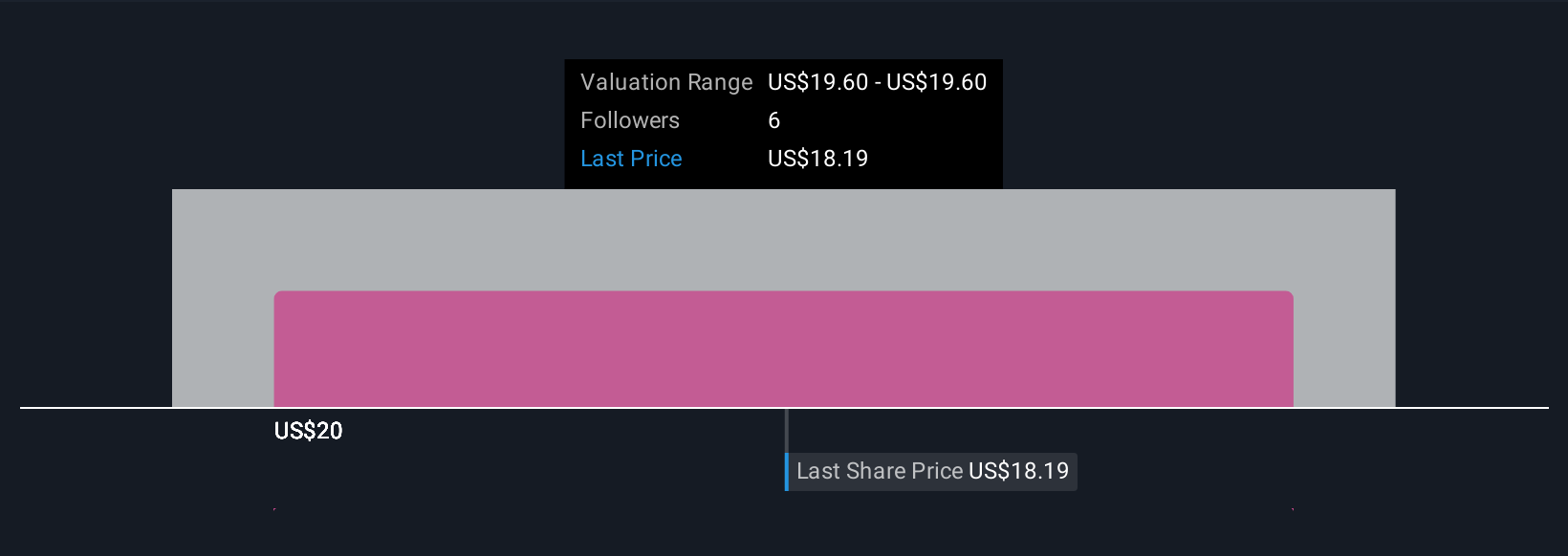

Explore another fair value estimate on Terns Pharmaceuticals - why the stock might be worth just $29.33!

Build Your Own Terns Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terns Pharmaceuticals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Terns Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terns Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terns Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TERN

Terns Pharmaceuticals

A clinical-stage biopharmaceutical company, develops small-molecule product candidates for the treatment of oncology and obesity.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.