- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Tempus AI (TEM): Assessing Valuation Following FDA Clearance for xR IVD and Strategic Expansion

Reviewed by Kshitija Bhandaru

If you’ve been tracking Tempus AI (TEM) recently, you no doubt caught the headline: FDA 510(k) clearance for its RNA-based Tempus xR IVD device. This new assay brings next-generation gene rearrangement detection into the clinical workflow and adds significant weight to Tempus’ push into advanced oncology diagnostics. For investors, such a regulatory green light is not just another product launch. It also signals further credibility in the precision medicine space and answers many questions about Tempus’ strategic direction.

This clearance caps off a run of operational progress, including new partnerships with big-name pharma companies and Tempus’ expansion into chronic kidney disease diagnostics. Over the past year, shares have surged 46%, with momentum especially strong in recent months. This points to growing market optimism as Tempus secures wider adoption of its technology in both oncology and nephrology settings. The mix of regulatory wins, commercial agreements, and a high single-digit revenue growth rate creates a compelling story around the stock’s trajectory.

With investor expectations rising and the stock on the move, the question now is whether Tempus AI is undervalued given these milestones or if the market has already priced in the growth ahead.

Most Popular Narrative: 6.8% Overvalued

According to the most widely followed valuation narrative, Tempus AI shares appear slightly overvalued compared to their analyst-calculated fair value. The latest analysis highlights robust growth expectations, balanced by profit and risk factors, resulting in a conservative fair value only modestly below the current share price.

Strong growth in testing volumes and biopharma partnerships positions Tempus AI for durable revenue gains, supported by differentiated technology and a growing data advantage. Expanding clinical-genomic offerings and disciplined cost management drive improving profitability, while rising AI adoption and regulatory clarity provide long-term growth opportunities.

Think Tempus AI is just another healthcare tech play? This narrative is built around surprising growth projections and bold profit targets, along with a future earnings multiple higher than what most biotech companies ever command. Wondering what ambitious forecasts and analyst thinking are behind these numbers? Dive into the full narrative to get the exact formula fueling that fair value.

Result: Fair Value of $73.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increasing competition in AI diagnostics or uncertainty around reimbursement for key assays could quickly challenge the positive outlook for Tempus AI.

Find out about the key risks to this Tempus AI narrative.Another View: Discounted Cash Flow Model

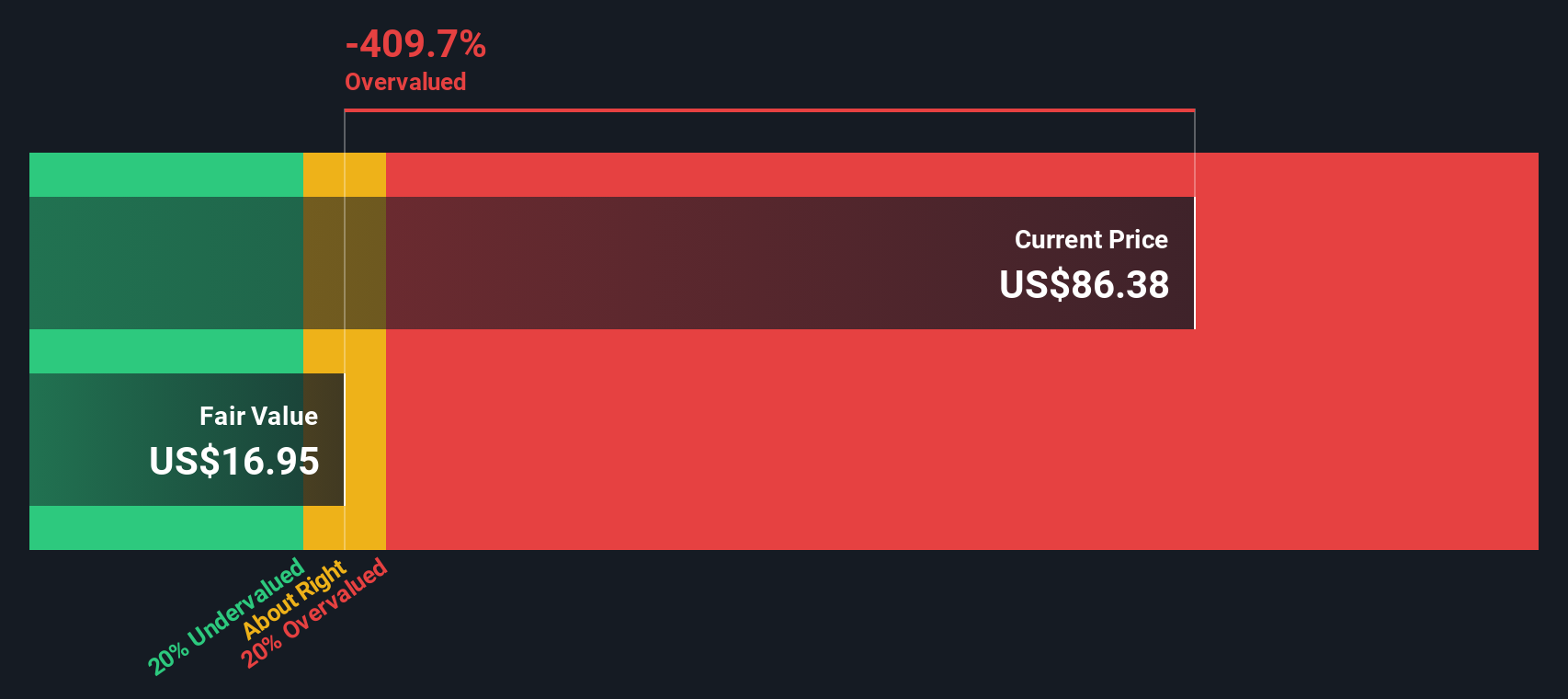

While analysts' fair value relies on future earnings and growth projections, our SWS DCF model takes a closer look at the company’s estimated future cash flows. This method offers a much more conservative picture and suggests Tempus AI may be even more overvalued than the analyst consensus. Does the higher share price reflect true long-term value, or is optimism running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tempus AI Narrative

If you prefer your own perspective or want to test the numbers yourself, building a custom narrative with your own research takes just a few minutes. This approach can offer fresh insights. Do it your way

A great starting point for your Tempus AI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock the next wave of smart investing moves by targeting companies primed for breakthroughs, market-beating growth, and unique competitive edges. Don’t watch from the sidelines while others seize these opportunities. Make your next winning pick now.

- Boost your income potential by uncovering stocks with strong yields through our collection of dividend stocks with yields > 3%.

- Tap into the future of healthcare by finding innovators on the front lines of AI-powered medicine with healthcare AI stocks.

- Get ahead of the curve by zeroing in on undervalued companies poised for a re-rating using our suite of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Limited growth with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives