- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Tempus AI (NasdaqGS:TEM) Reports Promising Earnings with Revenue Increase

Reviewed by Simply Wall St

Tempus AI (NasdaqGS:TEM) recently saw its market presence elevated as it was added to multiple Russell indices, showcasing an enhanced visibility. The company also bolstered its strategic partnerships, collaborating with Northwestern University on Alzheimer's research using its AI platform. Despite competing dynamics in the market where technology stocks generally saw positive momentum, Tempus AI's share price increased 19% over the last quarter. This movement was supported by initiatives like the launch of a liquid biopsy assay and reports of promising earnings, which included a significant revenue increase and an upward revision of yearly financial guidance.

Every company has risks, and we've spotted 3 weaknesses for Tempus AI you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent addition of Tempus AI to multiple Russell indices and its strategic collaboration with Northwestern University have significantly enhanced its market visibility and highlighted its role in cutting-edge Alzheimer's research utilizing AI. These developments could accelerate Tempus' revenue growth and elevate its earnings prospects as the company continues to expand its partnerships and refine its AI-driven precision medicine capabilities. In particular, the integration of new platforms may increase client retention, bolstering long-term revenue streams. As the company aligns with pharma giants such as AstraZeneca and Pathos, these partnerships have the potential to validate and further drive demand for its oncology models, which is a critical factor for sustained growth.

Tempus AI's shares have experienced a total return of 65.22% over the past year, demonstrating strong performance relative to the broader market and significantly surpassing the US Life Sciences industry's return, which saw a decline of 19.4% over the same period. This robust performance underscores investor confidence in Tempus' growth trajectory, despite facing inherent risks such as high operational expenditures and dependency on major contracts.

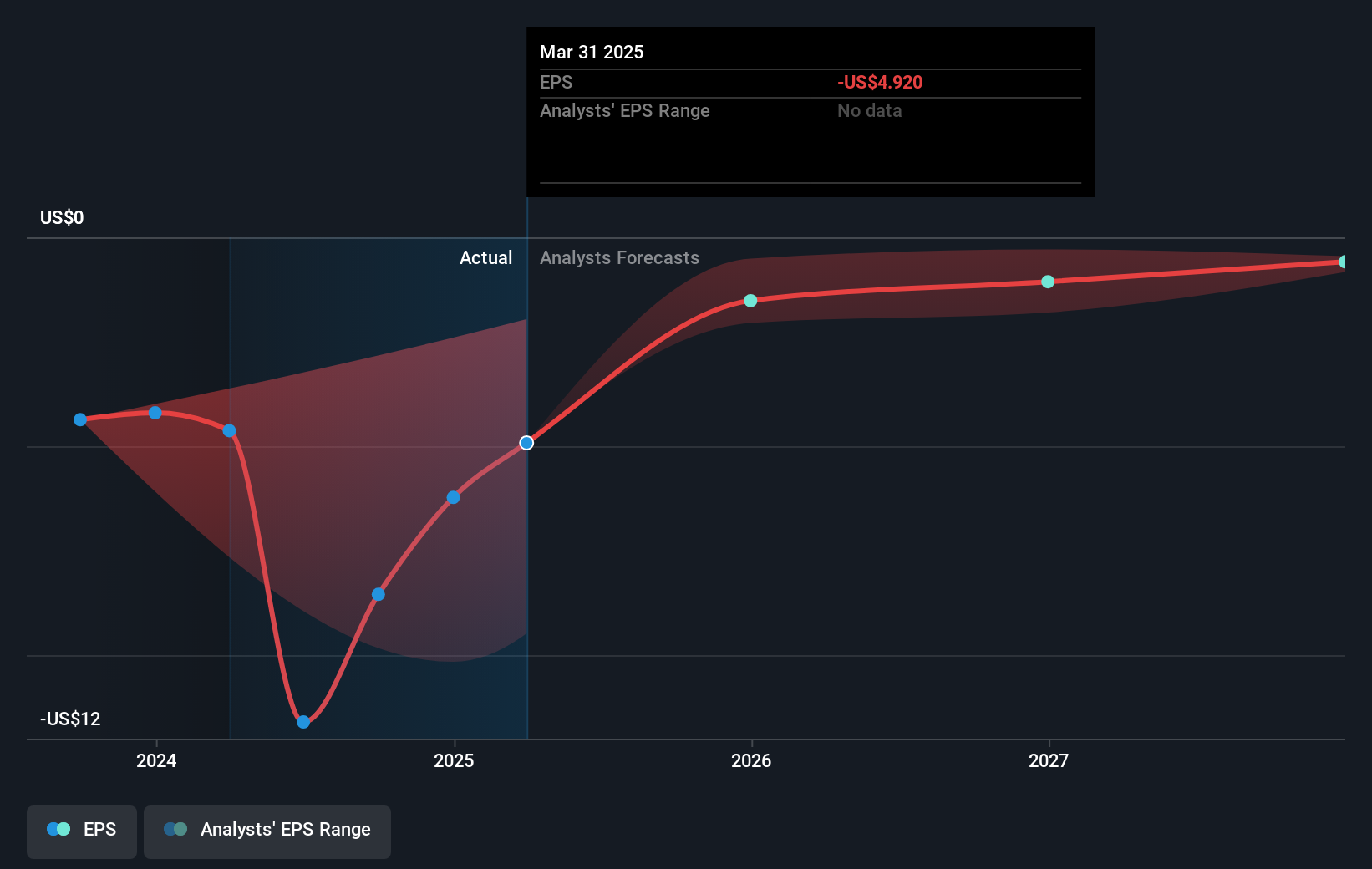

The current share price reflects a minor disparity compared to the consensus analyst price target of US$65.5, indicating that analysts view the stock as neutrally valued, with a difference of 7.0%. This suggests cautious optimism regarding the company's future performance. As Tempus invests heavily in data infrastructure and AI, the increased cost base may weigh on profitability in the short term. However, successful execution could lead to a shift from low-margin diagnostics to high-margin software contracts, thus enhancing earnings forecasts. Whether Tempus can achieve anticipated revenue growth of 21.71% annually remains contingent on continued expansion of its AI and data offerings, in line with industry adoption of precision medicine.

Click to explore a detailed breakdown of our findings in Tempus AI's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives