- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Will Bio-Techne's (TECH) Latest Spatial Biology Tools Reshape Its Edge in Translational Research?

Reviewed by Sasha Jovanovic

- In September 2025, Bio-Techne Corporation announced new advancements in its spatial biology portfolio, unveiling enhanced RNAscope ISH and Lunaphore COMET technologies for simultaneous detection of RNA and protein biomarkers on the same tissue section, presented at the National Society of Histotechnology Convention.

- This development highlights Bio-Techne's focus on equipping researchers and clinicians with tools that enable improved diagnostic utility, particularly in cases with limited tissue availability.

- We'll explore how Bio-Techne's spatial biology innovations may influence its investment narrative and outlook for translational research growth.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

Bio-Techne Investment Narrative Recap

For those considering Bio-Techne, the core belief rests on the continued rise of precision medicine and diagnostics, with scalable technologies driving both adoption and revenue growth. The September 2025 advancements in spatial biology underscore the company's innovation efforts but do not immediately impact the near-term catalyst of recovering biotech and pharma spending, or address the ongoing challenges of depressed funding and potential regulatory overhangs.

Among recent news, the September spatial biology announcement is particularly relevant: the improved RNAscope ISH and Lunaphore COMET platforms bolster Bio-Techne's positioning in translational research, a key area for future growth. However, this has yet to materially counteract short-term pressures from softer demand among smaller biotech and academic customers, which remain the most pressing headwind.

Yet, despite these innovation milestones, investors should pay close attention to how ongoing declines in biotech funding might ...

Read the full narrative on Bio-Techne (it's free!)

Bio-Techne's narrative projects $1.5 billion in revenue and $250.1 million in earnings by 2028. This requires 6.5% yearly revenue growth and a $176.7 million increase in earnings from $73.4 million today.

Uncover how Bio-Techne's forecasts yield a $66.23 fair value, a 5% upside to its current price.

Exploring Other Perspectives

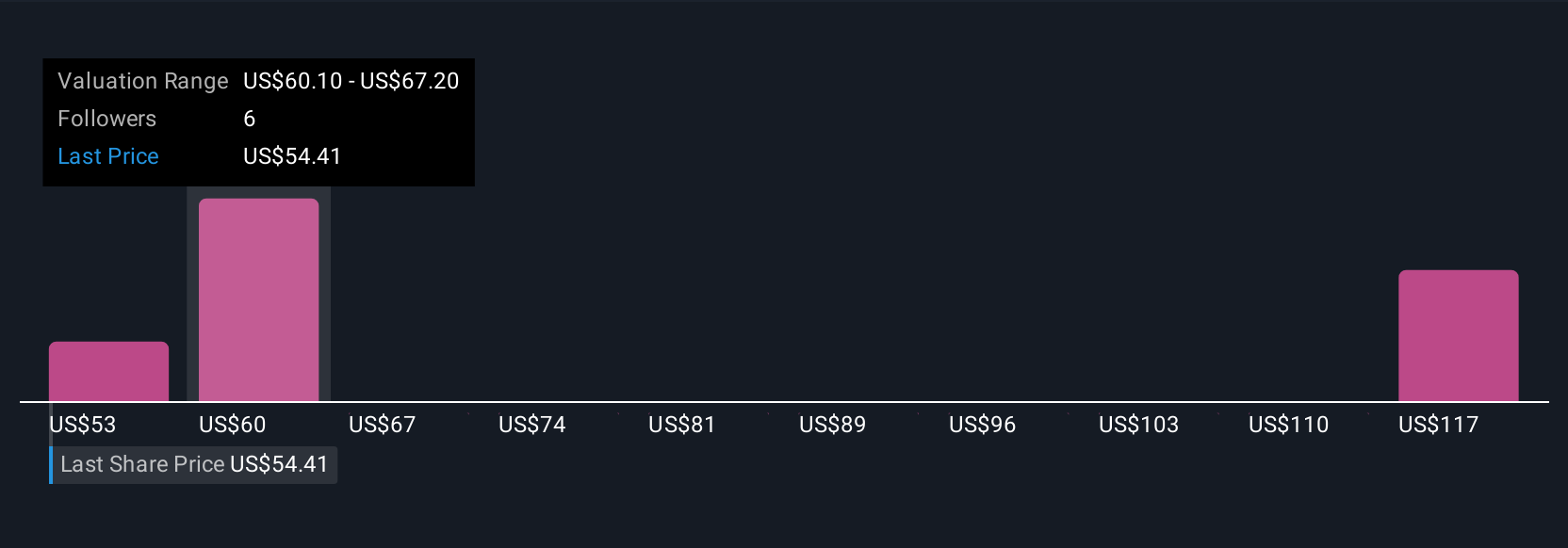

Four members of the Simply Wall St Community project fair values for Bio-Techne ranging from US$53.00 to US$86.09 per share. While some see expansion through spatial biology as promising, others are focused on the uncertain trajectory of research funding; consider how these viewpoints may influence future expectations.

Explore 4 other fair value estimates on Bio-Techne - why the stock might be worth 16% less than the current price!

Build Your Own Bio-Techne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bio-Techne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bio-Techne's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.