- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Bio-Techne (TECH): Assessing the Valuation as Shares Continue Their Recent Upward Momentum

Reviewed by Kshitija Bhandaru

Bio-Techne (TECH) shares edged up slightly on Tuesday, continuing their recent upward trend. Investors appear to be assessing the company’s moderate gains over the past week and month as they consider opportunities in the biotech sector.

See our latest analysis for Bio-Techne.

Bio-Techne’s share price has shown a gentle uptick lately, building on a cautious but steady trend rather than a breakout run. While the 1-year total shareholder return is modestly negative, recent price action suggests investors are still weighing the company’s longer-term potential and growth story in relation to broader sector sentiment.

If the buzz around biotech this week has you interested in what else is gaining traction, it's the perfect chance to check out See the full list for free.

So with shares still down from last year, but recent growth in both revenue and profits, is Bio-Techne flying under the radar, or have investors already priced in the company’s future gains?

Most Popular Narrative: 6.3% Undervalued

Bio-Techne last closed at $62.09, just below the most popular narrative’s fair value estimate. There is a gap between the consensus fair value and where the stock is trading now, hinting at the story behind expectations for the coming years.

“Analysts are assuming Bio-Techne's revenue will grow by 6.5% annually over the next 3 years. Analysts assume that profit margins will increase from 6.0% today to 17.0% in 3 years time.”

Want to discover how this valuation stacks up? The projected future for Bio-Techne hinges on bullish assumptions about margins and sales growth. What is the rationale for this ambitious leap in profitability and scale? Find out what makes analysts so confident and what it could mean for the share price.

Result: Fair Value of $66.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued declines in biotech funding, along with rising regulatory and geopolitical risks, could challenge these optimistic growth forecasts for Bio-Techne.

Find out about the key risks to this Bio-Techne narrative.

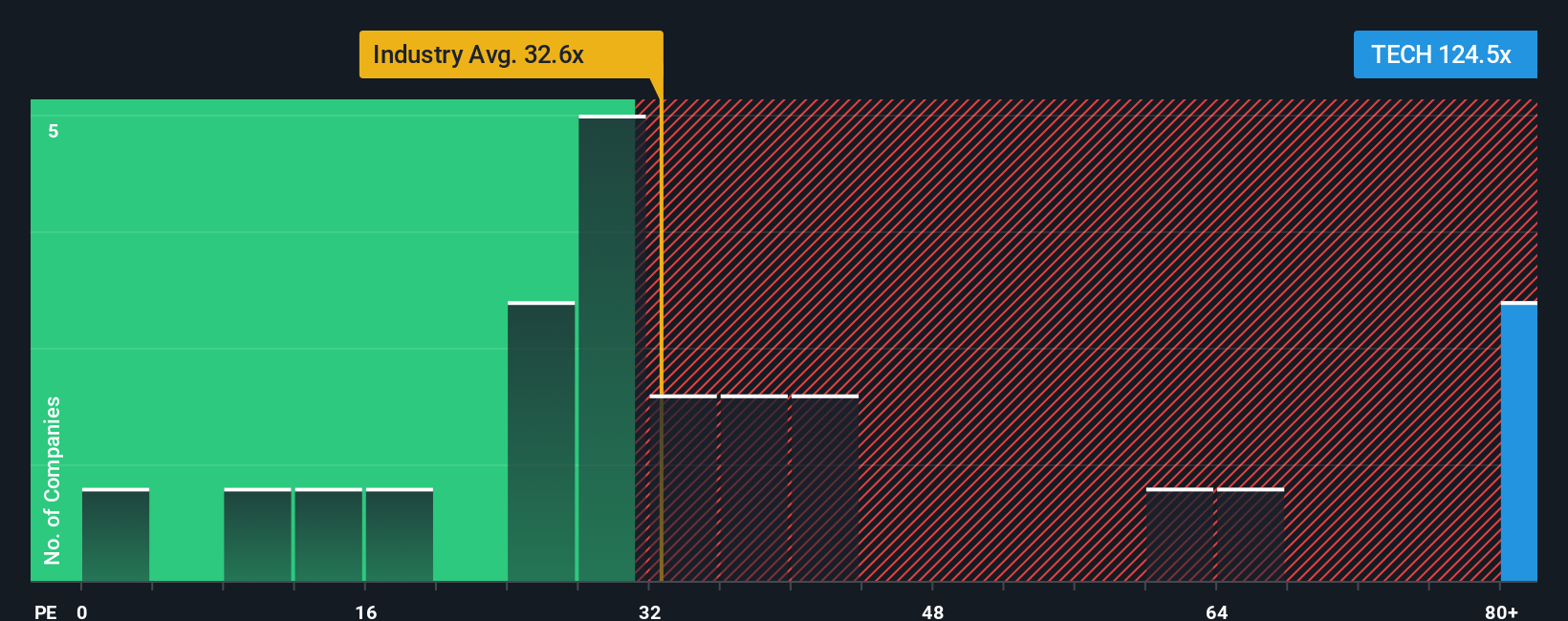

Another View: Valuation Multiples Signal Caution

While the analyst consensus sees Bio-Techne as undervalued, a look at its price-to-earnings ratio paints a different picture. Bio-Techne is trading at 131.8 times earnings, far above both the US Life Sciences industry average of 32.2x and its fair ratio of 23.7x. This sizable gap suggests that investors may be paying a high premium for anticipated growth. The key question is whether this premium will continue or if it presents risks should the growth outlook weaken.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bio-Techne Narrative

If you see Bio-Techne differently or want to base your view on your own research, you have the tools to build your perspective in just a few minutes with Do it your way.

A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make the most of your next move by uncovering stocks with proven momentum, untapped growth, or reliable returns using the Simply Wall Street Screener. Don’t let another opportunity pass you by.

- Get ahead of market trends by searching for innovation in artificial intelligence with these 24 AI penny stocks, where tomorrow's leaders are shaping real-world transformation.

- Access reliable potential income by checking out these 19 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3% and steady dividend histories.

- Seize value opportunities before others notice by reviewing these 900 undervalued stocks based on cash flows, showcasing stocks trading below their intrinsic worth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives