- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Bio-Techne Corporation's (NASDAQ:TECH) Price In Tune With Earnings

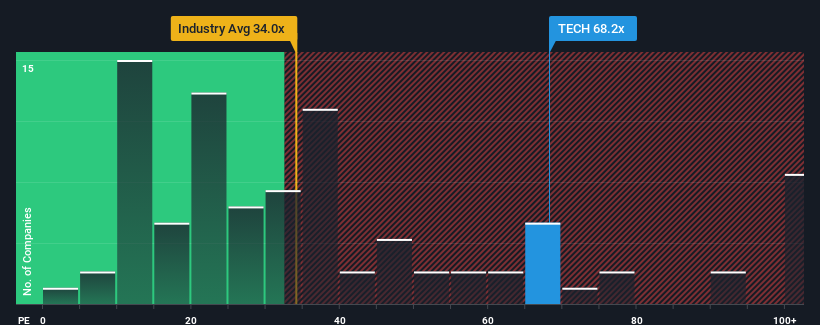

Bio-Techne Corporation's (NASDAQ:TECH) price-to-earnings (or "P/E") ratio of 68.2x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 18x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings that are retreating more than the market's of late, Bio-Techne has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Bio-Techne

Does Growth Match The High P/E?

In order to justify its P/E ratio, Bio-Techne would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 41%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 17% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 20% each year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 10% each year growth forecast for the broader market.

In light of this, it's understandable that Bio-Techne's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Bio-Techne maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Bio-Techne is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Bio-Techne, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives