- United States

- /

- Biotech

- /

- NasdaqGS:SYRE

Will Positive Phase 1 SPY003 Data and Narrowed Losses Reshape Spyre Therapeutics' (SYRE) Narrative?

Reviewed by Sasha Jovanovic

- On November 4, 2025, Spyre Therapeutics announced positive interim Phase 1 results for SPY003, its investigational antibody targeting the p19 subunit of IL-23 for inflammatory bowel disease, alongside third quarter earnings showing a net loss of US$11.18 million, down from US$69.03 million the prior year.

- The company’s update outlined SPY003’s safety and prolonged pharmacokinetics, highlighting plans for advancement into Phase 2 studies and its ambition to set a new standard of care for IBD.

- We'll explore how SPY003’s Phase 1 progress and its potential to improve IBD care shape Spyre Therapeutics’ investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Spyre Therapeutics' Investment Narrative?

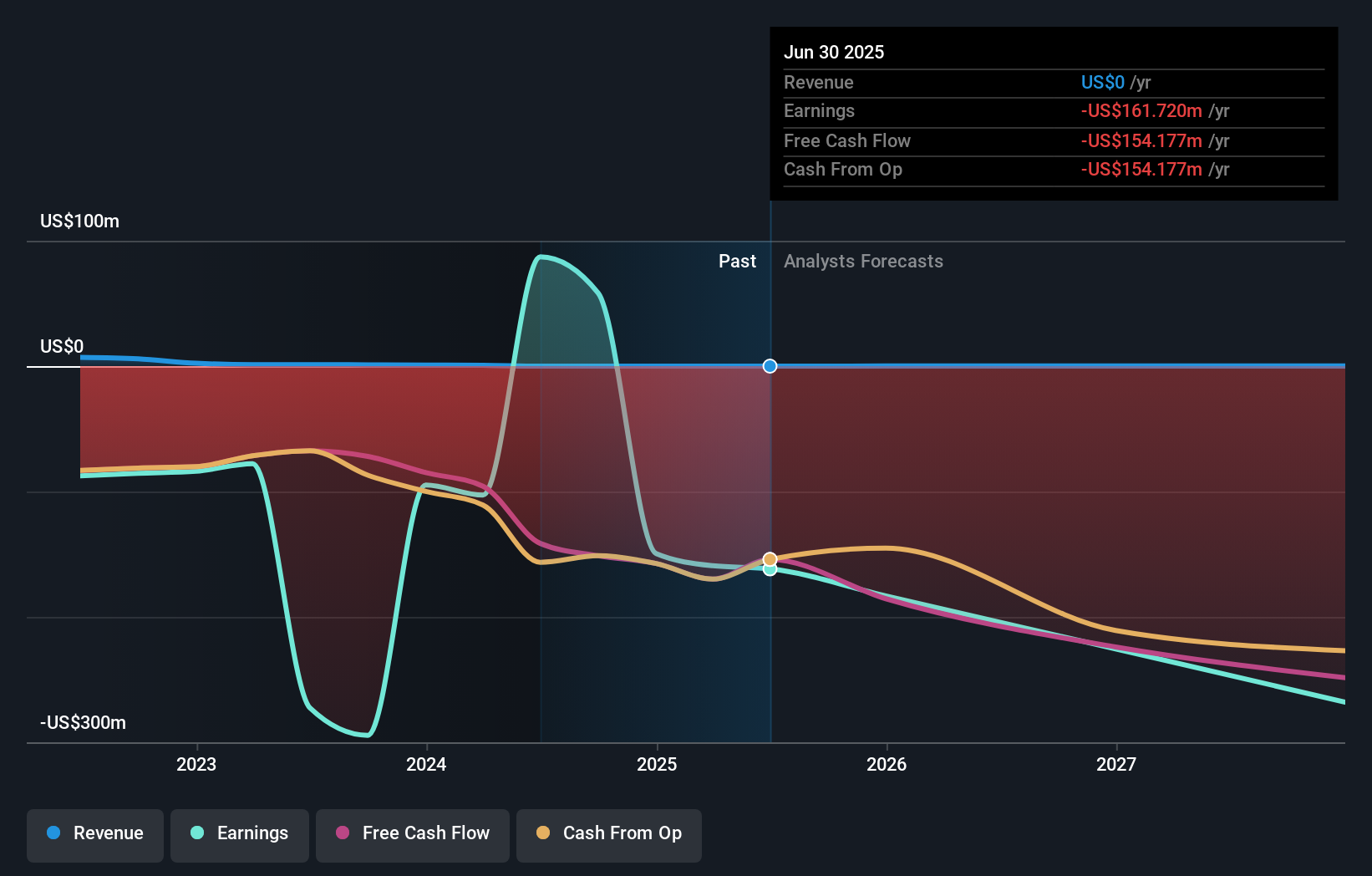

For anyone considering Spyre Therapeutics, the big picture centers squarely on belief in its ability to turn scientific promise into meaningful clinical and financial outcomes, primarily through the development of novel therapies like SPY003 for inflammatory bowel disease. The recent positive Phase 1 update for SPY003 injects momentum into the company’s investment story, reinforcing its pipeline and providing fresh evidence of progress toward potentially lucrative later-phase trials. While this update is undeniably positive, early-stage biotech stocks often hinge on near-term trial data and regulatory milestones, which remain the key short-term catalysts. Importantly, despite an improved financial picture and recent capital raises, the company is still unprofitable, faces ongoing dilution, and is years from potential profitability. The main risk facing Spyre now includes clinical and regulatory setbacks, which could shift sentiment rapidly, especially as share price volatility remains high even after favorable data. However, regulatory uncertainties and heavy reliance on future trial outcomes mean risks remain front and center for investors to consider.

The valuation report we've compiled suggests that Spyre Therapeutics' current price could be inflated.Exploring Other Perspectives

Explore 2 other fair value estimates on Spyre Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Spyre Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spyre Therapeutics research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Spyre Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spyre Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYRE

Spyre Therapeutics

A clinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD).

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives