- United States

- /

- Biotech

- /

- NasdaqGS:SYRE

How Investors Are Reacting To Spyre Therapeutics (SYRE) Phase 1 Data on SPY072’s Dosing and Efficacy

Reviewed by Sasha Jovanovic

- Earlier this month, Spyre Therapeutics presented six-month follow-up data from its Phase 1 study of SPY072 at the ACR Convergence Congress, highlighting strong safety, promising pharmacokinetic results, and preclinical efficacy in a key animal model.

- The data support ongoing Phase 2 trials, with SPY072 showing the potential for less frequent dosing and efficacy comparable to, or surpassing, established treatments in rheumatic diseases.

- We’ll explore how SPY072’s differentiated dosing profile could influence Spyre Therapeutics’ place in the competitive rheumatology pipeline.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Spyre Therapeutics' Investment Narrative?

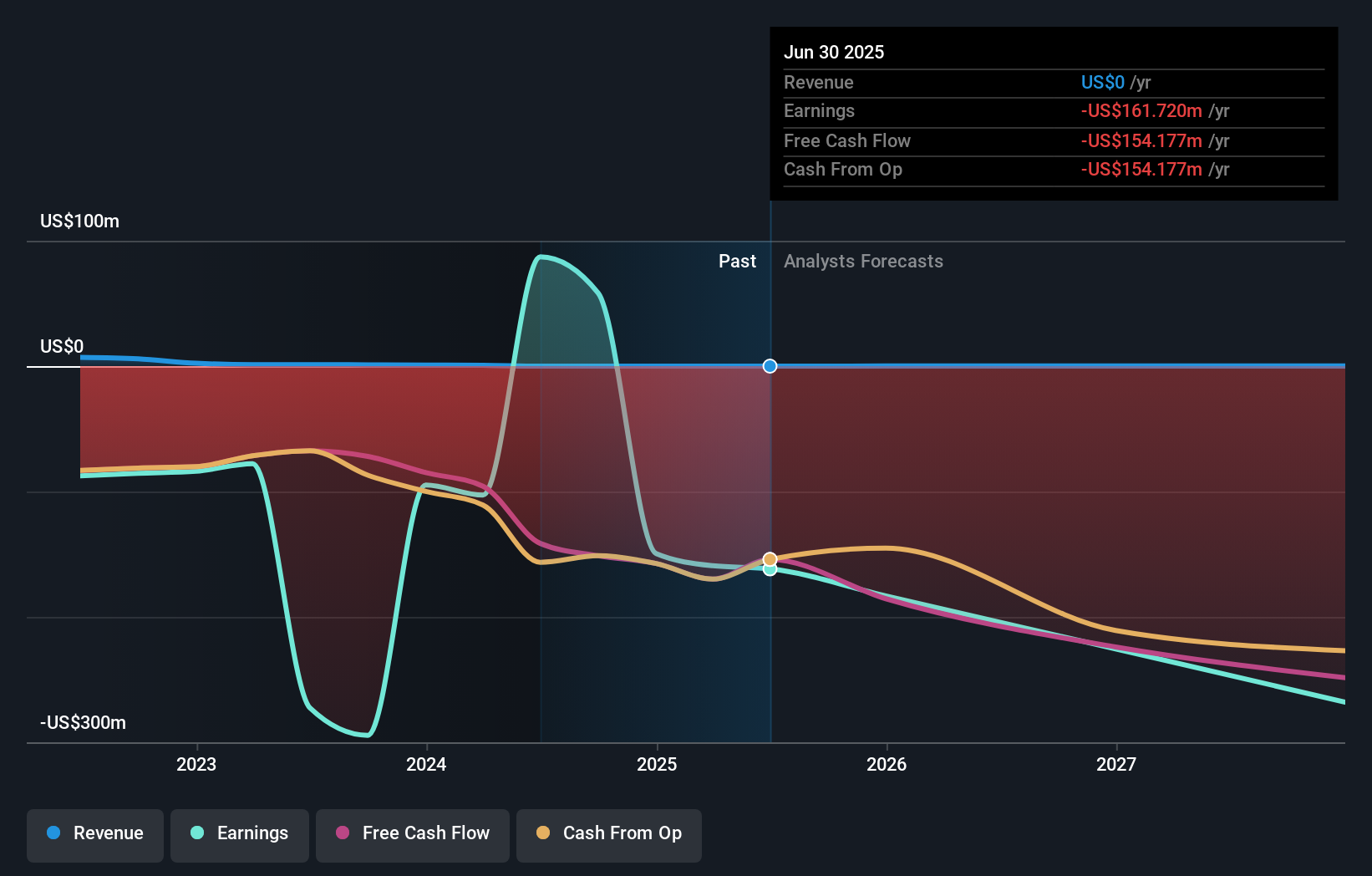

For someone considering Spyre Therapeutics, the investment story centers on breakthrough potential in rheumatology, underpinned by the latest Phase 1 and preclinical results for SPY072. The company’s recent $275 million equity raise is a crucial development: while it adds dilution in an already loss-making and unprofitable business, the extra capital could help fund pivotal Phase 2 studies and extend the operational runway at a pivotal juncture. This makes near-term trial milestones, particularly meaningful data readouts from SPY072’s ongoing Phase 2 evaluation, even more important as potential catalysts for sentiment and valuation. However, the risks have shifted too. With persistent losses, limited revenue, a recent history of underperformance, and another round of dilution, investor expectations now hinge on clear clinical successes to justify the premium valuation and multiple board changes.

But in contrast, heavy dilution remains a risk investors should watch closely. Our expertly prepared valuation report on Spyre Therapeutics implies its share price may be too high.Exploring Other Perspectives

Explore 2 other fair value estimates on Spyre Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Spyre Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spyre Therapeutics research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Spyre Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spyre Therapeutics' overall financial health at a glance.

No Opportunity In Spyre Therapeutics?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYRE

Spyre Therapeutics

A clinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD).

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives