- United States

- /

- Biotech

- /

- NasdaqGS:STTK

Is Shattuck Labs (NASDAQ:STTK) In A Good Position To Invest In Growth?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Shattuck Labs (NASDAQ:STTK) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Shattuck Labs

How Long Is Shattuck Labs' Cash Runway?

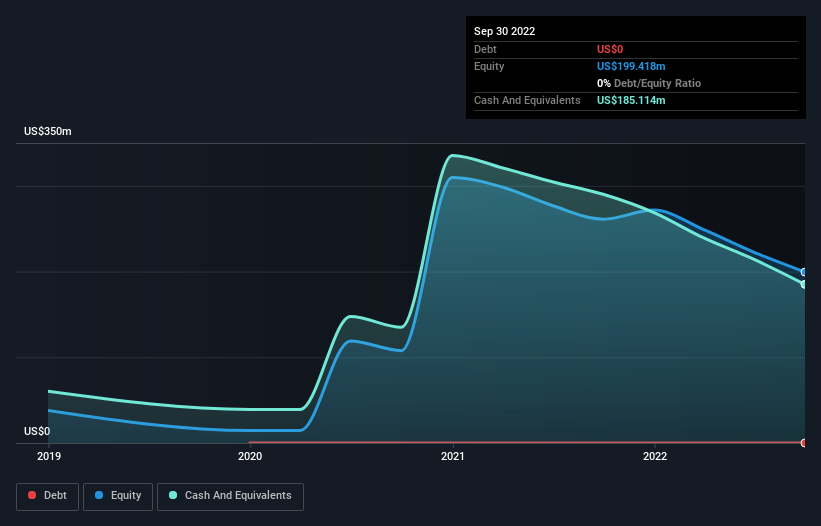

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Shattuck Labs last reported its balance sheet in September 2022, it had zero debt and cash worth US$185m. Looking at the last year, the company burnt through US$102m. So it had a cash runway of approximately 22 months from September 2022. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Well Is Shattuck Labs Growing?

Shattuck Labs boosted investment sharply in the last year, with cash burn ramping by 75%. But shareholders are no doubt taking some confidence from the rockstar revenue growth of 2,268% during that same year. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Shattuck Labs Raise Cash?

Even though it seems like Shattuck Labs is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$85m, Shattuck Labs' US$102m in cash burn equates to about 121% of its market value. Given just how high that expenditure is, relative to the company's market value, we think there's an elevated risk of funding distress, and we would be very nervous about holding the stock.

So, Should We Worry About Shattuck Labs' Cash Burn?

On this analysis of Shattuck Labs' cash burn, we think its revenue growth was reassuring, while its cash burn relative to its market cap has us a bit worried. Summing up, we think the Shattuck Labs' cash burn is a risk, based on the factors we mentioned in this article. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Shattuck Labs (of which 1 is concerning!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STTK

Shattuck Labs

A biotechnology company, develops antibodies for the treatment of inflammatory and immune-mediated diseases.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.