- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

How Investors May Respond To Scholar Rock Holding (SRRK) FDA Delay Tied to Manufacturing Partner Issues

Reviewed by Sasha Jovanovic

- Scholar Rock recently announced that the U.S. Food and Drug Administration (FDA) issued a Complete Response Letter for the apitegromab Biologics License Application, citing manufacturing issues at Catalent Indiana rather than concerns about the drug's safety or efficacy.

- This decision impacts the approval timeline for apitegromab, a potential first-in-class, muscle-targeted treatment for spinal muscular atrophy that has received several special regulatory designations in both the US and Europe.

- We'll explore how the FDA's facility-related decision shapes Scholar Rock's investment narrative and highlights the outsized role of manufacturing partners.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Scholar Rock Holding's Investment Narrative?

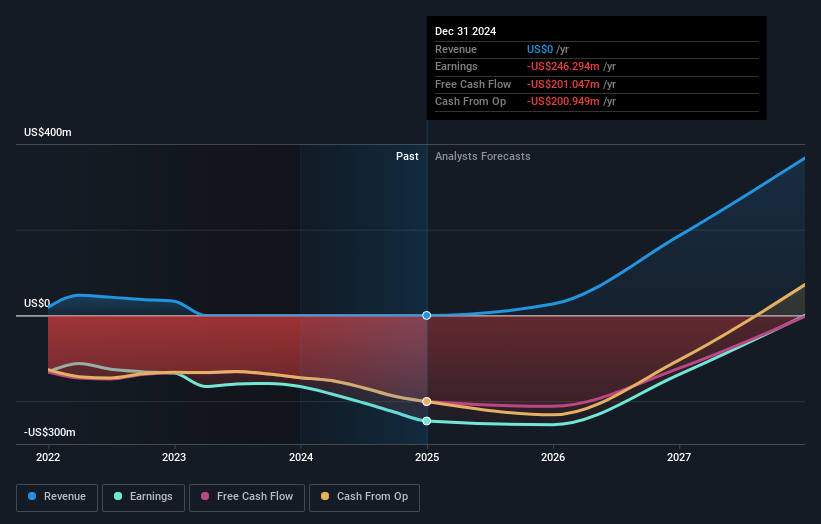

To be a shareholder in Scholar Rock right now, you effectively need to believe in its ability to turn strong clinical results for apitegromab into regulatory approval and eventual commercial success, despite a string of setbacks and its ongoing financial losses. The FDA’s recent Complete Response Letter introduces a new layer of complication, shifting the near-term catalyst from simple approval timing to the pace at which Catalent Indiana resolves manufacturing issues. While the drug's safety and efficacy remain unchallenged, investor focus is likely to shift from clinical outcomes to manufacturing and regulatory developments, both critical to future revenue. This news delays a potential revenue inflection point and increases the risk that cash burn or further dilution could pressure the business, given rising net losses and no approved product. Still, the long-term thesis remains intact for those who believe manufacturing setbacks are temporary and surmountable, but the time frame and risks have shifted for now.

However, facility risks are just one piece of the complex puzzle investors should weigh.

Exploring Other Perspectives

Explore another fair value estimate on Scholar Rock Holding - why the stock might be worth just $47.80!

Build Your Own Scholar Rock Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Scholar Rock Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scholar Rock Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Good value with adequate balance sheet.

Market Insights

Community Narratives