- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Sarepta Therapeutics (SRPT) Is Up 23.3% After FDA Lifts Elevidys Hold and Advances SRP-1003 Trial – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In recent days, Sarepta Therapeutics saw the US FDA lift a clinical hold on its Duchenne muscular dystrophy gene therapy Elevidys while the company progressed toward reporting preliminary clinical results for its SRP-1003 program in myotonic dystrophy type 1.

- These regulatory and clinical milestones coincide with Sarepta's operational restructuring and growing interest in its neuromuscular disease pipeline, underscoring the rapidly shifting environment for rare disease therapeutics.

- Next, we'll explore how the FDA's decision on Elevidys could influence Sarepta Therapeutics' investment narrative and prospects for restoring stakeholder confidence.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sarepta Therapeutics Investment Narrative Recap

To own Sarepta Therapeutics stock, an investor needs conviction in the company’s ability to overcome regulatory headwinds and safety concerns surrounding its ELEVIDYS gene therapy, while also seeing value in its expanding pipeline for rare neuromuscular diseases. The FDA’s recent lifting of the clinical hold on ELEVIDYS is a significant development, potentially reducing uncertainty for the company’s most important short-term catalyst, restoring trust and market uptake, though the introduction of a black-box liver toxicity warning remains a key business risk that could temper near-term optimism. If this risk results in lower patient demand or increased operational complexity, the revenue ramp and path to profitability could become considerably less predictable.

The most directly relevant announcement to these regulatory events is the FDA’s requirement for a black-box warning for ELEVIDYS, following a previous halt due to a patient’s death. This measure underscores how closely product safety and regulatory decision making now intersect with Sarepta’s immediate growth prospects, especially as the company moves to implement enhanced immunosuppression protocols and communicate safety updates to physicians and families. How quickly Sarepta can adapt and reassure stakeholders will influence both treatment uptake and confidence as it prepares for forthcoming data readouts from its neuromuscular portfolio.

By contrast, it’s equally important for investors to be aware that black-box warnings, even with resumed sales, can bring new reputational and patient adoption risks that...

Read the full narrative on Sarepta Therapeutics (it's free!)

Sarepta Therapeutics' outlook forecasts $1.4 billion in revenue and $171.6 million in earnings by 2028. This scenario assumes a 17.0% annual revenue decline and an earnings increase of $229.6 million from current earnings of -$58.0 million.

Uncover how Sarepta Therapeutics' forecasts yield a $22.88 fair value, in line with its current price.

Exploring Other Perspectives

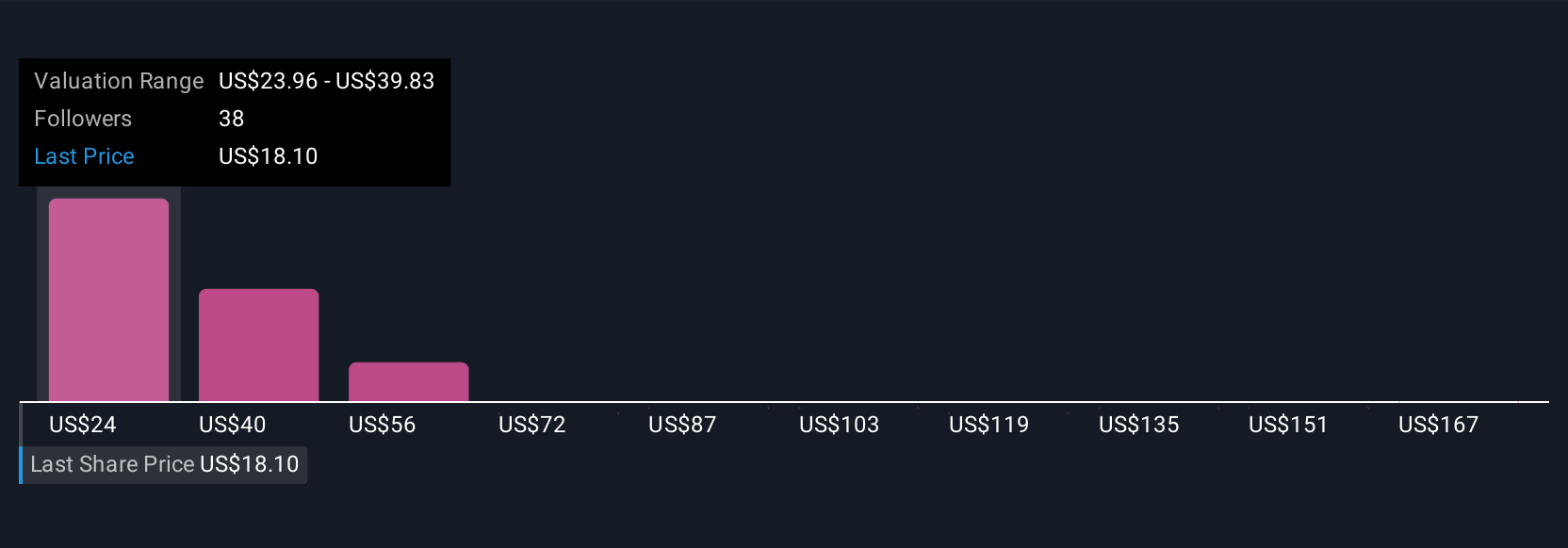

Private fair value estimates from 11 Simply Wall St Community members span US$22.88 to US$182.67, highlighting significant differences in outlook. Heightened regulatory scrutiny on ELEVIDYS sets the stage for diverging opinions about Sarepta’s future performance, explore what other market participants have to say.

Explore 11 other fair value estimates on Sarepta Therapeutics - why the stock might be worth just $22.88!

Build Your Own Sarepta Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sarepta Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sarepta Therapeutics' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives