- United States

- /

- Biotech

- /

- NasdaqGM:SPRY

Will ARS Pharmaceuticals' (SPRY) Conference Outreach Shape Investor Expectations for neffy's Global Potential?

Reviewed by Simply Wall St

- On September 3, 2025, ARS Pharmaceuticals, Inc. presented at the Cantor Global Healthcare Conference in New York, with Chief Commercial Officer Eric Karas and CEO Richard E. Lowenthal speaking at the event.

- This high-profile conference appearance offered an opportunity for ARS Pharmaceuticals to highlight recent business progress and share updates on its product development strategies with investors and industry stakeholders.

- We will explore how ARS Pharmaceuticals' recent conference presentation may shape expectations for neffy's continued global rollout and market adoption.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ARS Pharmaceuticals Investment Narrative Recap

To be a shareholder in ARS Pharmaceuticals, you need to believe in neffy’s long-term market potential as a first-in-class, needle-free epinephrine therapy, and that the company can successfully expand globally despite heavy reliance on a single product. The company’s recent Cantor Global Healthcare Conference appearance may help sustain near-term attention on neffy’s rollout, but does not appear to materially shift the most pressing catalyst: continued international approvals and launches. The biggest current risk remains product concentration and exposure if neffy were to face regulatory setbacks or intense new competition. One key announcement tied closely to these catalysts is the U.K. regulatory approval of EURneffy for adults and children over 30 kg, disclosed in mid-July 2025. This regulatory milestone is especially relevant in context with the recent conference, as successful launches in new markets represent the most immediate growth driver and are closely watched by both current and prospective investors. In contrast, investors should also be aware that heavy dependence on neffy means any disruption has the potential to...

Read the full narrative on ARS Pharmaceuticals (it's free!)

ARS Pharmaceuticals' outlook anticipates $415.9 million in revenue and $73.7 million in earnings by 2028. Achieving this would require a 54.7% annual revenue growth and an earnings increase of $121.7 million from current earnings of -$48.0 million.

Uncover how ARS Pharmaceuticals' forecasts yield a $31.00 fair value, a 208% upside to its current price.

Exploring Other Perspectives

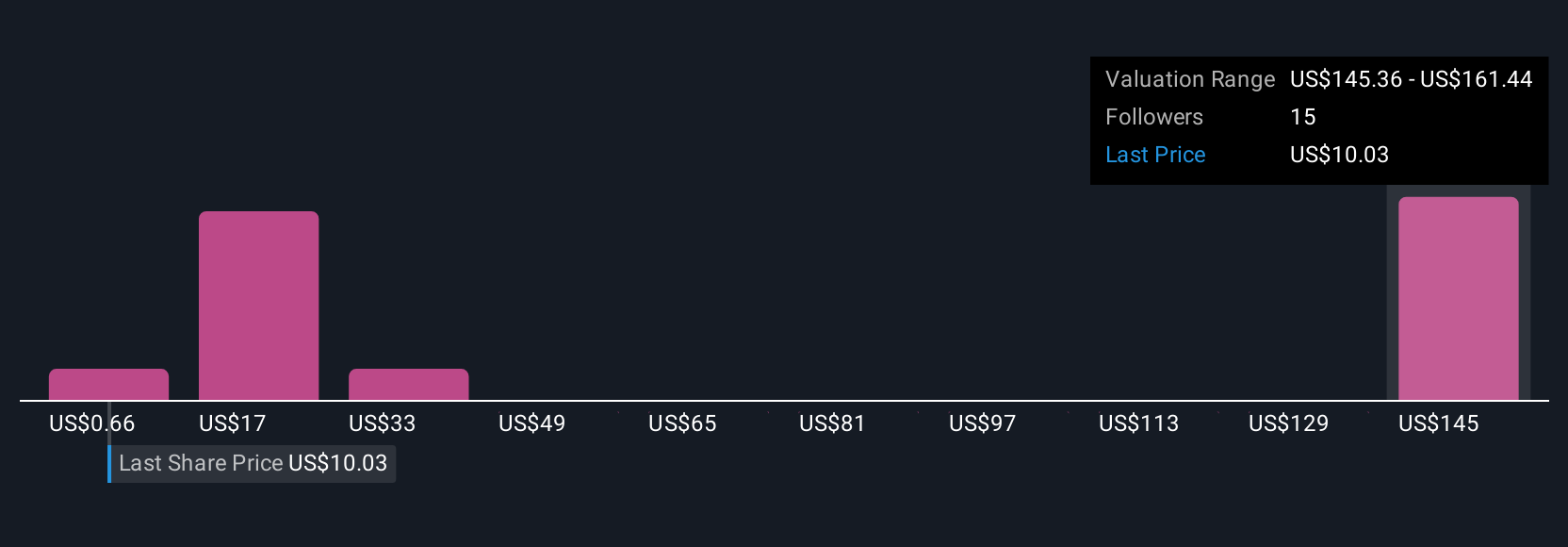

The Simply Wall St Community supplied eight fair value estimates for ARS Pharmaceuticals ranging from US$0.66 to US$161.80. While many see international expansion as a catalyst, the company’s lack of diversification may weigh on future results; compare your view with these varied perspectives.

Explore 8 other fair value estimates on ARS Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own ARS Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ARS Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ARS Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ARS Pharmaceuticals' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SPRY

ARS Pharmaceuticals

A biopharmaceutical company, develops and commercializes treatments for severe allergic reactions.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives