- United States

- /

- Pharma

- /

- NasdaqCM:SNES

One SenesTech, Inc. (NASDAQ:SNES) Analyst Has Been Cutting Their Forecasts Enthusiastically

The latest analyst coverage could presage a bad day for SenesTech, Inc. (NASDAQ:SNES), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. Worse, SenesTech has been out of favour with the market in recent times, so it will be interesting to see if this downgrade is enough to sink the stock even further. Over the past week the stock price has fallen 11% to US$1.95.

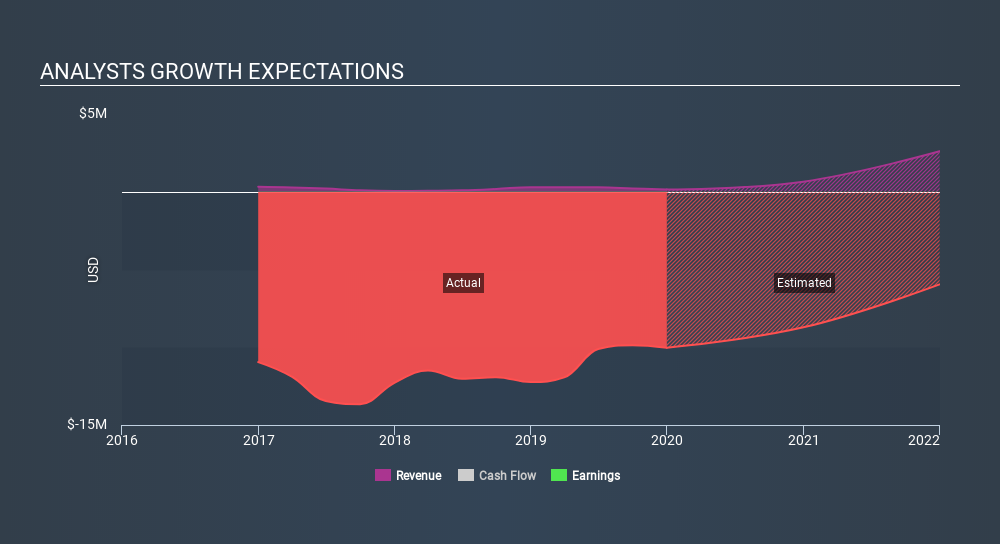

Following the downgrade, the most recent consensus for SenesTech from its sole analyst is for revenues of US$650k in 2020 which, if met, would be a major 355% increase on its sales over the past 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 30% to US$5.36. However, before this estimates update, the consensus had been expecting revenues of US$750k and US$5.34 per share in losses. So there's been quite a change-up of views after the recent consensus updates, withthe analyst making a serious cut to their revenue forecasts while also making no real change to the loss per share numbers.

Check out our latest analysis for SenesTech

The consensus price target fell 75% to US$5.00, with the analyst clearly concerned about the weaker revenue outlook and expectation of ongoing losses.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. For example, we noticed that SenesTech's rate of growth is expected to accelerate meaningfully, with revenues forecast to grow 355%, well above its historical decline of 5.9% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 5.0% per year. Not only are SenesTech's revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

While the analyst did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on SenesTech after today.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with SenesTech's business, like dilutive stock issuance over the past year. Learn more, and discover the 3 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:SNES

SenesTech

Engages in the development and commercialization of a technology for managing animal pest populations through fertility control.

Medium-low risk with excellent balance sheet.

Market Insights

Community Narratives