- United States

- /

- Biotech

- /

- NasdaqGS:SNDX

How NCCN Guideline Expansion for Revumenib Has Changed the Investment Story at Syndax Pharmaceuticals (SNDX)

Reviewed by Sasha Jovanovic

- On September 19, 2025, Syndax Pharmaceuticals announced that the National Comprehensive Cancer Network updated its Clinical Practice Guidelines to include revumenib as a category 2A recommendation for relapsed or refractory acute myeloid leukemia with NPM1 mutation, following positive AUGMENT-101 trial results published in Blood.

- This guideline inclusion marks an important endorsement for revumenib in a new genetic subset of AML patients, expanding its recognized utility beyond existing recommendations for KMT2A rearrangement.

- We'll now explore how this NCCN guideline update for revumenib in NPM1-mutant AML could influence Syndax Pharmaceuticals' investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Syndax Pharmaceuticals Investment Narrative Recap

To be a Syndax Pharmaceuticals shareholder, you need conviction in the company’s ability to grow by expanding Revuforj and Niktimvo into new patient populations and indications. The recent NCCN guideline inclusion for revumenib in NPM1-mutant AML closely aligns with the most important short-term catalyst, potential FDA approval and adoption for this indication. However, the biggest risk remains the company's reliance on only two main commercial-stage assets, with any setback likely to have an outsized financial impact.

The June 2025 FDA Priority Review decision for Revuforj in relapsed or refractory NPM1-mutant AML is particularly relevant here, as a favorable regulatory outcome would directly build on this new NCCN recommendation and could meaningfully expand the drug’s approved use and near-term revenue potential.

By contrast, investors should be aware that if further expansion or commercial adoption of Revuforj or Niktimvo faces unexpected delays or obstacles, the company’s reliance on those two assets...

Read the full narrative on Syndax Pharmaceuticals (it's free!)

Syndax Pharmaceuticals' outlook anticipates $603.4 million in revenue and $43.5 million in earnings by 2028. This projection assumes a 97.8% annual revenue growth rate and reflects a $378.5 million earnings increase from current earnings of -$335.0 million.

Uncover how Syndax Pharmaceuticals' forecasts yield a $36.55 fair value, a 134% upside to its current price.

Exploring Other Perspectives

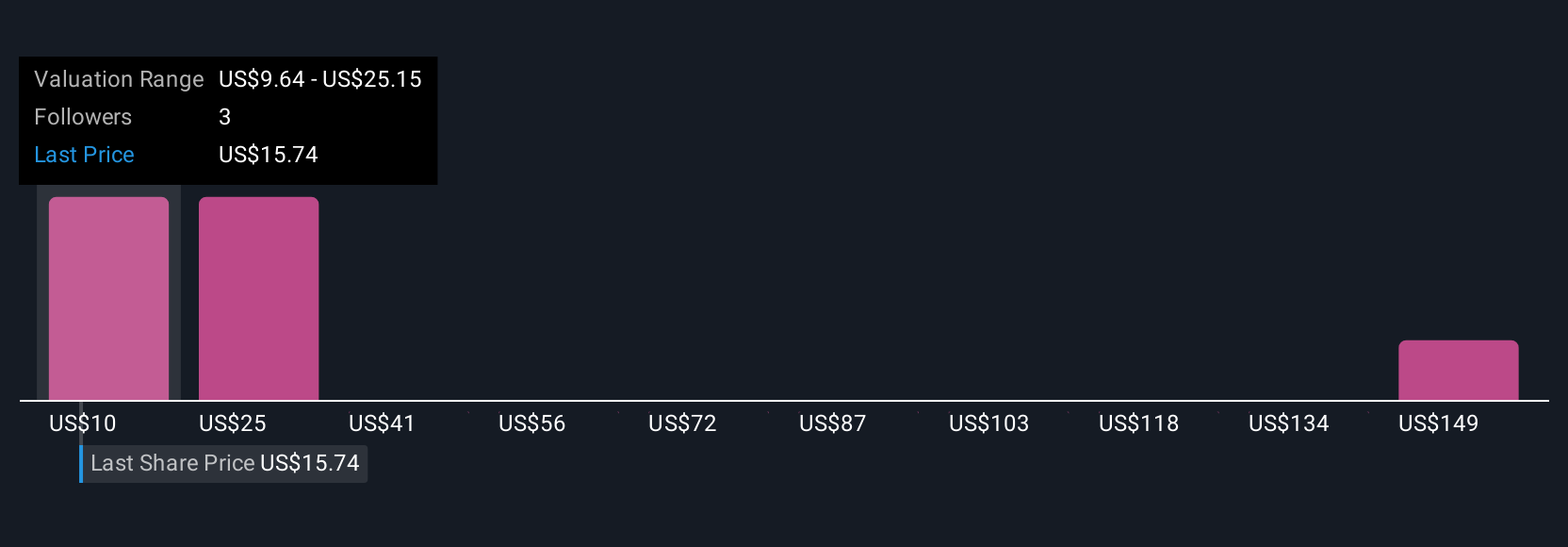

Simply Wall St Community members generated five fair value estimates for SNDX, ranging from US$9.64 to US$157.55. While community expectations are broad, the ongoing push for guideline and regulatory wins may influence whether future growth meets high hopes or exposes risk from limited diversification.

Explore 5 other fair value estimates on Syndax Pharmaceuticals - why the stock might be worth 38% less than the current price!

Build Your Own Syndax Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Syndax Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Syndax Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Syndax Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDX

Syndax Pharmaceuticals

A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives