- United States

- /

- Biotech

- /

- NasdaqGS:SNDX

Did Revumenib’s NCCN Guideline Endorsement Just Shift Syndax Pharmaceuticals’ (SNDX) Investment Narrative?

Reviewed by Sasha Jovanovic

- On September 19, 2025, Syndax Pharmaceuticals announced that the National Comprehensive Cancer Network (NCCN) updated its Clinical Practice Guidelines in Oncology for Acute Myeloid Leukemia to include revumenib as a category 2A recommendation for relapsed or refractory AML with an NPM1 mutation, following positive pivotal results from the AUGMENT-101 trial published earlier this year.

- This NCCN guideline update highlights a strengthened clinical positioning for revumenib, potentially broadening its adoption as a recommended treatment for certain acute myeloid leukemia patients.

- We'll examine how this guideline endorsement for revumenib could influence Syndax’s investment narrative and its future market reach.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Syndax Pharmaceuticals Investment Narrative Recap

To be a shareholder in Syndax Pharmaceuticals, you need conviction in the continued clinical and commercial expansion of its two lead therapies, especially the timely approval and broad adoption of Revuforj (revumenib) in key leukemia subtypes. The newly announced NCCN guideline inclusion bolsters short-term visibility for a crucial regulatory catalyst, but the most significant risk remains: if positive momentum stalls or regulatory decisions are delayed, revenue acceleration and future profitability projections could falter.

The June 2025 FDA Priority Review grant for Revuforj in relapsed/refractory mutant NPM1 AML stands out as directly relevant to this recent NCCN development. This Priority Review sets an October 2025 target action date, and paired with the guideline inclusion, increases the probability that Revuforj’s addressable market could widen substantially within the next few months, should the FDA decision be favorable.

However, if anticipated label expansion or market penetration does not materialize as quickly as hoped, investors should remain aware that...

Read the full narrative on Syndax Pharmaceuticals (it's free!)

Syndax Pharmaceuticals' outlook anticipates $603.4 million in revenue and $43.5 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 97.8% and a $378.5 million increase in earnings from the current -$335.0 million.

Uncover how Syndax Pharmaceuticals' forecasts yield a $36.55 fair value, a 137% upside to its current price.

Exploring Other Perspectives

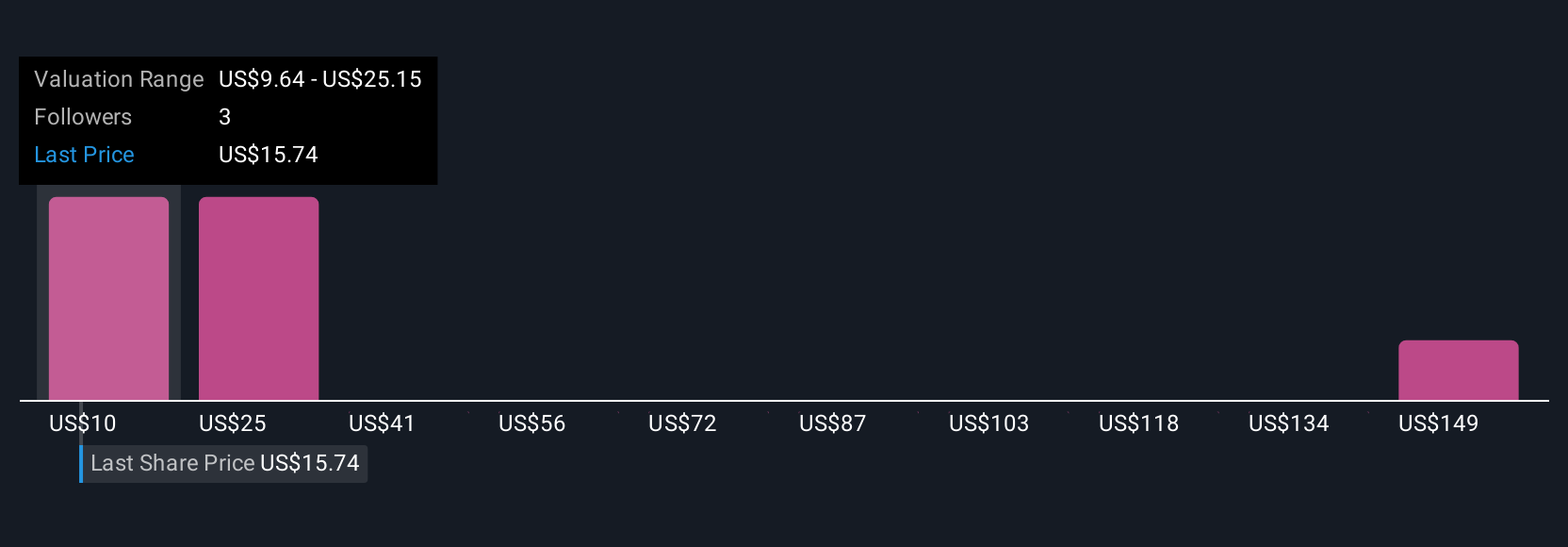

Private fair value estimates from five Simply Wall St Community members range from US$9.64 to US$158.27, showing a broad spectrum of conviction. While some anticipate rapid revenue growth ahead, views differ markedly, so consider these diverse perspectives as you weigh recent regulatory catalysts and clinical progress.

Explore 5 other fair value estimates on Syndax Pharmaceuticals - why the stock might be worth over 10x more than the current price!

Build Your Own Syndax Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Syndax Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Syndax Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Syndax Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDX

Syndax Pharmaceuticals

A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives