- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (SMMT): Valuation Perspectives Following Positive Phase III Results and Pipeline Expansion

Reviewed by Simply Wall St

Summit Therapeutics (SMMT) is drawing interest after announcing strong Phase III results for its lead drug, ivonescimab, in advanced squamous non-small cell lung cancer. The company also has plans to expand trials into metastatic colorectal cancer.

See our latest analysis for Summit Therapeutics.

Summit’s busy year has been marked by a number of key milestones, including its headline-making Phase III data for ivonescimab and the launch of new trials in metastatic colorectal cancer. Despite these advances, short-term sentiment remains volatile, with a dip in the 1-day share price return of 6.46% following an earnings miss. However, looking at the bigger picture, Summit’s three-year total shareholder return of 1,558% signals there is still strong long-term momentum at play.

If breakthrough oncology stories spark your curiosity, now is a great moment to discover other biotech and pharma names via our See the full list for free..

With substantial clinical progress, an expanded trial pipeline, and a recent pullback after earnings, is Summit Therapeutics trading at an attractive discount, or is all that future biotech promise already reflected in today’s stock price?

Price-to-Book of 72.6x: Is it justified?

At its last close of $18.74, Summit Therapeutics trades at a price-to-book ratio of 72.6x. This places the stock at a steep premium compared to peers in both the biotech industry and its immediate peer group.

The price-to-book ratio reflects what investors are willing to pay for each dollar of net assets. It is commonly used for biotechs and early stage healthcare companies due to volatile earnings and heavy R&D spend, but a high ratio can signal optimism or overexuberance.

For Summit, the market is placing a massive value on its future prospects, potentially driven by recent clinical breakthroughs and anticipated revenue growth. However, this ratio is significantly higher than the US Biotechs industry average of just 2.6x and the peer average of 4.8x, highlighting the substantial optimism already built into the share price at these levels.

Insufficient data exists to determine where the market could trend based on the fair ratio. For investors, this pricing should prompt a careful look at the pipeline, potential risks, and earnings visibility in the coming years.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 72.6x (OVERVALUED)

However, clinical progress does not guarantee commercial success. Ongoing losses or regulatory setbacks could quickly shift sentiment away from Summit’s lofty valuation.

Find out about the key risks to this Summit Therapeutics narrative.

Another View: Deep Discount by DCF?

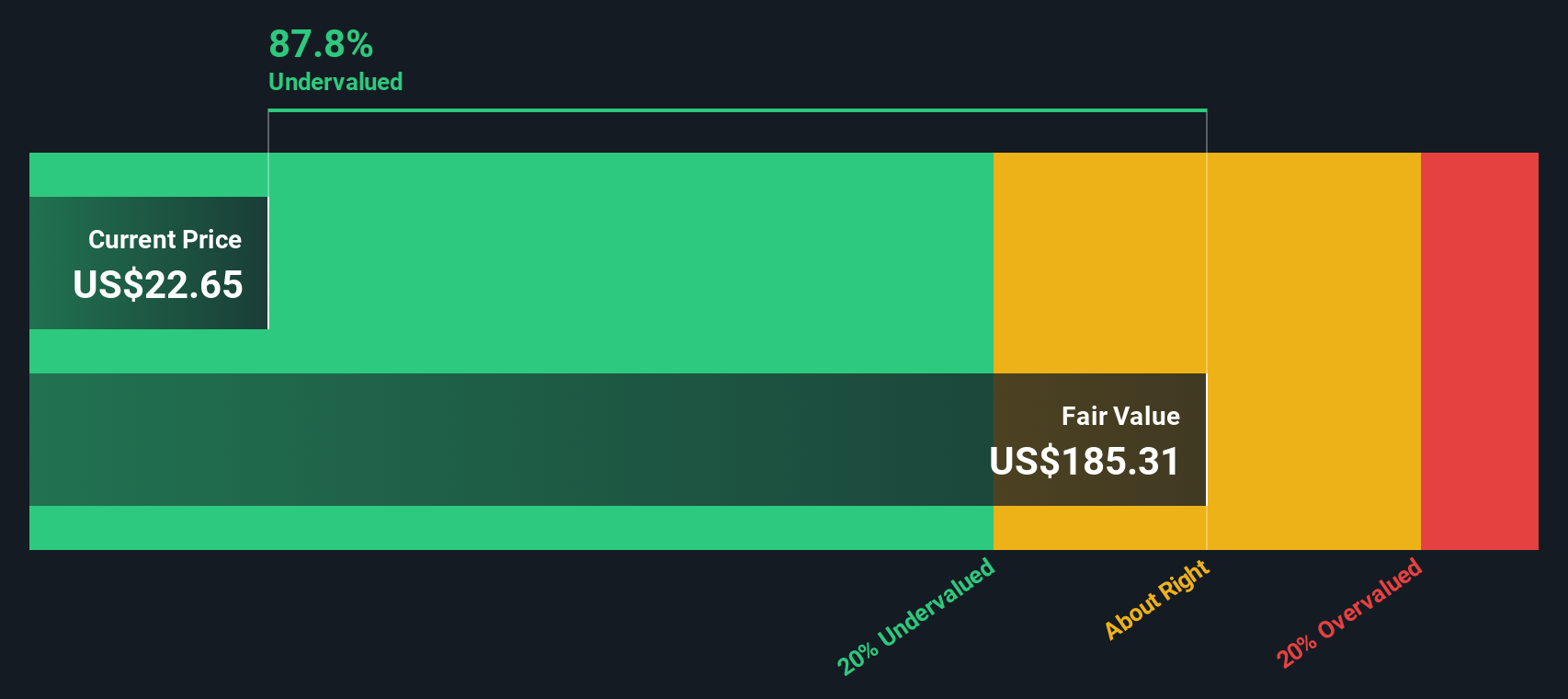

While Summit Therapeutics appears pricey using the price-to-book approach, our DCF model paints a much different picture. It suggests the stock may actually be undervalued, trading nearly 90% below its estimated fair value. Could the long-term outlook really be this optimistic, or is there something the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Summit Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Summit Therapeutics Narrative

If you have a different perspective or want to draw your own conclusions from the numbers, you can easily craft your own story in just a few minutes. Do it your way.

A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons with powerful investing tools that help you find tomorrow’s opportunities before everyone else. Don’t let smart options pass you by. Take action today.

- Spot high-upside potential by tracking these 24 AI penny stocks to unlock fresh possibilities in artificial intelligence and digital innovation.

- Secure steady returns, even in uncertain markets, by considering these 17 dividend stocks with yields > 3% that pay reliable yields above 3%.

- Catch early-stage opportunities by researching these 3581 penny stocks with strong financials that boast strong financials to fuel future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives