- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (SMMT): Valuation Insights Following Disappointing Phase III Ivonescimab Results

Reviewed by Kshitija Bhandaru

Summit Therapeutics (SMMT) shares came under pressure after the company disclosed that its investigational drug, ivonescimab, missed a key efficacy mark in its pivotal Phase III trial. The news has led to renewed investor caution.

See our latest analysis for Summit Therapeutics.

Summit’s recent share price has dipped as investors reassess expectations following the disappointing Phase III trial results for ivonescimab. This comes after earlier clinical milestones that initially put upward momentum behind the stock, but that momentum has faded with lingering concerns about efficacy outside China and additional legal headwinds. Despite this period of volatility, Summit’s 3-year total shareholder return of 20% points to a story that has been resilient over the longer term, even if the near-term outlook is cloudier right now.

If biotech twists and turns have you searching for your next opportunity, consider exploring See the full list for free.

Given Summit’s pullback and the disconnect between its current price and recent analyst targets, the question now is whether the market is underestimating its future prospects or if investor hesitancy is justified. This may leave little room for upside from here.

Price-to-Book of 61.4x: Is it justified?

Summit Therapeutics trades at a price-to-book (P/B) ratio of 61.4 times, a figure that dramatically outpaces both the US Biotechs industry and its peers. With the last close price of $21.43, this signals the market’s current appetite for Summit shares relative to its book value is unusually high.

The price-to-book ratio compares a company’s market value to its net asset value. This measure is especially relevant for businesses such as Summit in the biotech sector, which may not yet be profitable but have significant intangible assets or pipeline potential. However, an inflated P/B ratio often suggests either strong confidence in future breakthroughs or a disconnect between price and underlying fundamentals.

Summit’s P/B multiple of 61.4x is exponentially higher than the 2.5x average for US Biotechs and the 5.6x average among its closest peers. This disparity indicates that Summit is valued far above its sector norm, possibly pricing in expectations for future success that may be difficult to achieve based on current earnings and financial position.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 61.4x (OVERVALUED)

However, continued legal challenges and ongoing concerns about efficacy in key markets remain risks that could quickly shift sentiment for Summit Therapeutics.

Find out about the key risks to this Summit Therapeutics narrative.

Another View: Deep Discount to DCF Fair Value

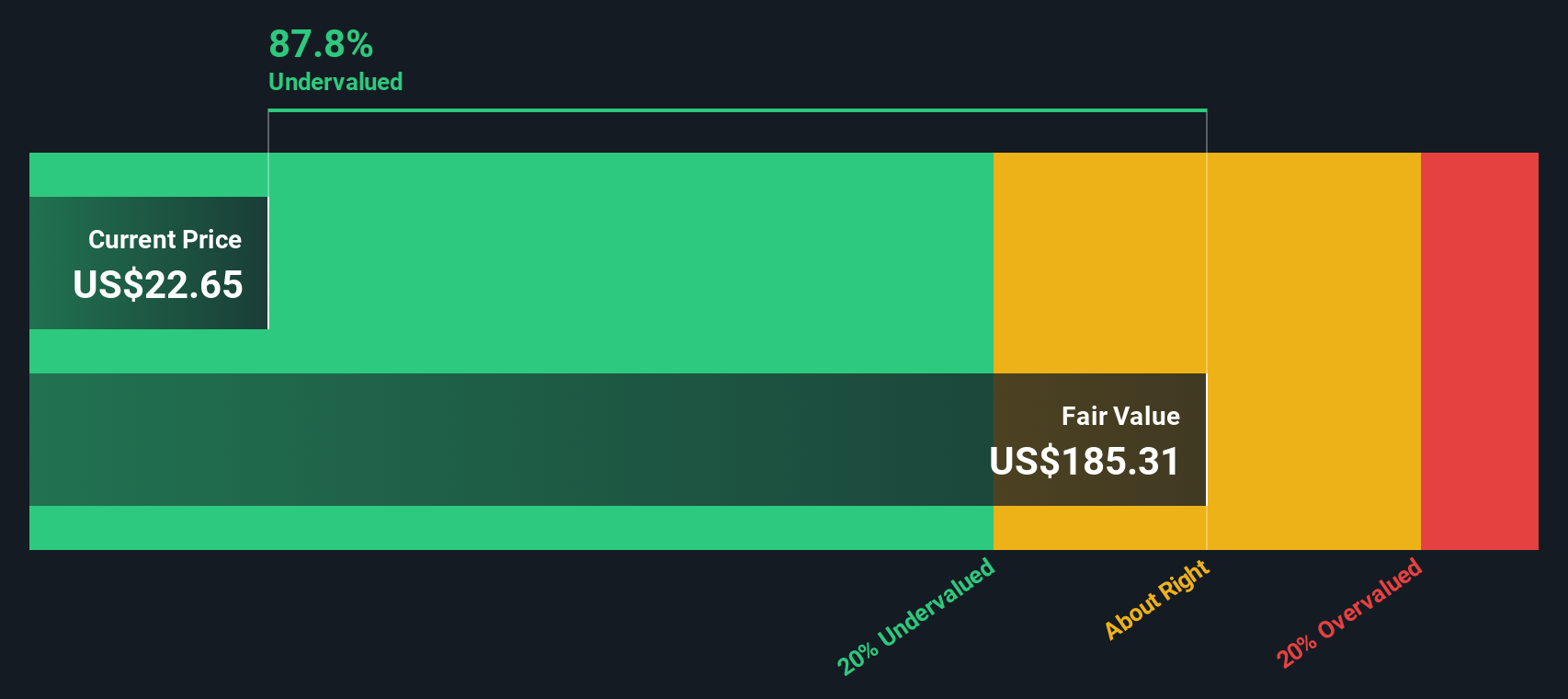

While Summit Therapeutics appears highly overvalued by the price-to-book ratio, our DCF model tells a completely different story. According to our SWS DCF model, shares are currently trading 88.4% below estimated fair value. This suggests the market might be overlooking long-term potential. Is the market being too cautious, or could this signal a rare mispricing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Summit Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Summit Therapeutics Narrative

If you want to interpret the numbers for yourself or take a different approach, it's easy to piece together your own conclusions using our platform. Do it your way

A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next investment winner could be a click away. Smart investors stay ahead by regularly expanding their watchlists, so give yourself the same edge.

- Supercharge your passive income by checking out the most promising picks among these 19 dividend stocks with yields > 3% with yields over 3% and consistent payout histories.

- Tap into the future of medicine by assessing innovation leaders among these 32 healthcare AI stocks who are changing the landscape of healthcare with artificial intelligence.

- Unlock massive growth opportunities and potential bargains by reviewing these 896 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives