- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (SMMT) Is Up 6.1% After Cancer Drug Ivonescimab Tops Keytruda Trial Results - What's Changed

Reviewed by Sasha Jovanovic

- Summit Therapeutics recently reported that its experimental cancer drug ivonescimab outperformed Merck’s Keytruda in a prior clinical trial, boosting optimism about its potential.

- This enthusiasm is tempered by concerns that limited diversity in the trial population could affect how regulators assess ivonescimab’s real-world applicability.

- We’ll now examine how ivonescimab’s encouraging trial results, alongside lingering regulatory questions, shape Summit Therapeutics’ evolving investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Summit Therapeutics' Investment Narrative?

To own Summit Therapeutics today, you really have to believe that ivonescimab can turn a zero‑revenue, loss‑making biotech into a viable commercial business. The recent data showing ivonescimab outperforming Keytruda adds weight to that thesis and appears to have sharpened near term catalysts, particularly the planned BLA filing and any FDA feedback on the Phase III HARMONi program. At the same time, the questions around trial diversity now look more central to the story, because they go straight to how regulators might judge real world relevance. With Summit’s valuation heavily tied to a single asset, the combination of sizeable ongoing losses, repeated equity financings and binary regulatory risk is front of mind. This latest news raises the stakes, rather than removing the uncertainty.

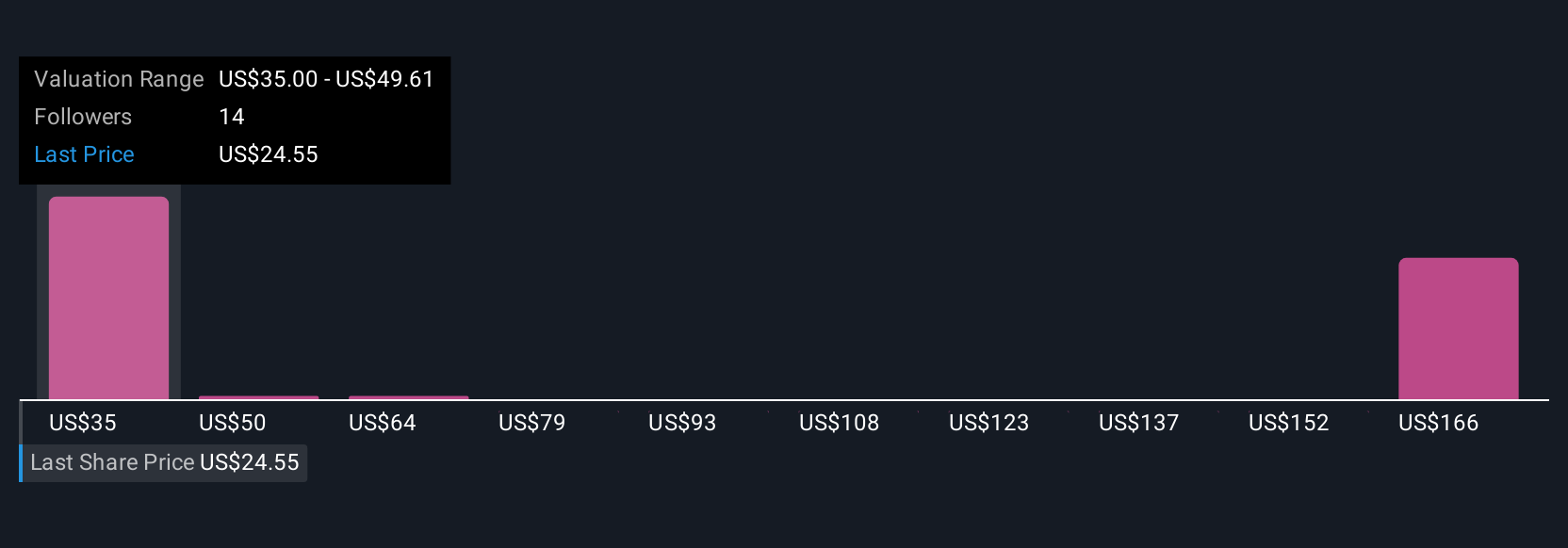

However, trial design and patient mix could matter more than some shareholders might expect. Summit Therapeutics' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Summit Therapeutics - why the stock might be worth 14% less than the current price!

Build Your Own Summit Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Summit Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Summit Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026