- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (SMMT): Assessing Valuation After Breakthrough Lung Cancer Data from HARMONi-6 Trial

Reviewed by Kshitija Bhandaru

Price-to-Book of 60x: Is it justified?

Summit Therapeutics is currently trading at a price-to-book ratio of 60 times, which is markedly higher than both its peer average of 5.6 and the US Biotech industry average of 2.3. This strongly suggests the stock is significantly overvalued when assessed with this metric.

The price-to-book ratio compares a company's market price with its net asset value. For biotechnology firms, this measure can shed light on how much confidence the market places in the company’s intangible pipeline and future prospects, despite current results. However, using a much higher ratio than competitors often means investors are pricing in substantial future growth or breakthroughs that have yet to materialize.

Such a premium multiple implies heightened expectations for the company’s future performance, innovation, or commercialization efforts. Whether this steep valuation is justified depends largely on upcoming results and successful clinical milestones.

Result: Fair Value of $20.95 (OVERVALUED)

See our latest analysis for Summit Therapeutics.However, any clinical setbacks or delays in commercialization could quickly temper enthusiasm. This serves as a reminder to investors of the persistent risks in biotech investing.

Find out about the key risks to this Summit Therapeutics narrative.Another View: Discounted Cash Flow Perspective

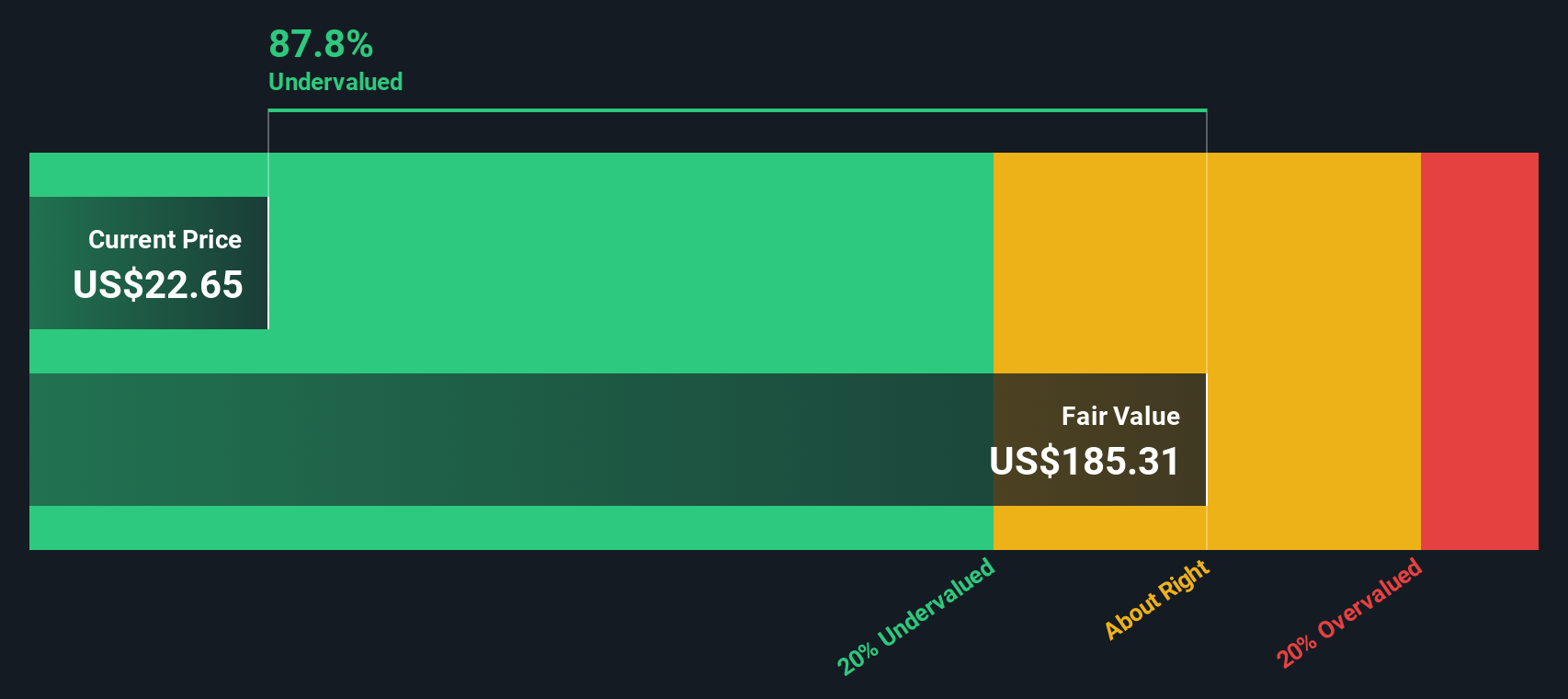

Taking a different approach, the SWS DCF model puts Summit Therapeutics in a very different light and suggests the stock may actually be undervalued. Does this challenge conventional wisdom or does it highlight a gap in expectations?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Summit Therapeutics to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Summit Therapeutics Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily construct your own perspective in just a few minutes. Do it your way

A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You could be missing out on your next big winner by sticking to the familiar. Explore ideas tailored to market trends that other investors are watching right now.

- Find hidden bargains on Wall Street by checking out stocks that are currently undervalued using cash flow fundamentals with undervalued stocks based on cash flows.

- Discover the cutting edge of artificial intelligence with a handpicked selection of promising companies reshaping the future with AI penny stocks.

- Increase your income potential by targeting top-yielding opportunities screened for strong, consistent dividends through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives