- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (NasdaqGM:SMMT) Sees 16% Stock Price Increase Over Past Month

Reviewed by Simply Wall St

Summit Therapeutics (NasdaqGM:SMMT) recently reported events that may align with its notable 16% share price increase over the past month. While broader market movements were influenced by economic data such as a weaker GDP report causing mixed market reactions, Summit's trajectory appeared to remain robust. The company's specific developments, if relevant, appeared aligned with or enhanced the overall upward market trends, otherwise they added weight to the broader moves observed in the market. Despite market volatility affecting big tech stocks, Summit's performance is indicative of a resilient interest in its shares over the measured period.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Over a three-year span, Summit Therapeutics' shareholders experienced a very large total return of 1517.81%, reflecting significant long-term share price appreciation. In comparison, Summit outperformed the US Biotechs industry, which saw a decline of 4.2% over the past year, highlighting the stock's resilience against industry trends. Furthermore, the company's share price outpaced the broader US market, which returned 7.7% within the same year.

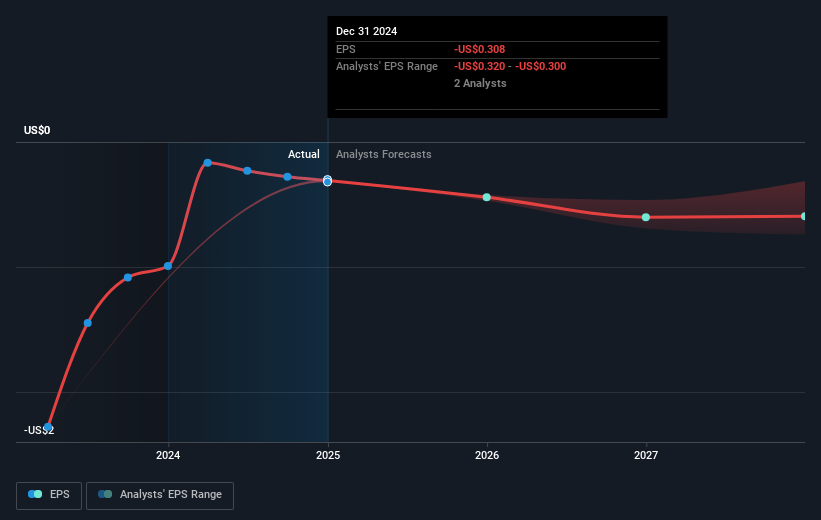

Despite the recent uptick in share price, Summit's revenue remains at US$0, with continued unprofitability and projected losses over the next three years. The company's recent executive appointments and strategic collaborations, as mentioned in the introduction, could influence its long-term prospects and potential for future revenue streams. However, current forecasts remain conservative, reflecting these ongoing challenges. The share price movement remains notable, yet Summit is trading below the consensus analyst price target of US$37.54, indicating potential room for growth from its current level. Analysts agree the stock could rise by 58.9%, albeit current valuations suggest it is trading below fair value estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Summit Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet and fair value.

Market Insights

Community Narratives