- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

Soleno Therapeutics (SLNO): Assessing Valuation and Growth Potential in the Biotech Sector

Reviewed by Kshitija Bhandaru

Soleno Therapeutics (SLNO) stock has drawn notice lately, especially as investors weigh up the biotech’s recent share performance and financial results. The company’s year-to-date gain, combined with intriguing growth metrics, has prompted renewed conversation around its value and future prospects.

See our latest analysis for Soleno Therapeutics.

Soleno Therapeutics’ share price has surged this year, reflecting heightened optimism about its growth prospects as revenue and net income show strong improvements. With a 26.8% year-to-date share price return and a three-year total shareholder return over 32%, momentum is building as confidence grows around the company’s trajectory.

If recent gains have sparked your curiosity, you might find it rewarding to check out other innovators in the sector using our See the full list for free..

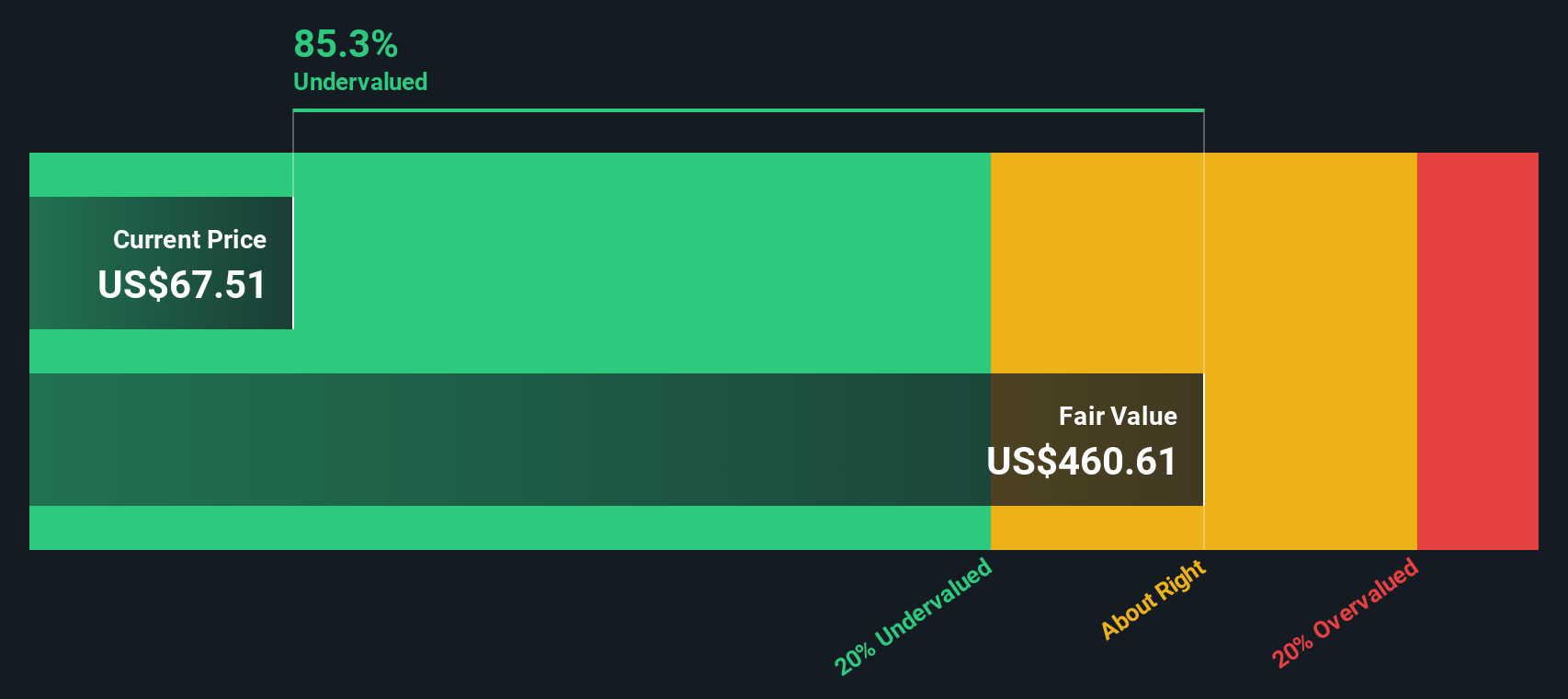

With shares enjoying strong momentum and impressive growth metrics, the question now is whether Soleno Therapeutics remains undervalued or if the market has already factored in its future potential, which could leave limited room for upside.

Price-to-Book of 12.8x: Is it justified?

Soleno Therapeutics’ price-to-book ratio is currently 12.8x, outpacing both its direct biotech peers and the broader market average. This suggests that investors are pricing in significant future growth or potential upside.

The price-to-book ratio measures how the market values a company’s net assets. It is often used in asset-heavy or research-driven sectors like pharmaceuticals and biotech. A high ratio typically signals that the market expects substantial improvements in profitability or value creation ahead, but it can also indicate an overheated valuation if fundamentals do not keep pace.

Compared to the US Biotechs industry average of just 2.4x and a peer group average of 10.7x, Soleno looks even more expensive on this metric. There is no available “fair” price-to-book ratio for Soleno, so it is unclear if the market is overshooting. However, relative to its sector and rivals, the premium is pronounced.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 12.8x (OVERVALUED)

However, weak recent returns and ongoing net losses could challenge optimism if growth stalls or if profitability continues to lag expectations.

Find out about the key risks to this Soleno Therapeutics narrative.

Another View: Discounted Cash Flow Model Paints a Different Picture

While Soleno Therapeutics appears overvalued when looking at its price-to-book ratio, the SWS DCF model offers a starkly different perspective. According to our DCF analysis, the stock trades at a hefty 87.7% discount to estimated fair value, hinting at potential undervaluation based on long-term cash flow assumptions.

Look into how the SWS DCF model arrives at its fair value.

Will the market recognize this deep value, or are there risks not captured in the numbers? The answer may define the next phase for Soleno’s share price.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soleno Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soleno Therapeutics Narrative

If you want to dig deeper or develop your own perspective, you can quickly craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Capitalize on new trends and untapped markets by using the Simply Wall Street Screener. These ideas could help you secure your next portfolio winner. Don’t leave your next move to chance.

- Uncover growth tailwinds as you scan these 24 AI penny stocks featuring breakthrough innovations that are shaking up industries today.

- Target value with these 900 undervalued stocks based on cash flows which could offer substantial upside based on their attractive fundamentals.

- Lock in future cash flow by adding these 19 dividend stocks with yields > 3% to your watchlist, focusing on businesses with consistently high yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives