- United States

- /

- Pharma

- /

- NasdaqGM:SIGA

Undiscovered Gems In US Market Including SIGA Technologies And 2 Other Small Caps

Reviewed by Simply Wall St

As the U.S. stock market navigates through geopolitical tensions and fluctuating oil prices, small-cap stocks have shown resilience amid broader market volatility. With major indices like the S&P 500 experiencing both rallies and declines, investors are increasingly looking to uncover hidden opportunities within the small-cap sector. In this dynamic environment, identifying promising stocks requires a keen eye for companies with strong fundamentals and growth potential that can weather current economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

SIGA Technologies (SIGA)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGA Technologies, Inc. is a commercial-stage pharmaceutical company that specializes in the health security market within the United States, with a market capitalization of approximately $454.37 million.

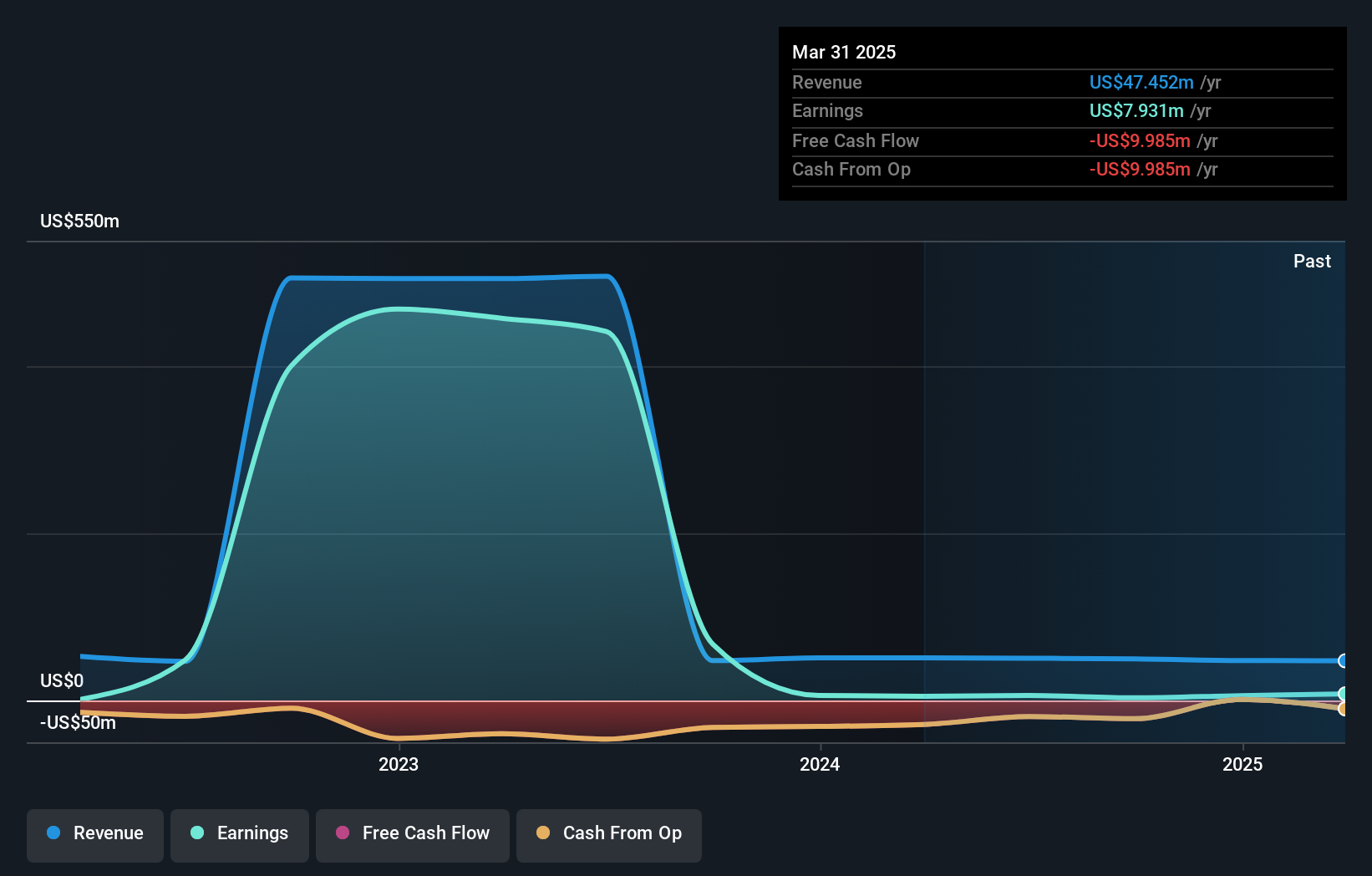

Operations: SIGA Technologies generates revenue primarily from its pharmaceuticals segment, amounting to $120.33 million.

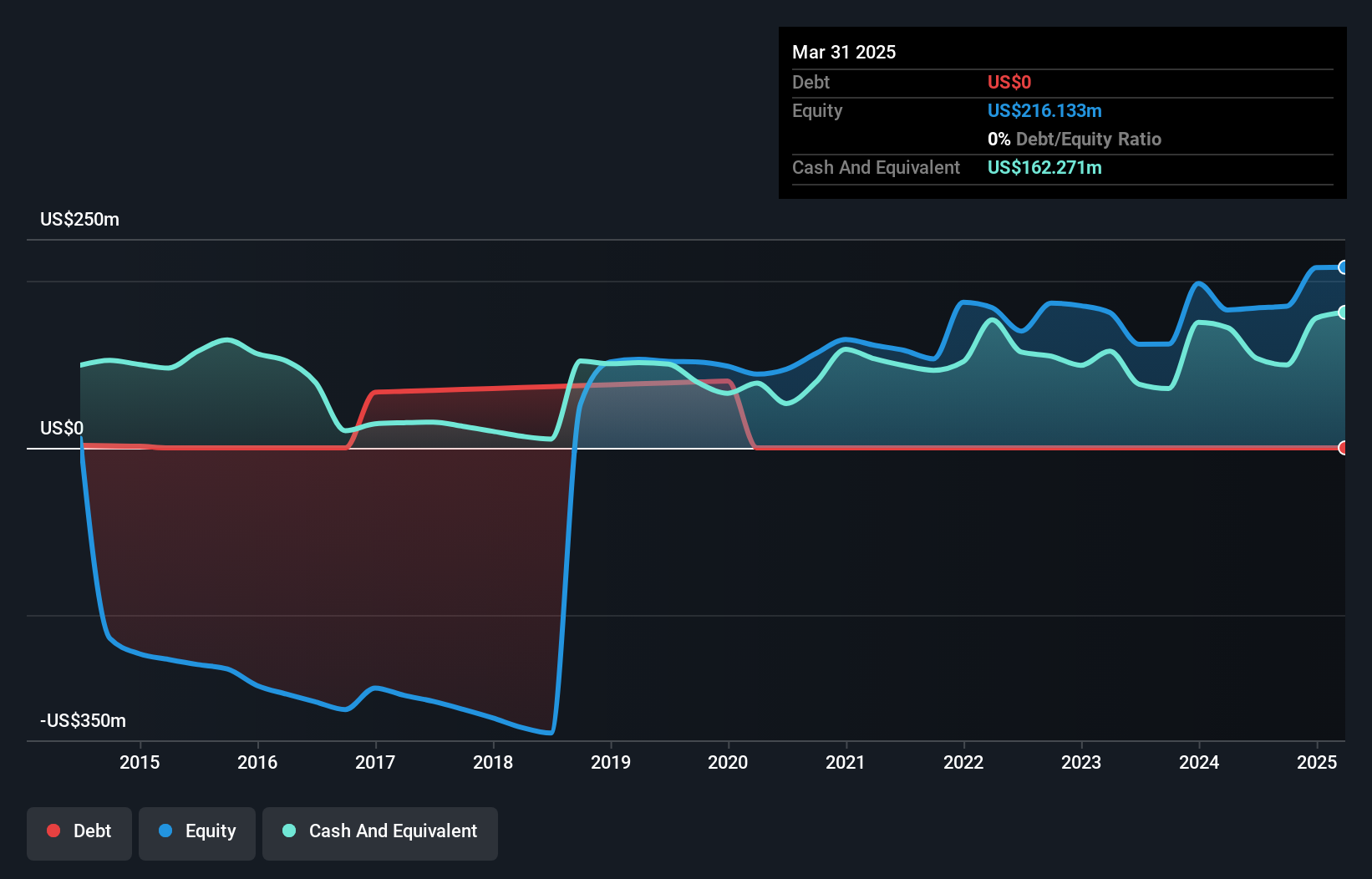

SIGA Technologies, a small cap player in the pharmaceutical space, has been navigating some challenging waters. Despite being debt-free, its recent performance showed a net loss of US$0.41 million for Q1 2025 against a net income of US$10.28 million last year, with revenue dropping to US$7.04 million from US$25.43 million previously. The company is trading at 71.8% below its estimated fair value and boasts high-quality earnings historically but faced negative earnings growth of 38.8% over the past year compared to the industry average of 13%. Recent amendments to corporate bylaws and ongoing strategic partnerships might influence future stability and growth prospects.

- Delve into the full analysis health report here for a deeper understanding of SIGA Technologies.

Explore historical data to track SIGA Technologies' performance over time in our Past section.

Investors Title (ITIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Investors Title Company provides title insurance services for residential, institutional, commercial, and industrial properties with a market capitalization of approximately $379.78 million.

Operations: Investors Title generates revenue primarily from its title insurance segment, which accounts for $258.58 million, complemented by exchange services contributing $11.29 million.

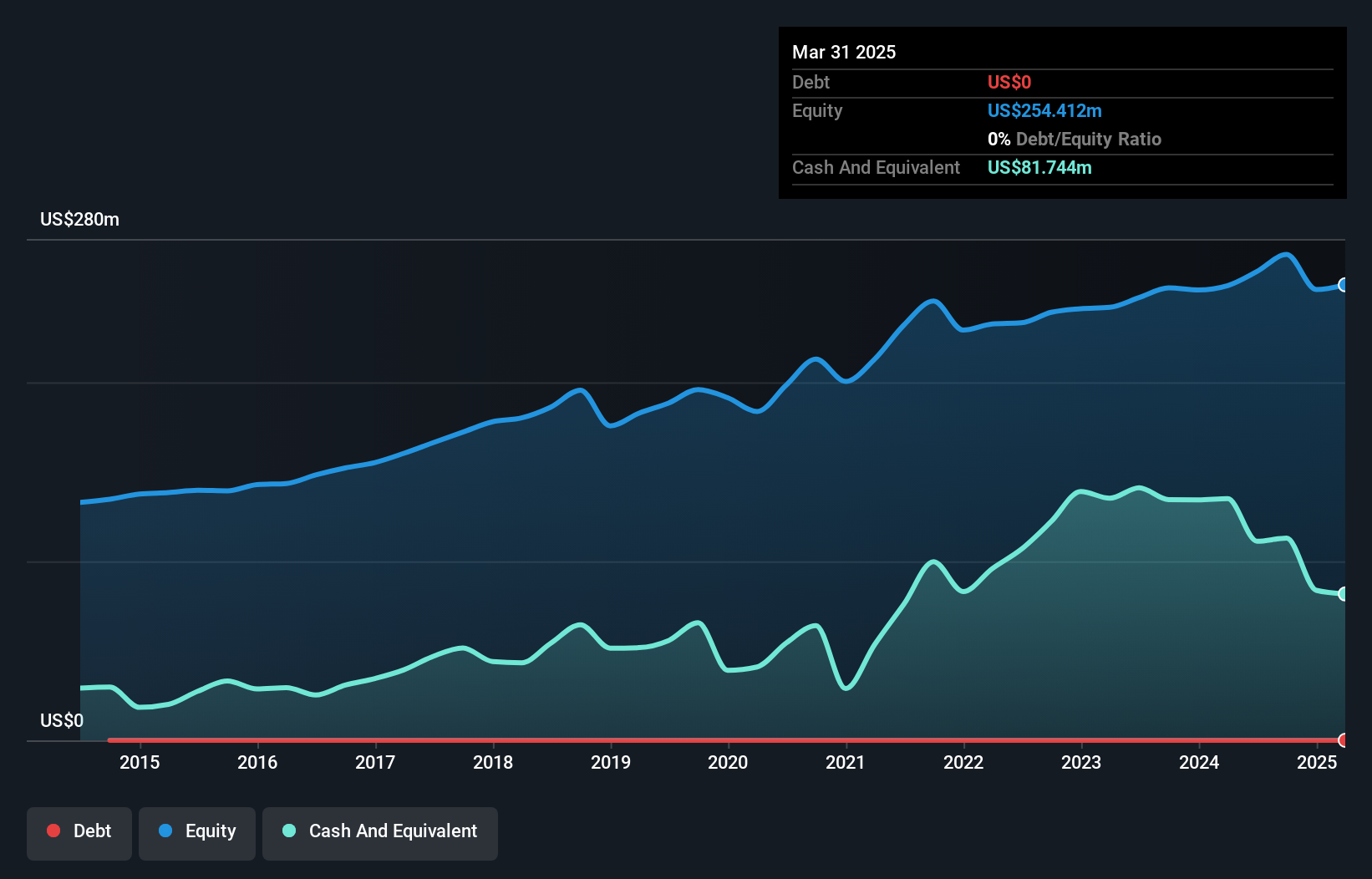

Investors Title, a nimble player in the insurance sector, showcases a robust financial profile with high-quality earnings and zero debt over the past five years. Trading at 30% below its estimated fair value, it offers potential value for investors. The company reported first-quarter revenue of US$56.57 million, up from US$53.46 million last year, although net income dipped to US$3.17 million from US$4.53 million previously. Despite an earnings decline of 11% annually over five years, recent growth outpaced industry averages at 19%. A dividend of $0.46 per share was declared recently, reinforcing shareholder returns amidst leadership changes.

- Dive into the specifics of Investors Title here with our thorough health report.

Evaluate Investors Title's historical performance by accessing our past performance report.

Transcontinental Realty Investors (TCI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Transcontinental Realty Investors, Inc., based in Dallas, is a real estate investment company with a diverse portfolio of properties across the U.S. and has a market cap of approximately $329.76 million.

Operations: TCI generates revenue primarily from its commercial and multifamily segments, totaling $47.18 million, with the multifamily segment contributing the larger share at $34.36 million.

Transcontinental Realty Investors, a small player in the real estate sector, has shown impressive earnings growth of 59.6% over the past year, outpacing the industry average of 25.8%. The net debt to equity ratio stands at a satisfactory 21.5%, down from 128.3% five years ago, indicating improved financial stability. Despite a one-off gain of US$3.3 million impacting recent financials, TCI's profitability remains robust with net income for Q1 2025 at US$4.62 million compared to US$2.55 million in the previous year’s quarter and basic EPS rising from US$0.30 to US$0.53 during this period.

- Click here and access our complete health analysis report to understand the dynamics of Transcontinental Realty Investors.

Learn about Transcontinental Realty Investors' historical performance.

Summing It All Up

- Dive into all 289 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SIGA

SIGA Technologies

A commercial-stage pharmaceutical company, focuses on the health security market in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives