- United States

- /

- Biotech

- /

- NasdaqCM:SGMO

Improved Revenues Required Before Sangamo Therapeutics, Inc. (NASDAQ:SGMO) Shares Find Their Feet

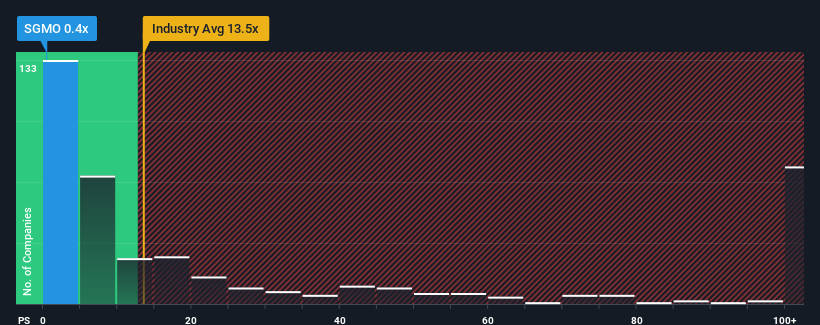

Sangamo Therapeutics, Inc.'s (NASDAQ:SGMO) price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 13.5x and even P/S above 57x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Sangamo Therapeutics

What Does Sangamo Therapeutics' Recent Performance Look Like?

Sangamo Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sangamo Therapeutics.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Sangamo Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 80% gain to the company's top line. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 31% per year over the next three years. That's not great when the rest of the industry is expected to grow by 228% per annum.

In light of this, it's understandable that Sangamo Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Sangamo Therapeutics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Sangamo Therapeutics' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Sangamo Therapeutics that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SGMO

Sangamo Therapeutics

A clinical-stage genomic medicine company, focuses on translating science into medicines that transform the lives of patients and families afflicted with serious diseases in the United States.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives