- United States

- /

- Pharma

- /

- NasdaqGM:SCYX

Lacklustre Performance Is Driving SCYNEXIS, Inc.'s (NASDAQ:SCYX) Low P/S

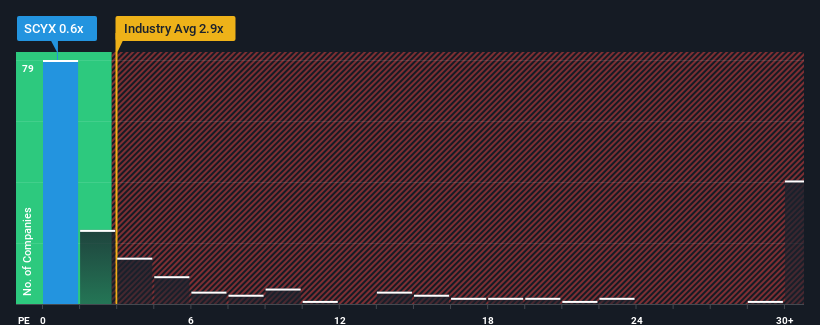

With a price-to-sales (or "P/S") ratio of 0.6x SCYNEXIS, Inc. (NASDAQ:SCYX) may be sending very bullish signals at the moment, given that almost half of all the Pharmaceuticals companies in the United States have P/S ratios greater than 2.9x and even P/S higher than 18x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for SCYNEXIS

How Has SCYNEXIS Performed Recently?

SCYNEXIS certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think SCYNEXIS' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

SCYNEXIS' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 8.1% per year as estimated by the five analysts watching the company. That's not great when the rest of the industry is expected to grow by 53% per year.

With this in consideration, we find it intriguing that SCYNEXIS' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does SCYNEXIS' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that SCYNEXIS' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, SCYNEXIS' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for SCYNEXIS (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on SCYNEXIS, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SCYX

SCYNEXIS

A biotechnology company, develops medicines to overcome and prevent difficult-to-treat and drug-resistant infections in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives