- United States

- /

- Pharma

- /

- NasdaqCM:SCLX

Scilex Holding Company's (NASDAQ:SCLX) 35% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Scilex Holding Company (NASDAQ:SCLX) shares have been powering on, with a gain of 35% in the last thirty days. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 73% share price drop in the last twelve months.

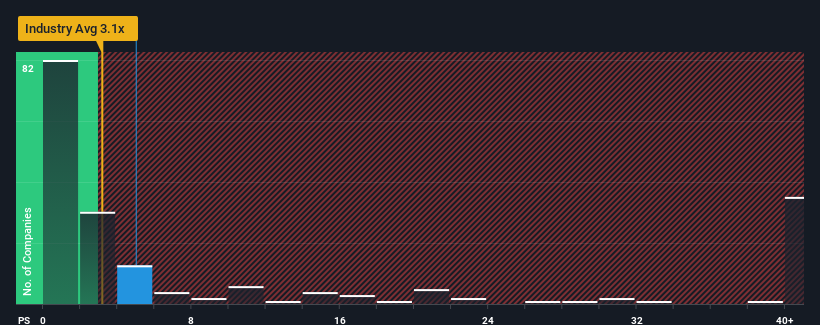

Since its price has surged higher, Scilex Holding may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 5x, since almost half of all companies in the Pharmaceuticals in the United States have P/S ratios under 3.1x and even P/S lower than 0.6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Scilex Holding

How Scilex Holding Has Been Performing

With revenue growth that's superior to most other companies of late, Scilex Holding has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Scilex Holding.Is There Enough Revenue Growth Forecasted For Scilex Holding?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Scilex Holding's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. Pleasingly, revenue has also lifted 92% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 35% each year as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 49% per annum growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Scilex Holding's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Scilex Holding's P/S

Scilex Holding shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Scilex Holding, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Scilex Holding (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If you're unsure about the strength of Scilex Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SCLX

Scilex Holding

Focuses on acquiring, developing, and commercializing non-opioid pain management products for the treatment of acute and chronic pain.

Undervalued with high growth potential.

Market Insights

Community Narratives