- United States

- /

- Biotech

- /

- NasdaqGS:SANA

Will Sana Biotechnology’s (SANA) Pipeline Shift Redefine Its Long-Term Strategic Positioning?

Reviewed by Sasha Jovanovic

- Sana Biotechnology announced it will webcast CEO Steve Harr's business overview and update at Citi’s 2025 Global Healthcare Conference on December 2 and the 8th Annual Evercore Healthcare Conference on December 3, with presentations accessible to investors for 30 days following the events.

- Recent focus has intensified around Sana's decision to prioritize development of its SC451 and SG299 drug candidates for diabetes and B-cell cancer and autoimmune diseases, signaling a shift in the company’s pipeline strategy.

- We’ll explore how Sana’s emphasis on SC451 and SG299 at major investor conferences shapes the company's investment narrative for the future.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Sana Biotechnology's Investment Narrative?

For potential shareholders in Sana Biotechnology, conviction centers on the company’s ability to progress its SC451 and SG299 programs, both now at the forefront of its pipeline. The recent announcement that Sana will highlight these drug candidates at major healthcare conferences adds visibility to the new focus and may shift short-term catalysts more firmly toward clinical milestones and meaningful updates for these two assets. While Sana’s share price has shown considerable volatility and it remains unprofitable without revenue in sight, the narrowing of its development pipeline and upcoming investor presentations could temporarily shift attention away from previous issues like lawsuits and executive turnover. However, with only a limited cash runway, material improvements in market sentiment may depend on successful trial updates rather than presentations alone, keeping risks around dilution and funding needs front of mind.

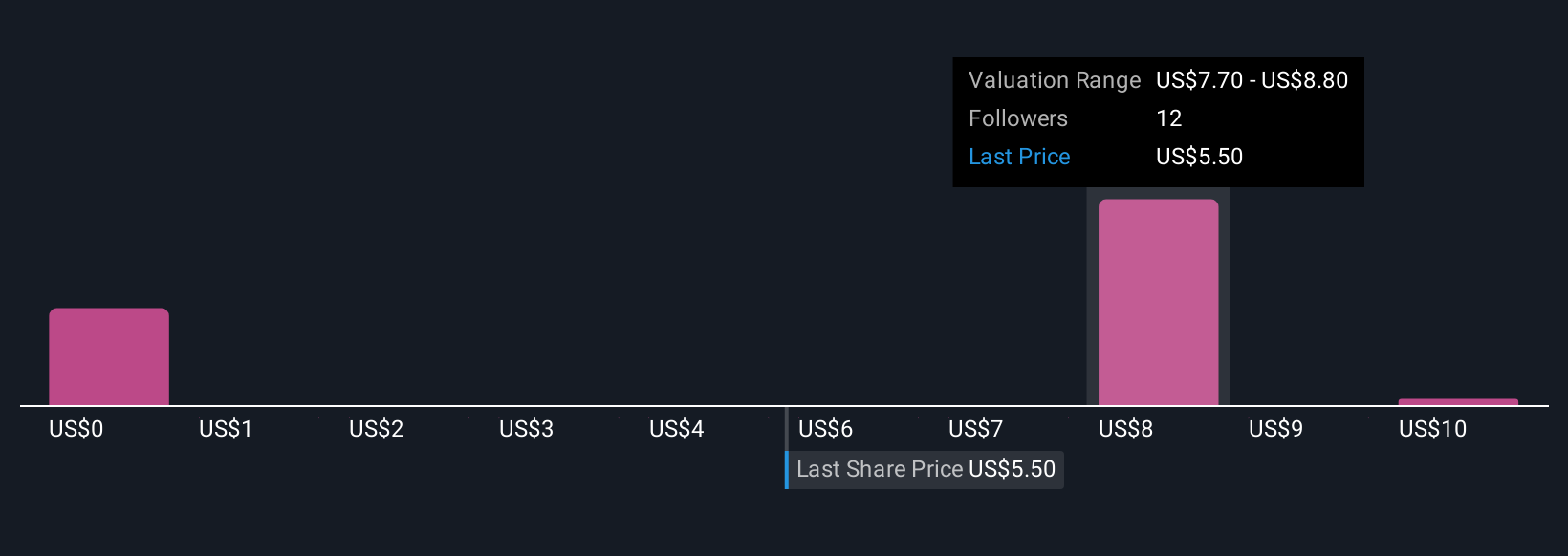

But with such a limited cash runway, one crucial risk stands out for investors. Upon reviewing our latest valuation report, Sana Biotechnology's share price might be too optimistic.Exploring Other Perspectives

Explore 8 other fair value estimates on Sana Biotechnology - why the stock might be worth less than half the current price!

Build Your Own Sana Biotechnology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sana Biotechnology research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

- Our free Sana Biotechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sana Biotechnology's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SANA

Sana Biotechnology

A biotechnology company, focuses on utilizing engineered cells as medicines in the United States.

Medium-low risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.