- United States

- /

- Biotech

- /

- NasdaqCM:SABS

Downgrade: Here's How Analysts See SAB Biotherapeutics, Inc. (NASDAQ:SABS) Performing In The Near Term

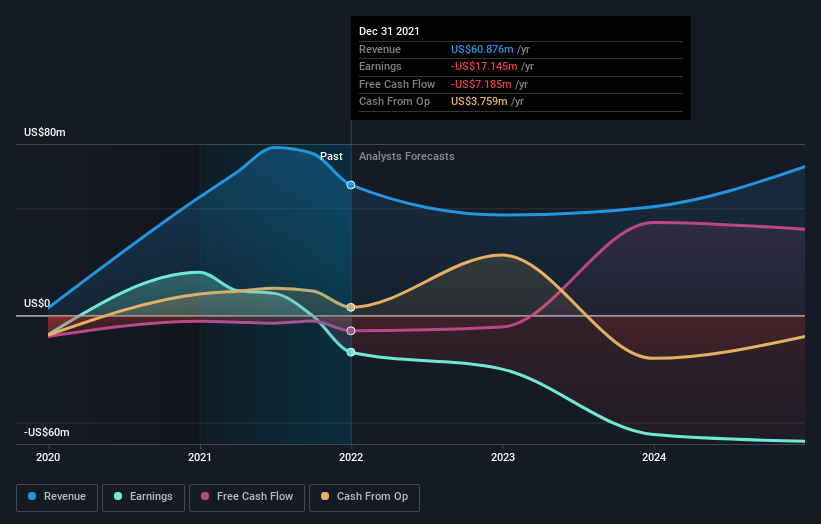

Market forces rained on the parade of SAB Biotherapeutics, Inc. (NASDAQ:SABS) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business. Investors however, have been notably more optimistic about SAB Biotherapeutics recently, with the stock price up a worthy 25% to US$2.81 in the past week. It will be interesting to see if the downgrade has an impact on buying demand for the company's shares.

Following the latest downgrade, the current consensus, from the three analysts covering SAB Biotherapeutics, is for revenues of US$47m in 2022, which would reflect a substantial 23% reduction in SAB Biotherapeutics' sales over the past 12 months. Losses are forecast to narrow 2.3% to US$0.39 per share. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$63m and losses of US$0.25 per share in 2022. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

Check out our latest analysis for SAB Biotherapeutics

The consensus price target fell 18% to US$10.35, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on SAB Biotherapeutics, with the most bullish analyst valuing it at US$16.50 and the most bearish at US$8.00 per share. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 23% by the end of 2022. This indicates a significant reduction from annual growth of 10% over the last year. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 11% per year. It's pretty clear that SAB Biotherapeutics' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at SAB Biotherapeutics. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that SAB Biotherapeutics' revenues are expected to grow slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of SAB Biotherapeutics.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with SAB Biotherapeutics, including major dilution from new stock issuance in the past year. Learn more, and discover the 1 other flag we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SABS

SAB Biotherapeutics

A clinical-stage biopharmaceutical company, focuses on the development of human polyclonal immunotherapeutic antibodies to address immune system disorders.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success