- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

How the FDA's Priority Review for Setmelanotide Could Shape Rhythm Pharmaceuticals' (RYTM) Rare Disease Strategy

Reviewed by Simply Wall St

- Rhythm Pharmaceuticals announced that the FDA has accepted for filing its supplemental New Drug Application for setmelanotide to treat acquired hypothalamic obesity and granted Priority Review, targeting a decision by December 20, 2025.

- The expedited review signals setmelanotide’s potential to address an unmet medical need and may accelerate commercial opportunities in a new therapeutic indication.

- We'll examine what the FDA's Priority Review for setmelanotide means for Rhythm's growth prospects and rare disease pipeline.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Rhythm Pharmaceuticals Investment Narrative Recap

To be a shareholder in Rhythm Pharmaceuticals, investors need to believe in the company’s ability to translate its rare disease pipeline, led by setmelanotide, into sustained commercial success despite current operating losses and ongoing capital raises. The FDA's Priority Review for setmelanotide in acquired hypothalamic obesity directly impacts Rhythm’s most important short-term catalyst, as regulatory progress here may meaningfully expand its addressable market, though substantial operating losses and the risk of future dilution remain material concerns.

Among recent announcements, Rhythm shared positive Phase 3 data on setmelanotide at the July Endocrine Society Meeting, presenting efficacy in treating hyperphagia and obesity. This supports the expanded application in the FDA’s Priority Review process, reinforcing setmelanotide’s status as Rhythm’s key growth lever while highlighting the pipeline’s significance for short- and medium-term outcomes.

However, with the potential for future dilutive capital raises still looming, investors should be aware that...

Read the full narrative on Rhythm Pharmaceuticals (it's free!)

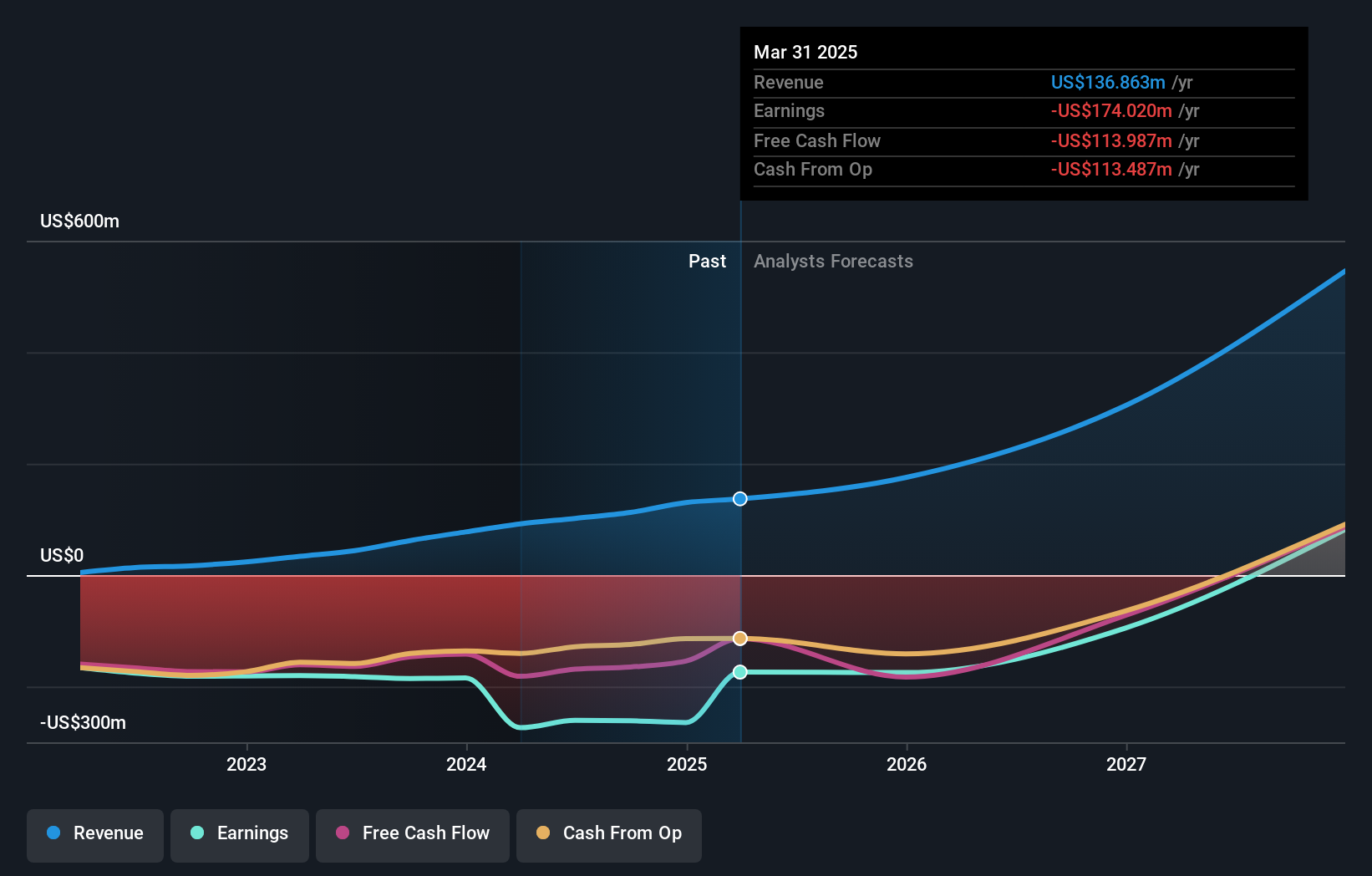

Rhythm Pharmaceuticals' narrative projects $742.1 million revenue and $250.7 million earnings by 2028. This requires 68.1% yearly revenue growth and a $439.1 million increase in earnings from -$188.4 million today.

Uncover how Rhythm Pharmaceuticals' forecasts yield a $112.50 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community users put Rhythm's fair value between US$33.51 and US$177.71 across three estimates. While optimism on new indications fuels potential, persistent operating losses could challenge your return expectations into the next phase of Rhythm’s growth story.

Explore 3 other fair value estimates on Rhythm Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own Rhythm Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rhythm Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rhythm Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rhythm Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives