- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

How Positive Analyst Coverage at Rhythm Pharmaceuticals (RYTM) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, Rhythm Pharmaceuticals received a wave of positive attention after Citigroup analyst Samantha Semenkow initiated coverage with a "Buy" rating, reflecting growing consensus sentiment from multiple brokerages.

- This surge in optimistic analyst outlooks highlights increasing confidence in Rhythm Pharmaceuticals' potential for growth and innovation within the rare disease biopharmaceutical sector.

- We'll explore how this increase in favorable analyst coverage could influence the company's investment narrative and future market positioning.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rhythm Pharmaceuticals Investment Narrative Recap

Owning Rhythm Pharmaceuticals means believing in its sustained ability to drive innovation in rare genetic obesity treatments, with commercial success hinging on expanding indications for its flagship drug, setmelanotide, and successfully managing regulatory and reimbursement hurdles. The recent upswing in analyst convictions, including the new "Buy" rating from Citigroup, reinforces confidence but does not materially alter the near-term catalyst, FDA approval for setmelanotide’s new use in acquired hypothalamic obesity, or overshadow the persistent risk of continued operating losses amid high research and development spending. Rhythm’s announcement that the FDA has extended the review period for setmelanotide’s supplemental approval to March 2026 is especially pertinent, as it directly impacts the key catalyst that could unlock new sources of revenue. This delay keeps the short-term focus squarely on regulatory outcomes and means investor attention will likely remain fixed on upcoming agency decisions and subsequent commercial launches. However, with such optimism around future opportunities, investors should also be mindful of the ongoing risk of dilution from potential future capital raises if losses persist...

Read the full narrative on Rhythm Pharmaceuticals (it's free!)

Rhythm Pharmaceuticals' outlook anticipates $742.1 million in revenue and $250.7 million in earnings by 2028. This scenario involves 68.1% annual revenue growth and a $439.1 million increase in earnings from the current level of -$188.4 million.

Uncover how Rhythm Pharmaceuticals' forecasts yield a $126.31 fair value, a 18% upside to its current price.

Exploring Other Perspectives

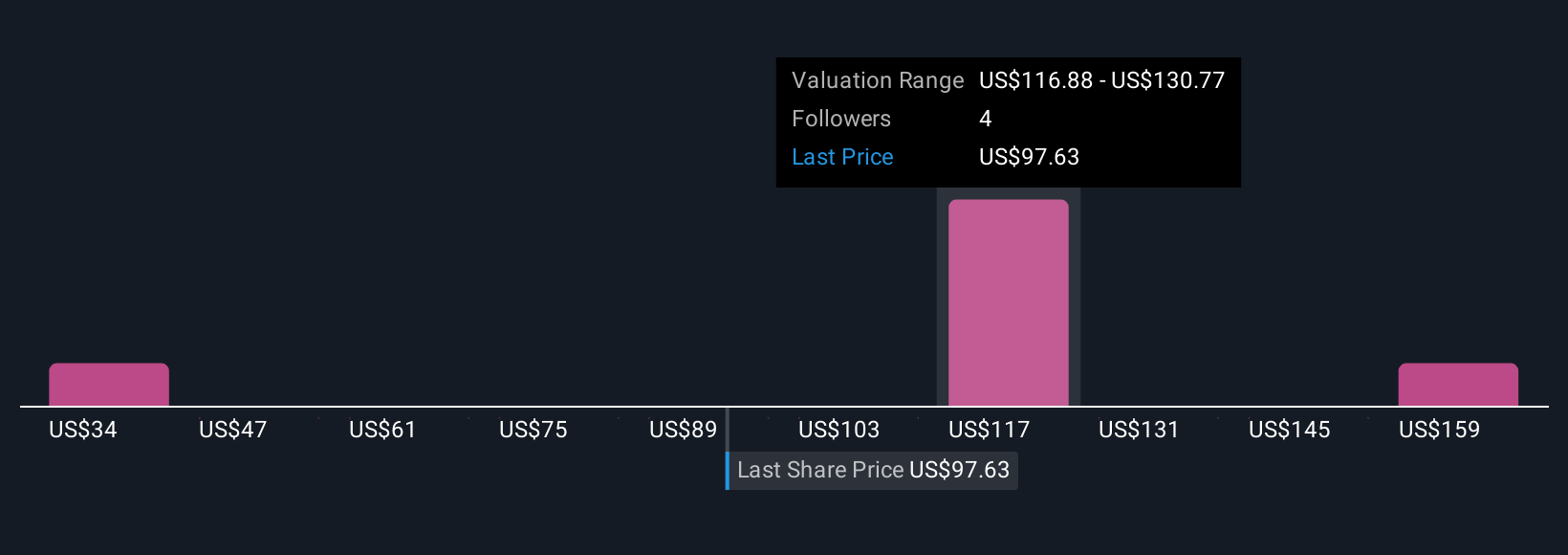

The Simply Wall St Community includes 3 independent fair value estimates for Rhythm Pharmaceuticals ranging from US$33.51 to US$156.51 per share. With the FDA decision delay and ongoing operating losses, perspectives on future value can differ sharply, so consider multiple angles before deciding on your stance.

Explore 3 other fair value estimates on Rhythm Pharmaceuticals - why the stock might be worth as much as 46% more than the current price!

Build Your Own Rhythm Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rhythm Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Rhythm Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rhythm Pharmaceuticals' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success