- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

FDA Review Extension for IMCIVREE Might Change the Case for Investing in Rhythm Pharmaceuticals (RYTM)

Reviewed by Sasha Jovanovic

- Rhythm Pharmaceuticals recently announced that the FDA has extended the review period for the supplemental New Drug Application (sNDA) for IMCIVREE (setmelanotide) in acquired hypothalamic obesity, moving the PDUFA goal date from December 20, 2025, to March 20, 2026, after requesting further sensitivity analyses on clinical efficacy data.

- This regulatory update was classified as a major amendment but did not involve new data submissions or concerns related to safety or manufacturing, providing some clarity for stakeholders despite the delay.

- We'll examine how the FDA's extended review period for IMCIVREE could influence Rhythm Pharmaceuticals' investment outlook and future growth potential.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Rhythm Pharmaceuticals Investment Narrative Recap

To be a shareholder in Rhythm Pharmaceuticals, you need to believe in the company’s ability to expand IMCIVREE (setmelanotide) into new, underserved indications like acquired hypothalamic obesity, driving material revenue growth. The FDA’s three-month review extension for this key approval is not expected to materially impact the most important catalyst, the eventual launch of IMCIVREE in this indication, but it does highlight how regulatory timing risk remains a factor for Rhythm's investment case.

The recent Q3 earnings announcement is especially relevant: while Rhythm reported strong revenue growth (up to US$51.3 million from US$33.25 million year-over-year), operating losses persisted and the net loss widened compared to last year. This underlines that despite the potential upside from future approvals, the company’s reliance on setmelanotide and ongoing high R&D and SG&A expenses make near-term financial improvement highly dependent on successful regulatory outcomes.

On the other hand, investors should be aware that persistent losses and the possibility of future dilutive capital raises...

Read the full narrative on Rhythm Pharmaceuticals (it's free!)

Rhythm Pharmaceuticals' narrative projects $742.1 million revenue and $250.7 million earnings by 2028. This requires 68.1% yearly revenue growth and a $439.1 million earnings increase from -$188.4 million currently.

Uncover how Rhythm Pharmaceuticals' forecasts yield a $121.43 fair value, a 22% upside to its current price.

Exploring Other Perspectives

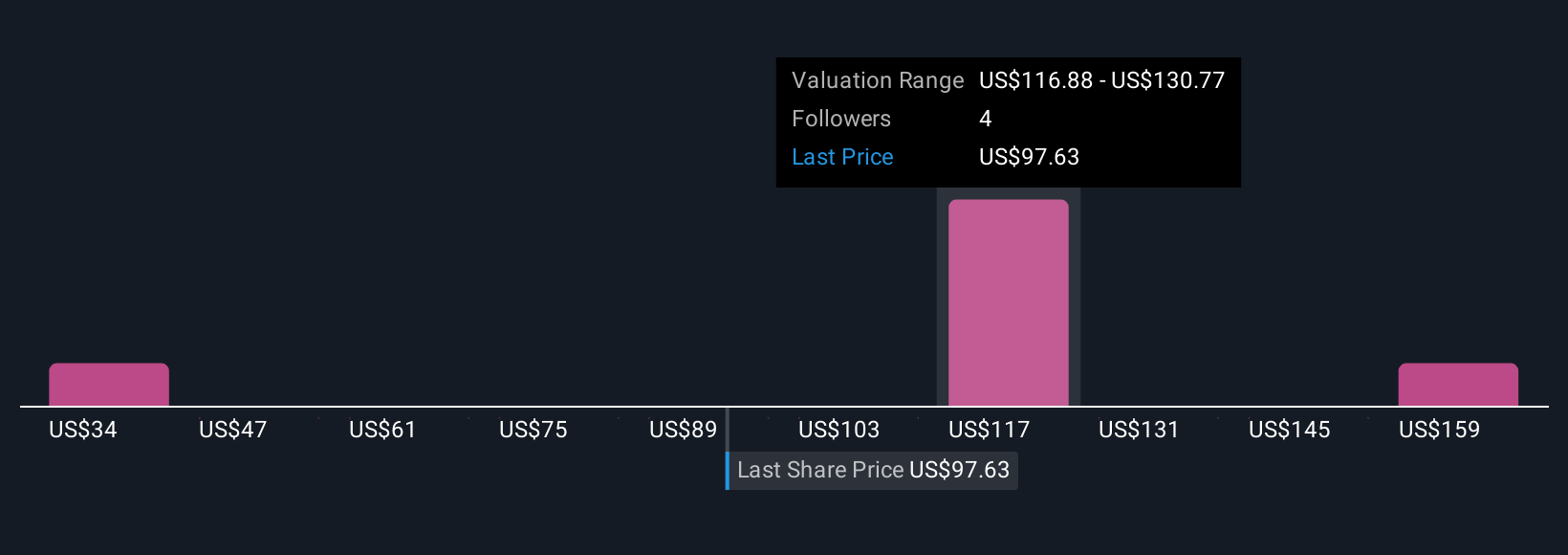

Three different fair value estimates from the Simply Wall St Community span a broad range, from US$33.51 to US$184.37 per share. With the FDA extending its review of IMCIVREE, timing risk remains front of mind for many market participants considering Rhythm’s future performance.

Explore 3 other fair value estimates on Rhythm Pharmaceuticals - why the stock might be worth as much as 85% more than the current price!

Build Your Own Rhythm Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rhythm Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Rhythm Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rhythm Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives