- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

A Look at Rhythm Pharmaceuticals (RYTM) Valuation After FDA Extends IMCIVREE Review for More Data Analyses

Reviewed by Simply Wall St

Investors in Rhythm Pharmaceuticals (RYTM) saw movement after news that the FDA extended its review of the company’s supplemental New Drug Application for IMCIVREE in acquired hypothalamic obesity. The agency cited a need for further sensitivity analyses of clinical data.

See our latest analysis for Rhythm Pharmaceuticals.

The FDA's request for additional clinical analyses might have caused a bout of uncertainty, but Rhythm Pharmaceuticals has still delivered an eye-catching year, with the share price up over 65% year-to-date and a remarkable 1-year total shareholder return of nearly 77%. This reflects building momentum despite brief pullbacks. Investors seem to be weighing both growth prospects from IMCIVREE and the recent positive revenue trends seen in quarterly results, fueling optimism about the company's longer-term trajectory.

If biotech news like this has your attention, you can check out more healthcare innovators through our curated screener: See the full list for free.

With such rapid revenue growth and a 26% discount to analyst price targets, the question is whether Rhythm shares remain undervalued or if the market has already factored in all that future potential. Is there still a buying opportunity here?

Most Popular Narrative: 18.1% Undervalued

Rhythm Pharmaceuticals’ most widely followed narrative puts its fair value significantly above the latest closing price, framing the stock as an undervalued growth opportunity ahead of major milestones.

Upcoming potential regulatory approvals and launches for setmelanotide (IMCIVREE) in new indications like acquired hypothalamic obesity and Prader-Willi syndrome, alongside expansion into younger age groups, are set to materially grow Rhythm's commercial opportunity and topline over the next several years.

How aggressive are the forecasts behind this call? The underlying narrative relies on explosive expansion, margin improvements, and ambitious earnings multiples that few biotechs can consistently achieve. Can these numbers really hold up? The full narrative reveals the bold assumptions powering this valuation.

Result: Fair Value of $121.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating losses and Rhythm's dependence on setmelanotide could quickly challenge the current bullish outlook if progress stalls or if competitor pressure mounts.

Find out about the key risks to this Rhythm Pharmaceuticals narrative.

Another View: What Do Market Ratios Suggest?

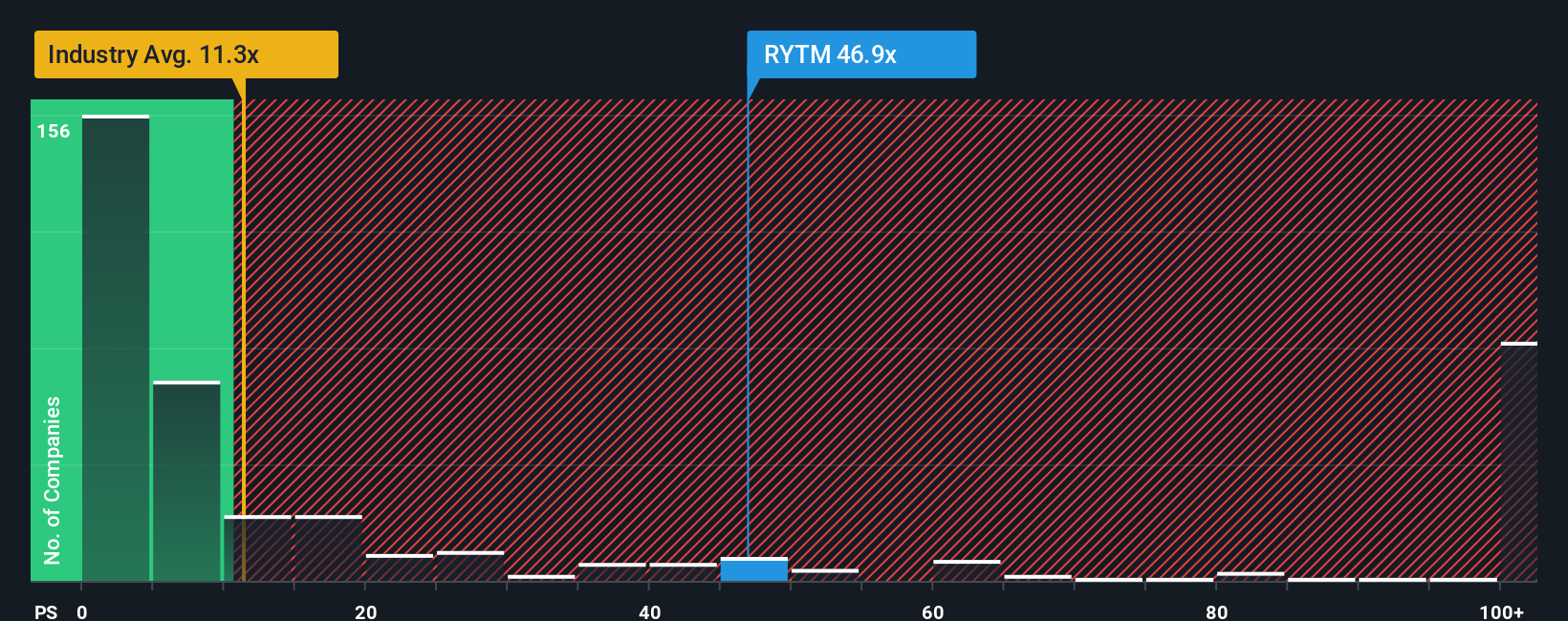

While analysts see strong upside, a look at Rhythm’s price-to-sales ratio offers a more cautious perspective. The current ratio stands at 38.1x, which is much higher than both the US Biotechs industry average of 10.9x and direct peers at 18.8x. Even compared to the fair ratio of 21.5x, Rhythm looks expensive. This gap raises questions about whether growth expectations are already fully reflected in the current price, or if there is a risk investors could face a valuation reset if results do not deliver.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rhythm Pharmaceuticals Narrative

If you want to take a closer look at the numbers or interpret the story your own way, you can build a fully personalized outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rhythm Pharmaceuticals.

Looking for More Investment Ideas?

Level up your investing strategy by targeting stocks with proven growth, valuable trends, and fresh market potential. Don’t miss out on companies transforming their industries. The next big winner might be a click away.

- Capture upside by targeting these 885 undervalued stocks based on cash flows that are trading below their fair value, before the rest of the market catches on.

- Tap into the future of medicine and technology with these 32 healthcare AI stocks that are at the forefront of AI-driven healthcare breakthroughs.

- Uncover new opportunities for income by scanning these 16 dividend stocks with yields > 3% featuring strong yields and consistent payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives