- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Why Recursion Pharmaceuticals (RXRX) Is Up 19.2% After Securing $12.5M Milestone in AI Drug Partnership

Reviewed by Sasha Jovanovic

- Rallybio recently announced that Recursion Pharmaceuticals secured a US$12.5 million milestone payment as part of their ongoing collaboration to advance a key drug candidate.

- This milestone, linked to their AI-driven platform, reflects growing industry confidence in Recursion’s ability to innovate through partnerships and next-generation technology.

- We will explore how the fresh milestone payment, earned through Recursion’s AI-powered drug discovery platform, impacts the company’s investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Recursion Pharmaceuticals Investment Narrative Recap

To be a shareholder in Recursion Pharmaceuticals, you need conviction in AI-driven drug discovery and confidence that large-scale pharma partnerships will deliver sustainable growth. The recently secured US$12.5 million milestone payment from Rallybio boosts near-term revenue but does not meaningfully reduce Recursion’s biggest risk: ongoing reliance on milestone and collaboration payments, with most internal programs still in early clinical stages.

Among recent announcements, the open-source release of Boltz-2 stands out as particularly relevant. This AI model enhances Recursion’s competitive position and is central to the company’s growth catalysts, aiming to deliver faster and more cost-effective drug discovery as collaboration revenue remains vital.

In contrast, investors should be aware that significant partnership payments alone may not offset the financial strain if internal pipeline candidates face delays or setbacks...

Read the full narrative on Recursion Pharmaceuticals (it's free!)

Recursion Pharmaceuticals is projected to reach $220.9 million in revenue and $35.5 million in earnings by 2028. Achieving this would require annual revenue growth of 50.7% and an increase in earnings of $684.6 million from current earnings of -$649.1 million.

Uncover how Recursion Pharmaceuticals' forecasts yield a $6.47 fair value, a 17% upside to its current price.

Exploring Other Perspectives

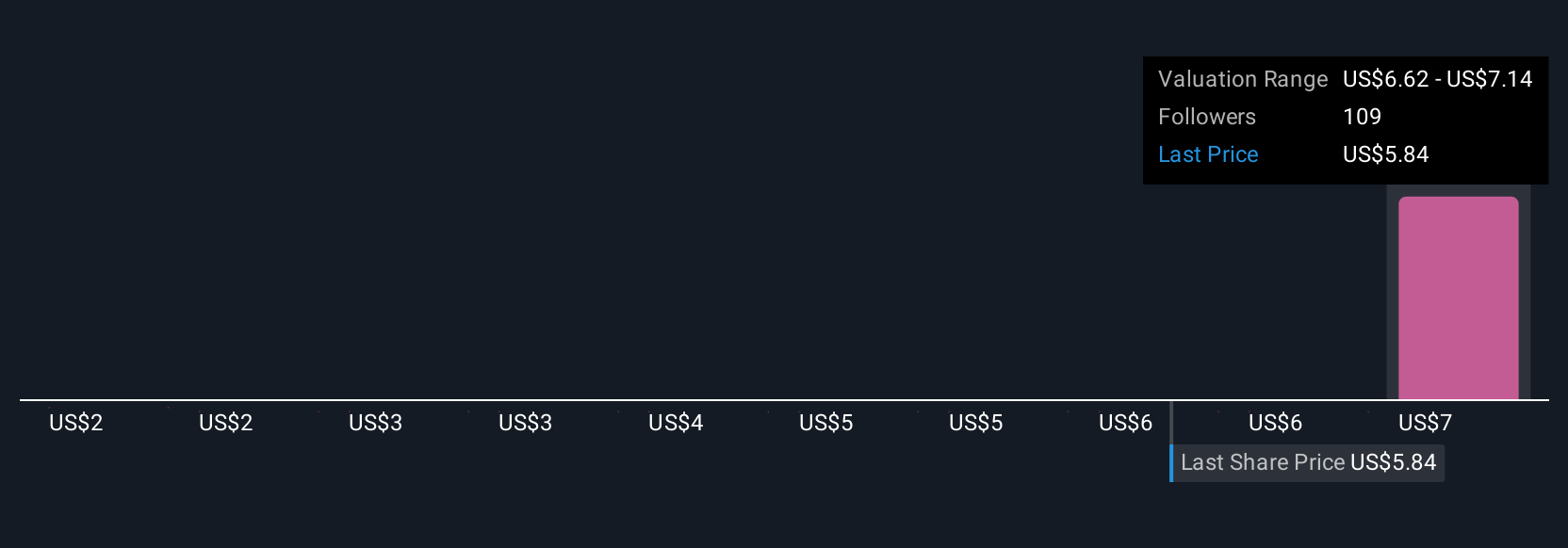

Four fair value estimates from the Simply Wall St Community span US$1.92 to US$10 per share, highlighting wide differences in outlook. Given Recursion’s reliance on external partnerships for near-term revenue, these diverse opinions underscore why it is important to consider multiple sources and viewpoints before making any decisions.

Explore 4 other fair value estimates on Recursion Pharmaceuticals - why the stock might be worth as much as 81% more than the current price!

Build Your Own Recursion Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Recursion Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recursion Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success