- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals, Inc.'s (NASDAQ:RXRX) Share Price Could Signal Some Risk

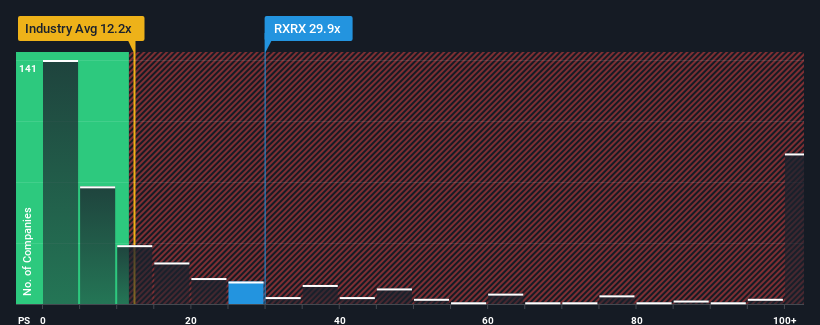

You may think that with a price-to-sales (or "P/S") ratio of 29.9x Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) is a stock to avoid completely, seeing as almost half of all the Biotechs companies in the United States have P/S ratios under 12.7x and even P/S lower than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Recursion Pharmaceuticals

What Does Recursion Pharmaceuticals' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Recursion Pharmaceuticals has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Recursion Pharmaceuticals will help you uncover what's on the horizon.How Is Recursion Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Recursion Pharmaceuticals' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 5.5% during the coming year according to the seven analysts following the company. With the industry predicted to deliver 90% growth, that's a disappointing outcome.

In light of this, it's alarming that Recursion Pharmaceuticals' P/S sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

For a company with revenues that are set to decline in the context of a growing industry, Recursion Pharmaceuticals' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Recursion Pharmaceuticals (1 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Recursion Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives