- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

A Closer Look at Recursion Pharmaceuticals (RXRX) Valuation Following Recent Share Price Slide

Reviewed by Simply Wall St

See our latest analysis for Recursion Pharmaceuticals.

Recursion Pharmaceuticals' momentum has cooled recently, with a 15.4% decline in the last week alone. This highlights shifting sentiment as investors weigh ongoing sector challenges. Despite short-term setbacks, the company’s one-year total shareholder return of -26.7% shows meaningful underperformance and lingering uncertainty around near-term growth prospects.

Interested in discovering where innovation is paying off in healthcare? Check out See the full list for free. for a closer look at other promising stocks in the sector.

With Recursion trading below analysts’ price targets and showing a modest annual revenue growth, investors are left wondering: Is RXRX now undervalued, or are expectations for future gains already fully reflected in its share price?

Most Popular Narrative: 22.7% Undervalued

Recursion Pharmaceuticals closed at $5.00, notably below the most widely followed narrative’s fair value estimate of $6.47. This gap points to a potential opportunity if the narrative’s assumptions hold, while also raising questions about what could drive such a positive outlook.

Rapid integration and iterative improvement of the Recursion OS 2.0 platform, incorporating advanced AI and ML tools (such as Boltz-2 and causal AI for clinical trial design), are expected to drive faster and more cost-effective drug discovery and development, improving R&D efficiency and supporting long-term margin expansion.

Want to know why expectations are so aggressive? This narrative leans on future growth rates and ambitious profitability targets most companies only dream about. If you’re curious which blockbuster assumptions underpin that target price, dive in and see the numbers that justify this bold fair value.

Result: Fair Value of $6.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on pharma partnerships and slow progress in clinical trials could challenge the optimistic outlook and place pressure on Recursion’s long-term revenue ambitions.

Find out about the key risks to this Recursion Pharmaceuticals narrative.

Another View: Multiples Tell a Different Story

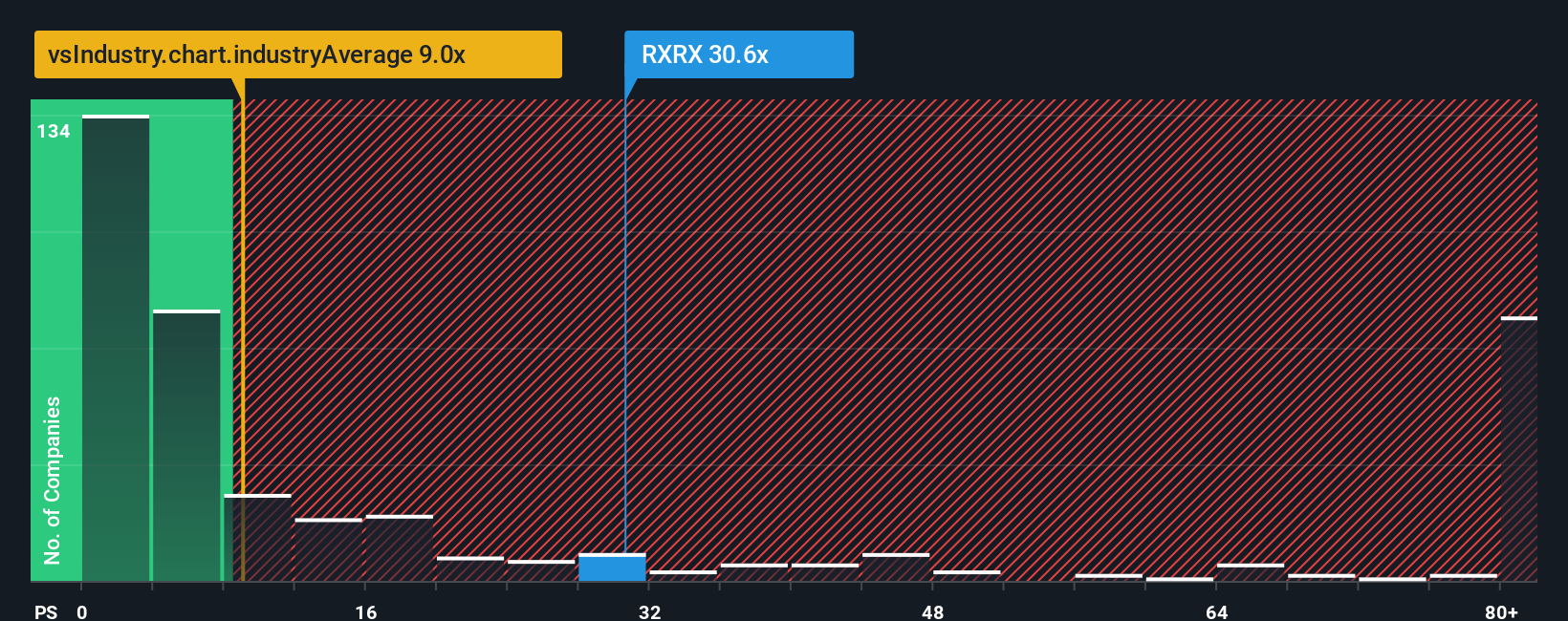

Looking at Recursion Pharmaceuticals through the lens of its price-to-sales ratio paints a more cautious picture. At 33.8x, the company trades much higher than both the US Biotechs industry average of 10.8x and its peers’ 14.2x. The fair ratio is currently estimated at 0x, which signals elevated valuation risk if expectations falter.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Recursion Pharmaceuticals Narrative

If you’d rather follow your own logic or dig into the numbers yourself, it takes just a few minutes to shape your own perspective. Do it your way

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity when you can tap into a world of promising stocks? Uncover bold investment ideas with these hand-picked ways to stay ahead:

- Amplify your research by scanning these 27 AI penny stocks for innovative companies driving breakthroughs in automation and artificial intelligence.

- Power up your portfolio with steady income streams by checking out these 20 dividend stocks with yields > 3% offering attractive yields above 3%.

- Seize value-driven opportunities and spot bargain buys by reviewing these 844 undervalued stocks based on cash flows backed by solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives