- United States

- /

- Pharma

- /

- NasdaqGM:RVNC

Revance Therapeutics, Inc.'s (NASDAQ:RVNC) Earnings Haven't Escaped The Attention Of Investors

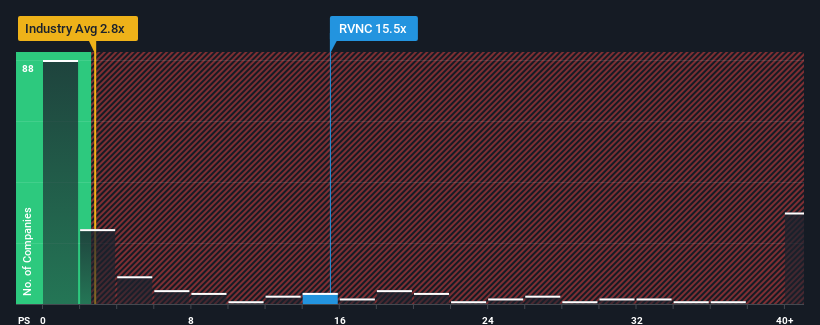

When you see that almost half of the companies in the Pharmaceuticals industry in the United States have price-to-sales ratios (or "P/S") below 2.8x, Revance Therapeutics, Inc. (NASDAQ:RVNC) looks to be giving off strong sell signals with its 15.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Revance Therapeutics

How Revance Therapeutics Has Been Performing

Revance Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Revance Therapeutics will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Revance Therapeutics?

In order to justify its P/S ratio, Revance Therapeutics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 75% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 60% each year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 43% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Revance Therapeutics' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Revance Therapeutics' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Revance Therapeutics shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Revance Therapeutics (at least 1 which is concerning), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RVNC

Revance Therapeutics

A biotechnology company, engages in the development, manufacture, and commercialization of neuromodulators for various aesthetic and therapeutic indications in the United States and internationally.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives