- United States

- /

- Biotech

- /

- NasdaqGS:RVMD

Revolution Medicines (RVMD): Valuation Insights Following Promising Elironrasib Clinical Trial Update

Reviewed by Simply Wall St

Revolution Medicines (RVMD) drew attention after announcing updated clinical results for its experimental therapy, elironrasib, just ahead of a key industry conference. The new data showcases encouraging antitumor activity for patients with KRAS G12C-mutated cancers, a group with few effective treatments.

See our latest analysis for Revolution Medicines.

Revolution Medicines’ string of clinical advancements, including the latest elironrasib update and an FDA voucher for daraxonrasib, has caught the market’s attention. The stock’s momentum is building, with a 25% one-month share price return and a 17% total shareholder return over the past year, underscoring optimism around the pipeline and broader outlook.

Considering how biotech breakthroughs can drive price action, now might be just the right time to explore new opportunities with our See the full list for free.

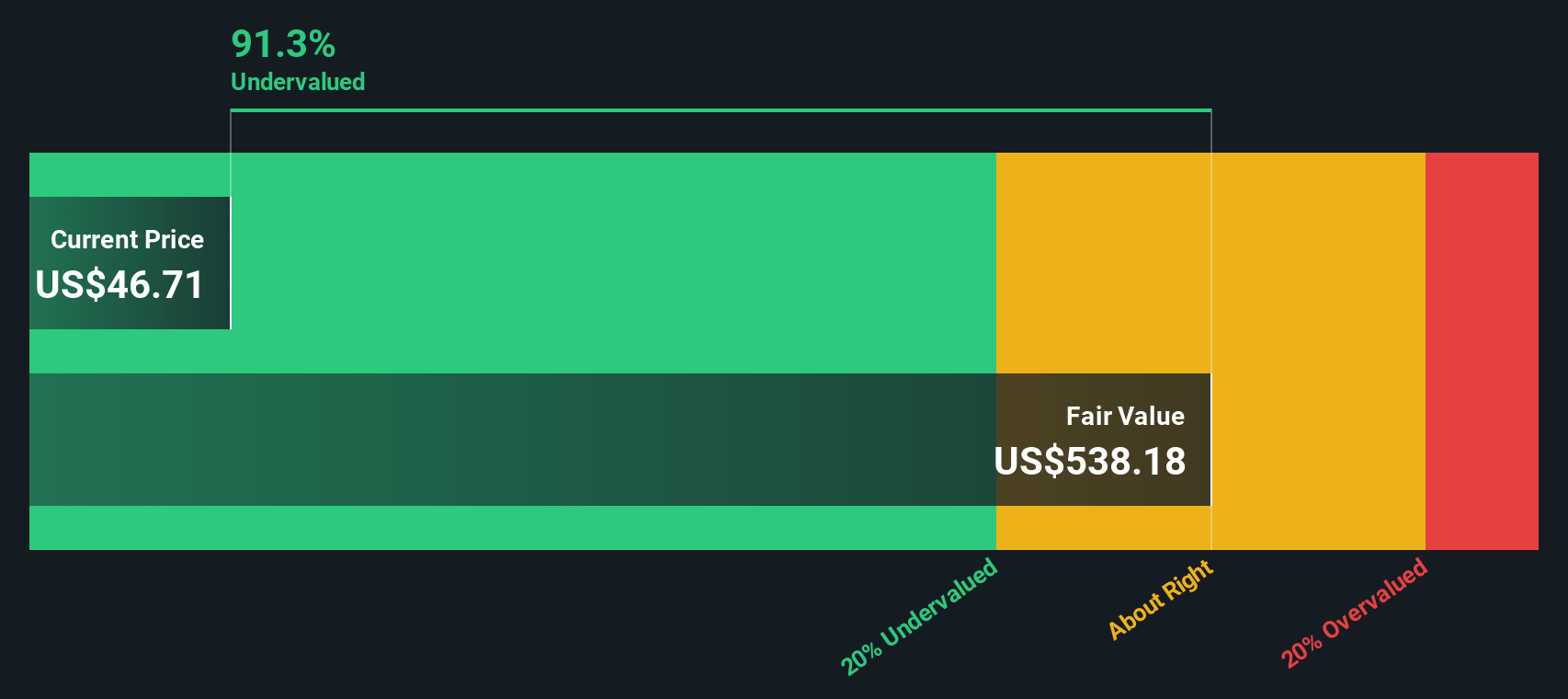

Yet with shares rising fast and blockbuster hopes building, the key question is whether Revolution Medicines remains undervalued at current levels or if the recent surge already reflects most of its future growth potential.

Price-to-Book of 5.5x: Is it justified?

Revolution Medicines is trading at a price-to-book ratio of 5.5x, placing its valuation well above the US Biotechs industry average of 2.5x. This signals that investors are attaching a premium to the company’s assets compared to many peers.

The price-to-book ratio measures a company’s market price against its net assets. This helps to gauge how much of a premium or discount the market assigns to a biotechnology firm’s research pipeline and intellectual property. For a biotechnology company still in its development phase, such as Revolution Medicines, the ratio is often higher due to optimism about future breakthroughs or anticipated product revenue streams.

While paying up for high-growth or high-potential biotech players is common, a price-to-book of 5.5x puts Revolution Medicines at more than double the industry’s average. This suggests the market is crediting the company with a differentiated pipeline or greater revenue potential compared to the majority of its peers, despite it not yet being profitable.

Compared to direct peers, Revolution Medicines is actually good value because its price-to-book ratio is far lower than the peer group average of 20.5x. The valuation could shift if investor appetite changes or new results from its pipeline emerge.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.5x (OVERVALUED compared to industry, UNDERVALUED compared to peer group)

However, uncertainty remains if upcoming clinical results disappoint or if investor sentiment towards high-growth biotechs shifts. This could potentially pressure Revolution Medicines’ valuation.

Find out about the key risks to this Revolution Medicines narrative.

Another View: Discounted Cash Flow Perspective

Taking a step back from ratios, the SWS DCF model offers a long-term view of Revolution Medicines' potential value. This approach estimates the company’s fair value at $275.28 per share, which is over 80% higher than its current share price. Is the market missing something, or could this be a case of overly optimistic forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Revolution Medicines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Revolution Medicines Narrative

If you have your own perspective or want to dig into the numbers firsthand, it takes just a few minutes to shape your own narrative and reach your own conclusions. Do it your way

A great starting point for your Revolution Medicines research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the most exciting opportunities are often just a click away. Don’t let overlooked trends or niche movers slip past your radar. Here’s where to start:

- Uncover hidden potential by analyzing these 3566 penny stocks with strong financials with strong fundamentals and robust growth stories that might soon capture the spotlight.

- Strengthen your long-term portfolio. Check out these 17 dividend stocks with yields > 3% offering steady, attractive yields where consistent income meets capital appreciation.

- Catalyze your strategy with these 27 AI penny stocks tapping into groundbreaking advancements and the explosive momentum driving the AI sector forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RVMD

Revolution Medicines

A clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives