- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

Those Who Purchased Retrophin (NASDAQ:RTRX) Shares A Year Ago Have A 55% Loss To Show For It

Investing in stocks comes with the risk that the share price will fall. Unfortunately, shareholders of Retrophin, Inc. (NASDAQ:RTRX) have suffered share price declines over the last year. The share price is down a hefty 55% in that time. However, the longer term returns haven't been so bad, with the stock down 20% in the last three years. Even worse, it's down 37% in about a month, which isn't fun at all. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

See our latest analysis for Retrophin

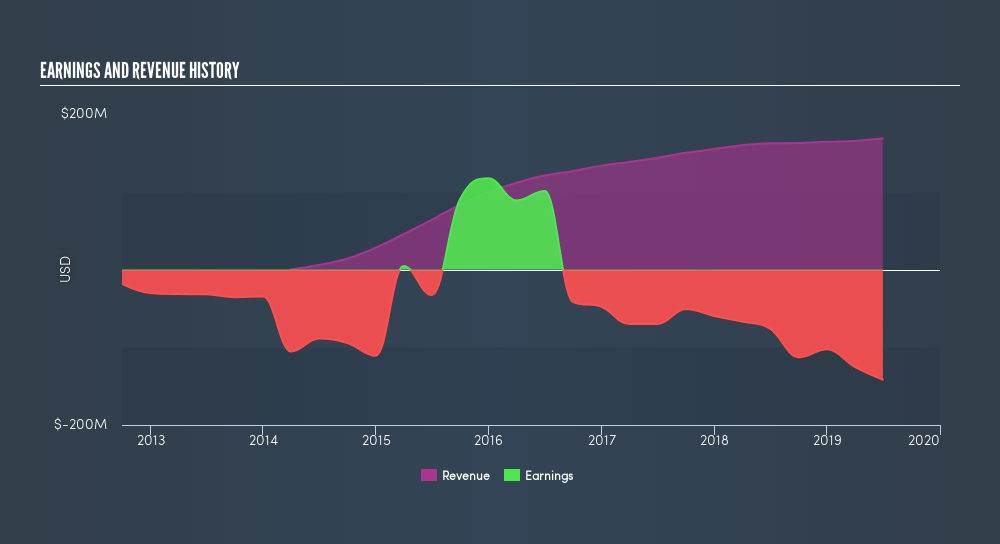

Retrophin isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Retrophin grew its revenue by 4.0% over the last year. While that may seem decent it isn't great considering the company is still making a loss. It's likely this muted growth has contributed to the share price decline of 55% in the last year. Like many holders, we really want to see better revenue growth in companies that lose money. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Retrophin shareholders are down 55% for the year. Unfortunately, that's worse than the broader market decline of 0.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.0% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Retrophin it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases in the United States.

High growth potential and good value.

Market Insights

Community Narratives