- United States

- /

- Life Sciences

- /

- NasdaqCM:RPID

We're Keeping An Eye On Rapid Micro Biosystems' (NASDAQ:RPID) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Rapid Micro Biosystems (NASDAQ:RPID) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Rapid Micro Biosystems

How Long Is Rapid Micro Biosystems' Cash Runway?

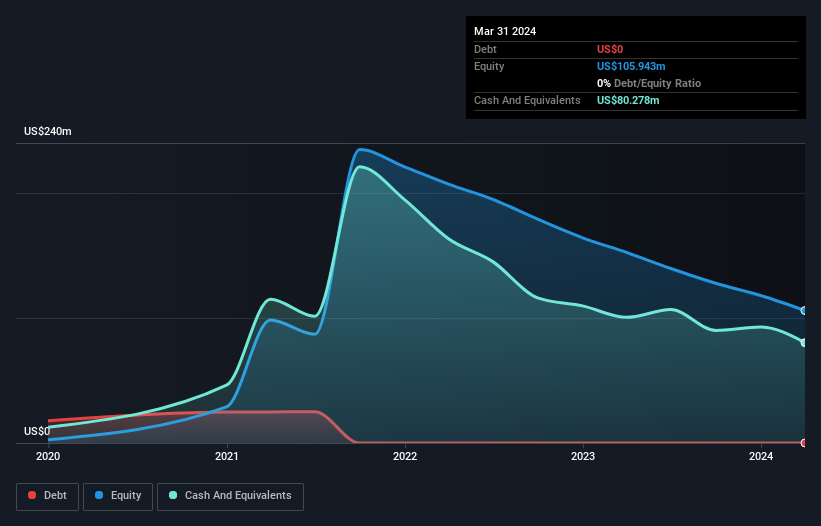

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2024, Rapid Micro Biosystems had cash of US$80m and no debt. Looking at the last year, the company burnt through US$46m. Therefore, from March 2024 it had roughly 21 months of cash runway. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. You can see how its cash balance has changed over time in the image below.

How Well Is Rapid Micro Biosystems Growing?

We reckon the fact that Rapid Micro Biosystems managed to shrink its cash burn by 28% over the last year is rather encouraging. On top of that, operating revenue was up 28%, making for a heartening combination It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Rapid Micro Biosystems Raise Cash?

Rapid Micro Biosystems seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Rapid Micro Biosystems has a market capitalisation of US$28m and burnt through US$46m last year, which is 161% of the company's market value. That suggests the company may have some funding difficulties, and we'd be very wary of the stock.

So, Should We Worry About Rapid Micro Biosystems' Cash Burn?

On this analysis of Rapid Micro Biosystems' cash burn, we think its revenue growth was reassuring, while its cash burn relative to its market cap has us a bit worried. Summing up, we think the Rapid Micro Biosystems' cash burn is a risk, based on the factors we mentioned in this article. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 2 warning signs for Rapid Micro Biosystems that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RPID

Rapid Micro Biosystems

A life sciences technology company, provides products for the detection of microbial contamination in the manufacture of pharmaceutical, medical devices, and personal care products in the United States, Germany, Switzerland, Japan, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026