- United States

- /

- Life Sciences

- /

- NasdaqCM:RPID

Rapid Micro Biosystems, Inc.'s (NASDAQ:RPID) Shares Leap 25% Yet They're Still Not Telling The Full Story

Rapid Micro Biosystems, Inc. (NASDAQ:RPID) shares have continued their recent momentum with a 25% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

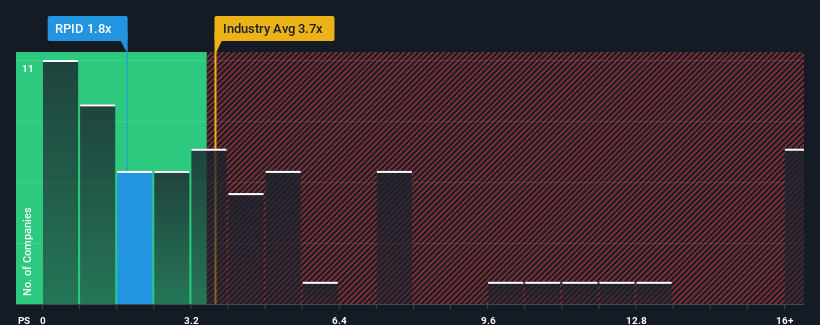

Even after such a large jump in price, Rapid Micro Biosystems' price-to-sales (or "P/S") ratio of 1.8x might still make it look like a buy right now compared to the Life Sciences industry in the United States, where around half of the companies have P/S ratios above 3.7x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Rapid Micro Biosystems

What Does Rapid Micro Biosystems' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Rapid Micro Biosystems has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Rapid Micro Biosystems will help you uncover what's on the horizon.How Is Rapid Micro Biosystems' Revenue Growth Trending?

Rapid Micro Biosystems' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 27% last year. Revenue has also lifted 13% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 21% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 5.2%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Rapid Micro Biosystems' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Rapid Micro Biosystems' P/S?

Rapid Micro Biosystems' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Rapid Micro Biosystems currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Rapid Micro Biosystems, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RPID

Rapid Micro Biosystems

A life sciences technology company, provides products for the detection of microbial contamination in the manufacture of pharmaceutical, medical devices, and personal care products in the United States, Germany, Switzerland, Japan, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026