- United States

- /

- Life Sciences

- /

- NasdaqCM:RPID

Rapid Micro Biosystems, Inc. (NASDAQ:RPID) Looks Just Right With A 70% Price Jump

Rapid Micro Biosystems, Inc. (NASDAQ:RPID) shares have continued their recent momentum with a 70% gain in the last month alone. The last month tops off a massive increase of 211% in the last year.

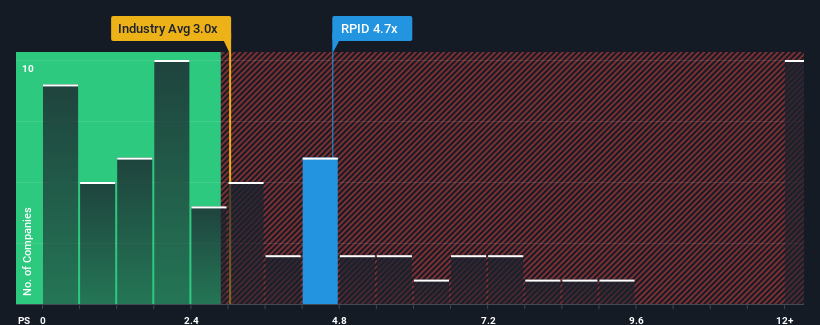

Since its price has surged higher, you could be forgiven for thinking Rapid Micro Biosystems is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.7x, considering almost half the companies in the United States' Life Sciences industry have P/S ratios below 3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Rapid Micro Biosystems

How Has Rapid Micro Biosystems Performed Recently?

With revenue growth that's superior to most other companies of late, Rapid Micro Biosystems has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Rapid Micro Biosystems' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Rapid Micro Biosystems?

In order to justify its P/S ratio, Rapid Micro Biosystems would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. As a result, it also grew revenue by 21% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 3.5%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Rapid Micro Biosystems' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Rapid Micro Biosystems' shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Rapid Micro Biosystems maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Rapid Micro Biosystems has 2 warning signs (and 1 which is significant) we think you should know about.

If these risks are making you reconsider your opinion on Rapid Micro Biosystems, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RPID

Rapid Micro Biosystems

A life sciences technology company, provides products for the detection of microbial contamination in the manufacture of pharmaceutical, medical devices, and personal care products in the United States, Germany, Switzerland, Japan, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026