- United States

- /

- Life Sciences

- /

- NasdaqCM:RPID

Rapid Micro Biosystems, Inc. (NASDAQ:RPID) Just Reported And Analysts Have Been Lifting Their Price Targets

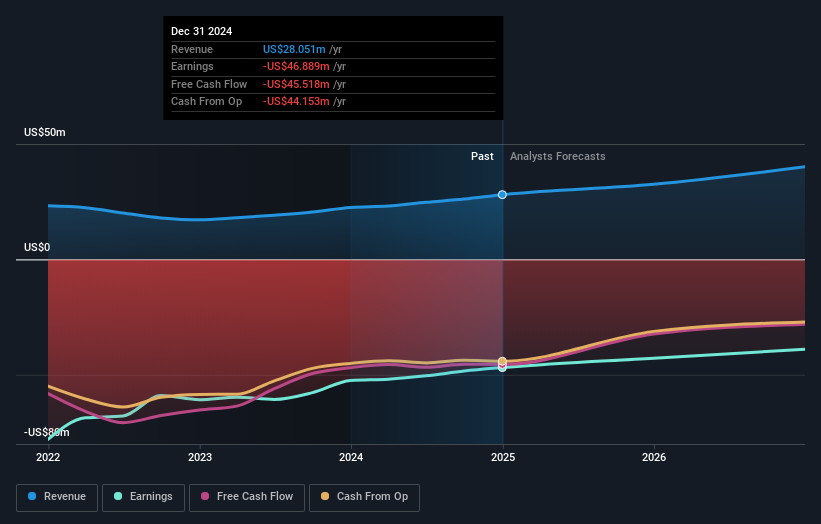

It's been a mediocre week for Rapid Micro Biosystems, Inc. (NASDAQ:RPID) shareholders, with the stock dropping 12% to US$2.47 in the week since its latest yearly results. Revenues came in at US$28m, in line with forecasts and the company reported a statutory loss of US$1.08 per share, roughly in line with expectations. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Rapid Micro Biosystems

Taking into account the latest results, the most recent consensus for Rapid Micro Biosystems from two analysts is for revenues of US$32.6m in 2025. If met, it would imply a notable 16% increase on its revenue over the past 12 months. Losses are expected to be contained, narrowing 10% from last year to US$0.98. Before this earnings announcement, the analysts had been modelling revenues of US$32.9m and losses of US$0.92 per share in 2025. So it's pretty clear consensus is mixed on Rapid Micro Biosystems after the new consensus numbers; while the analysts held their revenue numbers steady, they also administered a pronounced increase to per-share loss expectations.

Although the analysts are now forecasting higher losses, the average price target rose 36% to 5.875, which could indicate that these losses are expected to be "one-off", or are not anticipated to have a longer-term impact on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Rapid Micro Biosystems' rate of growth is expected to accelerate meaningfully, with the forecast 16% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 7.5% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 5.9% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Rapid Micro Biosystems is expected to grow much faster than its industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Rapid Micro Biosystems. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Rapid Micro Biosystems going out as far as 2026, and you can see them free on our platform here.

Before you take the next step you should know about the 2 warning signs for Rapid Micro Biosystems (1 shouldn't be ignored!) that we have uncovered.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RPID

Rapid Micro Biosystems

A life sciences technology company, provides products for the detection of microbial contamination in the manufacture of pharmaceutical, medical devices, and personal care products in the United States, Germany, Switzerland, Japan, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026