- United States

- /

- Biotech

- /

- NasdaqGM:RNA

We Think Avidity Biosciences (NASDAQ:RNA) Can Afford To Drive Business Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Avidity Biosciences (NASDAQ:RNA) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Avidity Biosciences

Does Avidity Biosciences Have A Long Cash Runway?

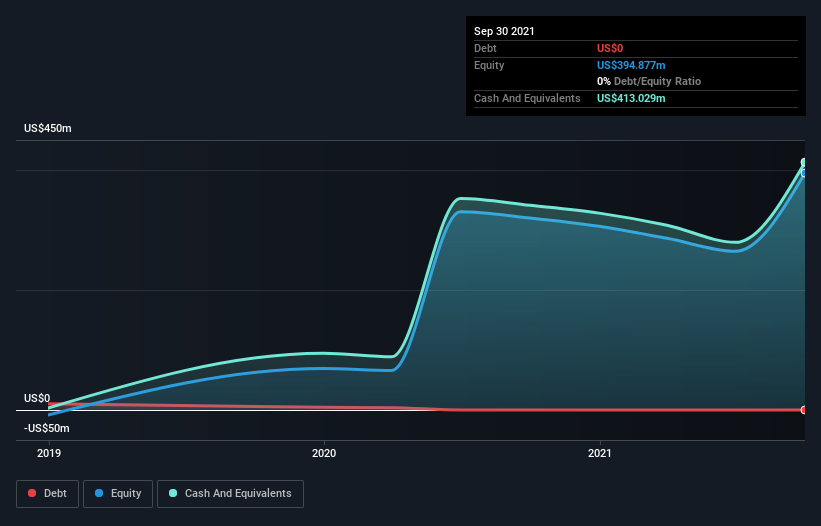

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Avidity Biosciences last reported its balance sheet in September 2021, it had zero debt and cash worth US$413m. Looking at the last year, the company burnt through US$84m. Therefore, from September 2021 it had 4.9 years of cash runway. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

How Well Is Avidity Biosciences Growing?

Notably, Avidity Biosciences actually ramped up its cash burn very hard and fast in the last year, by 180%, signifying heavy investment in the business. While that certainly gives us pause for thought, we take a lot of comfort in the strong annual revenue growth of 58%. Considering both these factors, we're not particularly excited by its growth profile. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Avidity Biosciences To Raise More Cash For Growth?

We are certainly impressed with the progress Avidity Biosciences has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$1.0b, Avidity Biosciences' US$84m in cash burn equates to about 8.2% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Avidity Biosciences' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Avidity Biosciences' cash burn. For example, we think its revenue growth suggests that the company is on a good path. Although we do find its increasing cash burn to be a bit of a negative, once we consider the other metrics mentioned in this article together, the overall picture is one we are comfortable with. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking a deeper dive, we've spotted 4 warning signs for Avidity Biosciences you should be aware of, and 1 of them is concerning.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:RNA

Avidity Biosciences

A biopharmaceutical company, engages in the delivery of RNA therapeutics.

Flawless balance sheet with limited growth.