- United States

- /

- Biotech

- /

- NasdaqGM:RNA

Assessing Avidity Biosciences After Its 556.6% Surge and Bullish RNA Therapy Updates

Reviewed by Bailey Pemberton

- Wondering if Avidity Biosciences is still a smart buy after its huge run, or if most of the upside is already priced in? Here is a look at what the numbers suggest about value from here.

- The stock has cooled slightly in the last week, slipping about 0.1%, but it is still up 2.6% over the past month, 129.7% year to date, and 556.6% over 3 years, which indicates the market has rapidly rewritten its expectations.

- That surge in optimism has been driven largely by excitement around Avidity's RNA-based therapeutics pipeline and a series of positive regulatory and clinical updates that have sharpened the market's focus on its long term potential. At the same time, investors are weighing typical biotech risks, including trial outcomes and competitive pressure in neuromuscular and rare disease indications.

- Despite the rally, Avidity only scores 1/6 on our valuation checks. Below, we break down what different valuation approaches suggest about that score and then finish by looking at a more intuitive way to think about what the market is really pricing in.

Avidity Biosciences scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Avidity Biosciences Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those projections back to their present value. For Avidity Biosciences, the model uses a 2 Stage Free Cash Flow to Equity framework, based on analyst forecasts for the next few years and longer term extrapolations.

Right now, Avidity is burning cash, with last twelve month free cash flow of about $590.7 Million in the red. Analyst and model projections suggest that free cash flow stays negative through 2028 before turning positive. It is projected to reach roughly $359.9 Million by 2035. These beyond five year figures are extrapolated rather than directly forecast by analysts, so they carry more uncertainty.

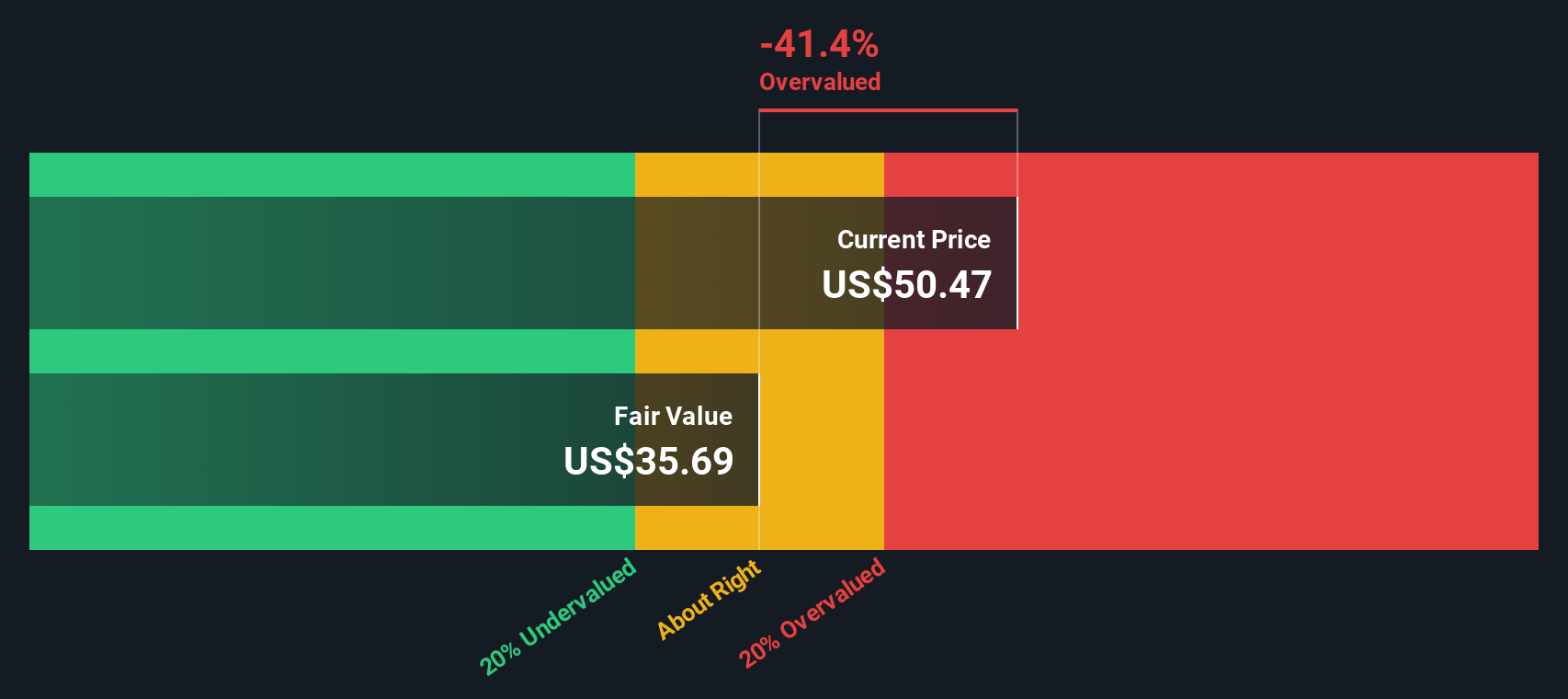

When all those future cash flows are discounted back, the DCF model produces an intrinsic value of about $30.59 per share. Compared with the current share price, this indicates the stock is roughly 134.2% overvalued. This suggests the market is assuming a much more optimistic future than the cash flow model supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Avidity Biosciences may be overvalued by 134.2%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Avidity Biosciences Price vs Book

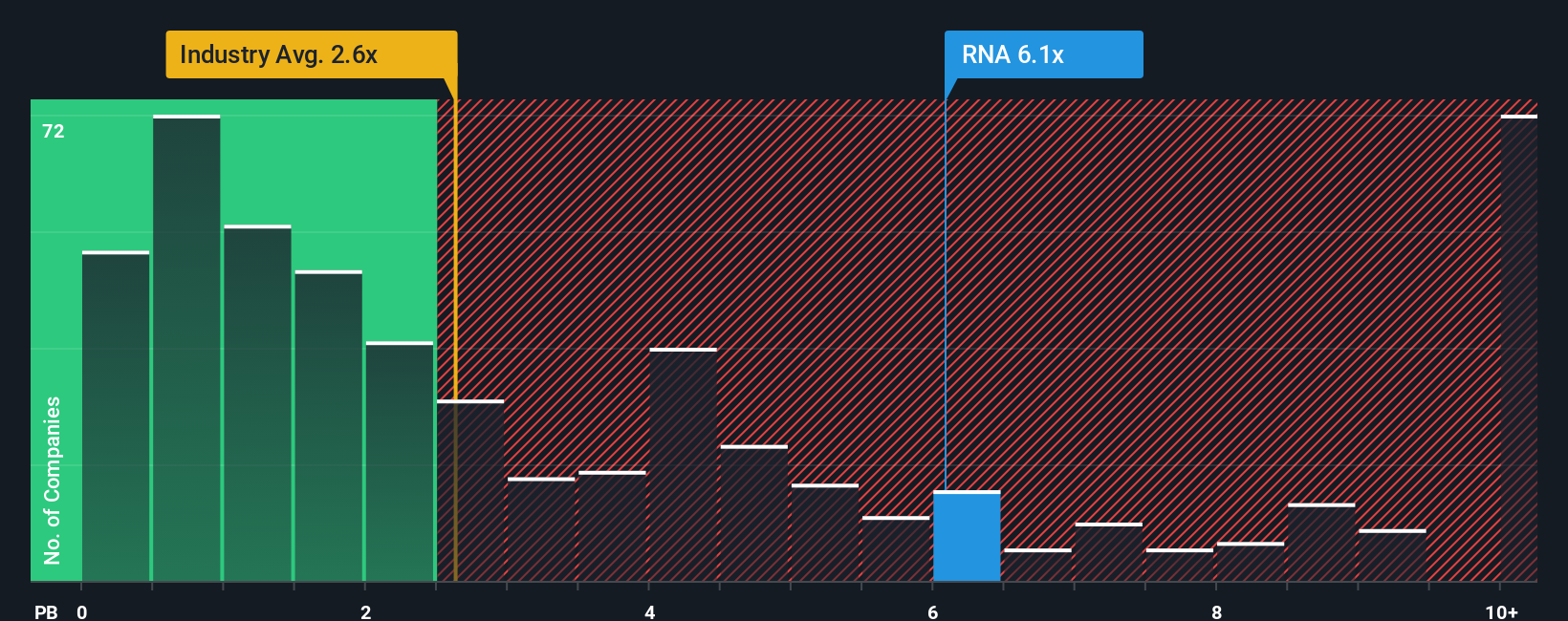

For companies that are still loss making, traditional earnings based measures like the price to earnings ratio are less useful, so investors often turn to asset based metrics such as the price to book ratio. This compares the company’s market value with the net assets on its balance sheet and is a simple way to gauge how much investors are willing to pay for each dollar of book value. In general, faster growth and lower perceived risk justify a higher multiple, while slower growth or greater uncertainty usually warrant a lower, more conservative multiple.

Avidity Biosciences currently trades on a price to book ratio of around 5.72x, which is well above the broader Biotechs industry average of about 2.72x, but still below the 10.85x average of its closest peers. Simply Wall St also uses a proprietary “Fair Ratio” to estimate what an appropriate price to book multiple might be for Avidity, given its specific mix of growth prospects, balance sheet strength, profitability profile, size, sector and stock specific risks. Because this Fair Ratio is tailored to the company rather than based on broad group averages, it tends to be a more informative yardstick than simple industry or peer comparisons. On this basis, the stock appears modestly overvalued relative to what its fundamentals would typically support.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

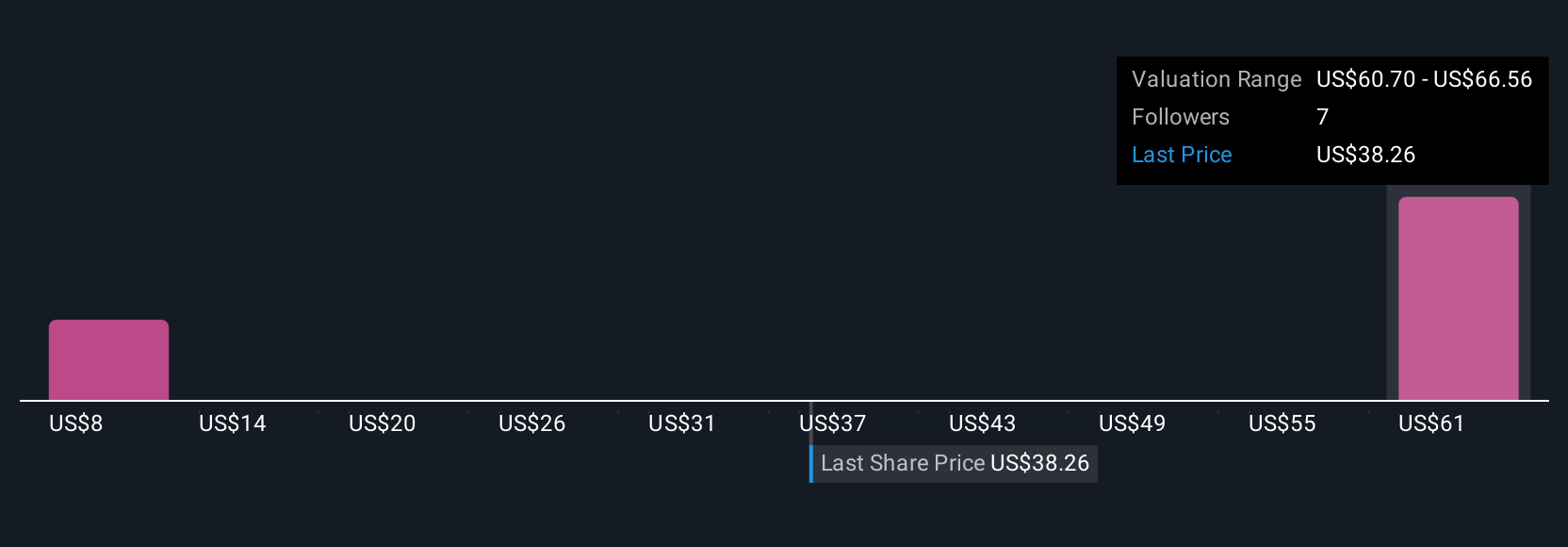

Upgrade Your Decision Making: Choose your Avidity Biosciences Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Avidity Biosciences with clear numbers. A Narrative is your story about the company, translated into assumptions for future revenue, earnings and margins, which then flow into a financial forecast and an estimate of fair value. On Simply Wall St, Narratives sit inside the Community page, where millions of investors can quickly create or explore different stories about the same stock without needing to build complex models. Each Narrative compares its Fair Value to the current share price, helping you assess Avidity under that specific view (for example, as a potential buy, hold or sell), and it automatically refreshes when new information such as trial results, partnerships or earnings is released. For example, one Avidity Narrative might assume rapid adoption of its RNA therapies and a high fair value, while another could assume slower approvals and more modest economics, resulting in a far lower estimate.

Do you think there's more to the story for Avidity Biosciences? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RNA

Avidity Biosciences

A biopharmaceutical company, engages in the delivery of RNA therapeutics called antibody oligonucleotide conjugates (AOCs).

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026