- United States

- /

- Biotech

- /

- NasdaqGS:RIGL

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has been flat in the last week yet it is up 32% over the past year with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks that align with these robust market conditions can be crucial for investors looking to capitalize on potential opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Invivyd | 47.87% | 67.72% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Legend Biotech | 34.07% | 69.26% | ★★★★★★ |

| Blueprint Medicines | 25.27% | 68.62% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 244 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Travere Therapeutics (NasdaqGM:TVTX)

Simply Wall St Growth Rating: ★★★★★★

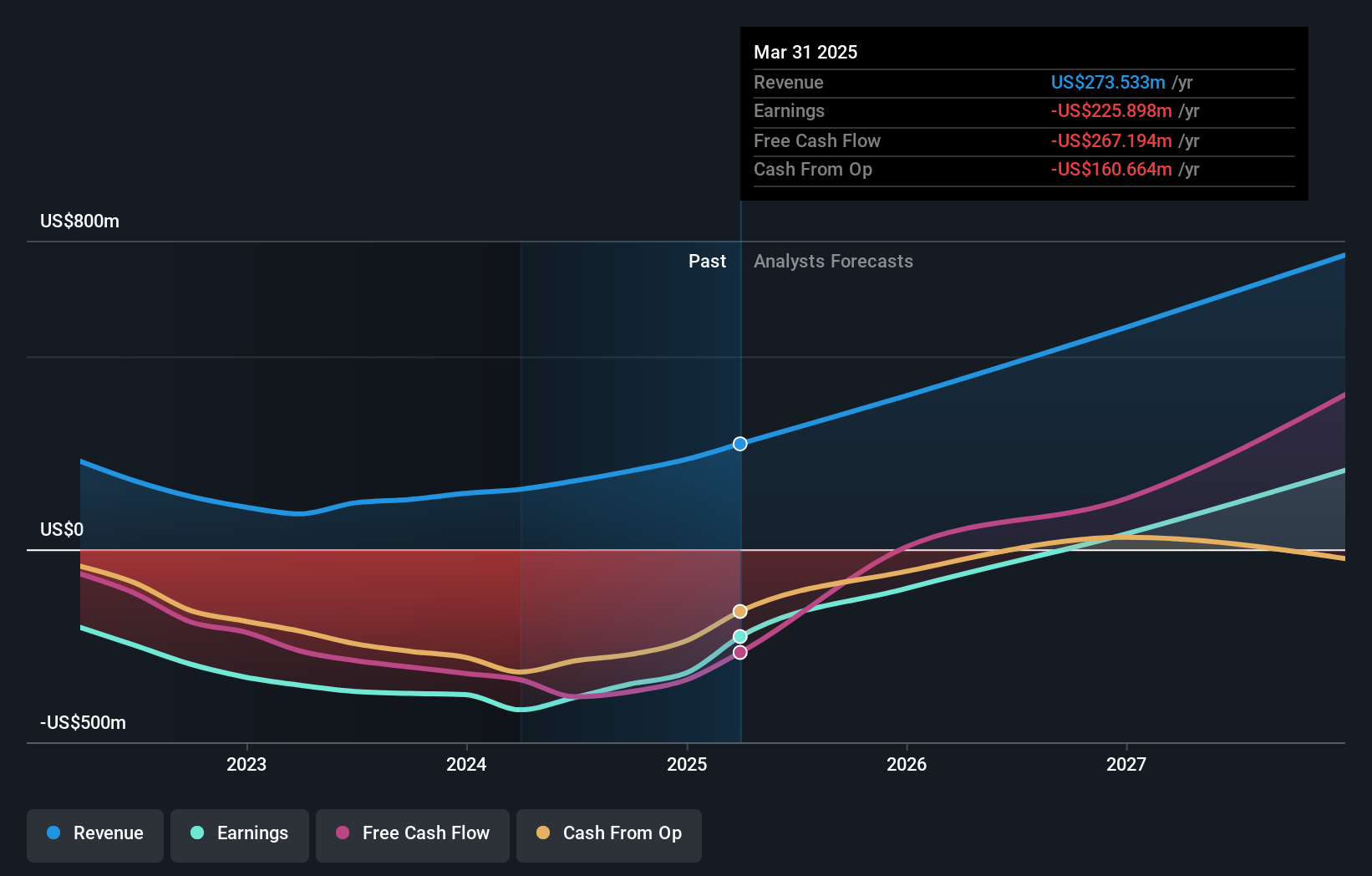

Overview: Travere Therapeutics, Inc. is a biopharmaceutical company focused on identifying, developing, and delivering therapies for rare kidney and metabolic diseases, with a market cap of $1.62 billion.

Operations: The company generates revenue primarily through the development and commercialization of innovative therapies, amounting to $203.45 million. Its focus is on addressing rare kidney and metabolic diseases.

Travere Therapeutics, recently engaging in multiple equity offerings, including a significant $125 million raise, reflects a strategic push to bolster its financial runway amidst challenging profitability metrics. The company's revenue surged by 69% year-over-year to $62.9 million in Q3 2024, yet it reported a substantial net loss of $54.81 million for the same period. This juxtaposition highlights aggressive investment in R&D and market expansion despite short-term earnings volatility. Notably, Travere's commitment to innovation is evident as R&D expenses have escalated in alignment with its pursuit of breakthrough therapies in nephrology and rare diseases—sectors demanding high investment for long-term gains. With recent FDA approvals boosting its commercial portfolio and a clear focus on scaling up promising treatments like FILSPARI®, Travere is navigating through its growth phase with calculated financial maneuvers and clinical advancements.

- Take a closer look at Travere Therapeutics' potential here in our health report.

Gain insights into Travere Therapeutics' past trends and performance with our Past report.

Autodesk (NasdaqGS:ADSK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Autodesk, Inc. is a global provider of 3D design, engineering, and entertainment technology solutions with a market capitalization of $67.34 billion.

Operations: Autodesk generates revenue primarily from its CAD/CAM software segment, which contributed $5.81 billion. The company's business model focuses on providing advanced design and engineering solutions across various industries worldwide.

Autodesk's strategic collaborations, notably with Trane Technologies and Esri, underscore its commitment to integrating AI and geospatial data into design processes, enhancing sustainability in building and planning sectors. This focus on innovation is mirrored in its R&D spending, which remains robust at 15.7% of revenue, aligning with industry demands for advanced software solutions. Financially, Autodesk has shown resilience with a 10% annual revenue growth forecast and an anticipated earnings increase of 15.73% per year, reflecting its adaptability in a competitive landscape. These initiatives not only strengthen Autodesk’s market position but also promise to drive future industry standards in design technology.

- Navigate through the intricacies of Autodesk with our comprehensive health report here.

Gain insights into Autodesk's historical performance by reviewing our past performance report.

Rigel Pharmaceuticals (NasdaqGS:RIGL)

Simply Wall St Growth Rating: ★★★★★☆

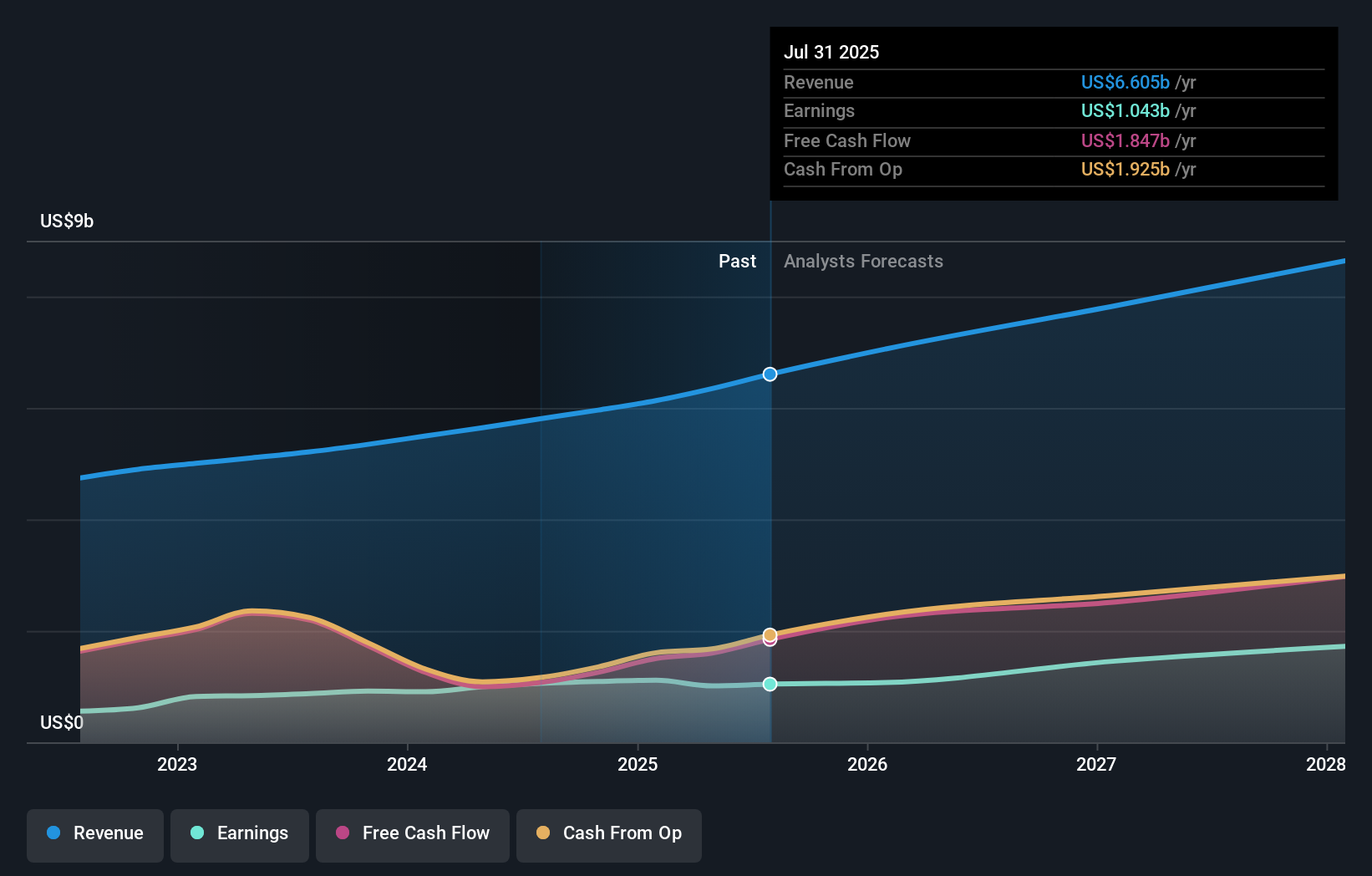

Overview: Rigel Pharmaceuticals, Inc. is a biotechnology company focused on discovering, developing, and providing therapies for hematologic disorders and cancer, with a market cap of $482.83 million.

Operations: Rigel Pharmaceuticals generates revenue primarily from its biotechnology segment, amounting to $157.37 million. The company focuses on developing therapies for hematologic disorders and cancer.

Rigel Pharmaceuticals has demonstrated a remarkable turnaround, evidenced by its recent earnings report where Q3 revenue soared to $55.31 million from $28.13 million year-over-year, alongside a shift to a net income of $12.42 million from a previous net loss of $5.69 million. This financial revival is underpinned by aggressive R&D efforts which are integral to its strategy, focusing on expanding its hematology-oncology portfolio as seen with six upcoming presentations at the ASH Annual Meeting. The company's commitment to innovation is further highlighted by an R&D expenditure that aligns with its revenue growth forecast of 12.8% annually, significantly outpacing the industry standard.

- Delve into the full analysis health report here for a deeper understanding of Rigel Pharmaceuticals.

Key Takeaways

- Click through to start exploring the rest of the 241 US High Growth Tech and AI Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIGL

Rigel Pharmaceuticals

A biotechnology company, engages in discovering, developing, and providing therapies that enhance the lives of patients with hematologic disorders and cancer.

High growth potential with acceptable track record.