- United States

- /

- Biotech

- /

- NasdaqGS:RIGL

Did Rigel's (RIGL) R289 Phase 1b Expansion Just Shift the Company's Pipeline Prospects?

Reviewed by Sasha Jovanovic

- Rigel Pharmaceuticals recently announced the enrollment of the first patient in the dose expansion phase of its ongoing Phase 1b study of R289 in relapsed or refractory lower-risk myelodysplastic syndrome (MDS), with up to 40 patients to be included and updated data expected later this year.

- This clinical advance for R289, which has received both Orphan Drug and Fast Track designations from the FDA, highlights Rigel's efforts to address unmet needs in lower-risk MDS with a potentially differentiated therapy.

- We will explore how the progression of R289 into the dose expansion phase could reshape Rigel's investment narrative and pipeline value.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Rigel Pharmaceuticals Investment Narrative Recap

To be a Rigel Pharmaceuticals shareholder, you need to believe in the company's ability to diversify revenue through advancing its pipeline, particularly with assets like R289 in lower-risk MDS. The recent enrollment milestone for R289 is a positive signal for pipeline progress and could be the most important short-term catalyst, though actual impact on revenue or long-term growth will depend on upcoming study data and eventual regulatory success. Risks remain around commercial concentration and execution in new indications, neither of which has been materially altered by this news event.

Among recent announcements, the commercial launch of GAVRETO for metastatic RET fusion-positive lung cancer stands out, showing Rigel's ongoing effort to expand its marketed portfolio. While important, near-term investor focus is likely to stay on R289’s clinical readout as a key pipeline driver, especially in the context of new targeted therapies entering hematology and oncology markets.

However, patient "carryover" benefits from the Medicare Part D cap and their effect on sustainable revenue is something investors should watch...

Read the full narrative on Rigel Pharmaceuticals (it's free!)

Rigel Pharmaceuticals' narrative projects $297.0 million in revenue and $42.4 million in earnings by 2028. This requires 3.5% yearly revenue growth and a $55.4 million decrease in earnings from the current $97.8 million.

Uncover how Rigel Pharmaceuticals' forecasts yield a $38.33 fair value, a 35% upside to its current price.

Exploring Other Perspectives

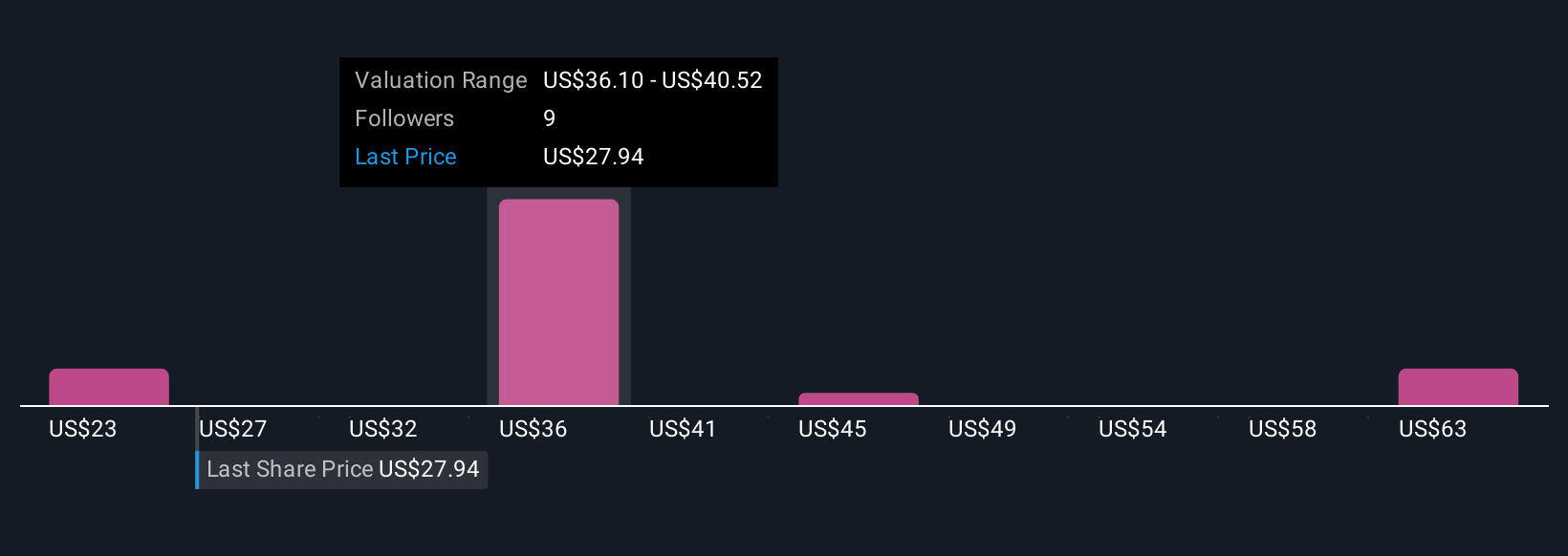

Five private investors in the Simply Wall St Community estimate Rigel’s fair value between US$26.87 and US$67, reflecting a wide range of views. Some point to accelerating pipeline catalysts while others highlight concerns about lasting growth as one-time patient affordability tailwinds normalize, so compare these insights to your own expectations before taking the next step.

Explore 5 other fair value estimates on Rigel Pharmaceuticals - why the stock might be worth 5% less than the current price!

Build Your Own Rigel Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigel Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rigel Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigel Pharmaceuticals' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIGL

Rigel Pharmaceuticals

A biotechnology company, engages in discovering, developing, and providing therapies that enhance the lives of patients with hematologic disorders and cancer.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026