- United States

- /

- Biotech

- /

- NasdaqGS:RGNX

Improved Revenues Required Before REGENXBIO Inc. (NASDAQ:RGNX) Stock's 75% Jump Looks Justified

REGENXBIO Inc. (NASDAQ:RGNX) shareholders would be excited to see that the share price has had a great month, posting a 75% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.9% over the last year.

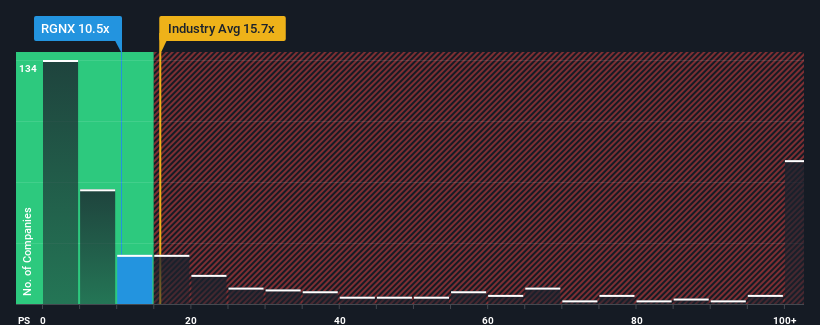

Although its price has surged higher, REGENXBIO may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 10.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.7x and even P/S higher than 76x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for REGENXBIO

How Has REGENXBIO Performed Recently?

While the industry has experienced revenue growth lately, REGENXBIO's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on REGENXBIO will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, REGENXBIO would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. The last three years don't look nice either as the company has shrunk revenue by 42% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 40% per year during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 265% per annum growth forecast for the broader industry.

In light of this, it's understandable that REGENXBIO's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift REGENXBIO's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of REGENXBIO's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for REGENXBIO you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RGNX

REGENXBIO

A clinical-stage biotechnology company, provides gene therapies that deliver functional genes to cells with genetic defects in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives